Auto Insurance Binder Example

From insurance binder to cover note.

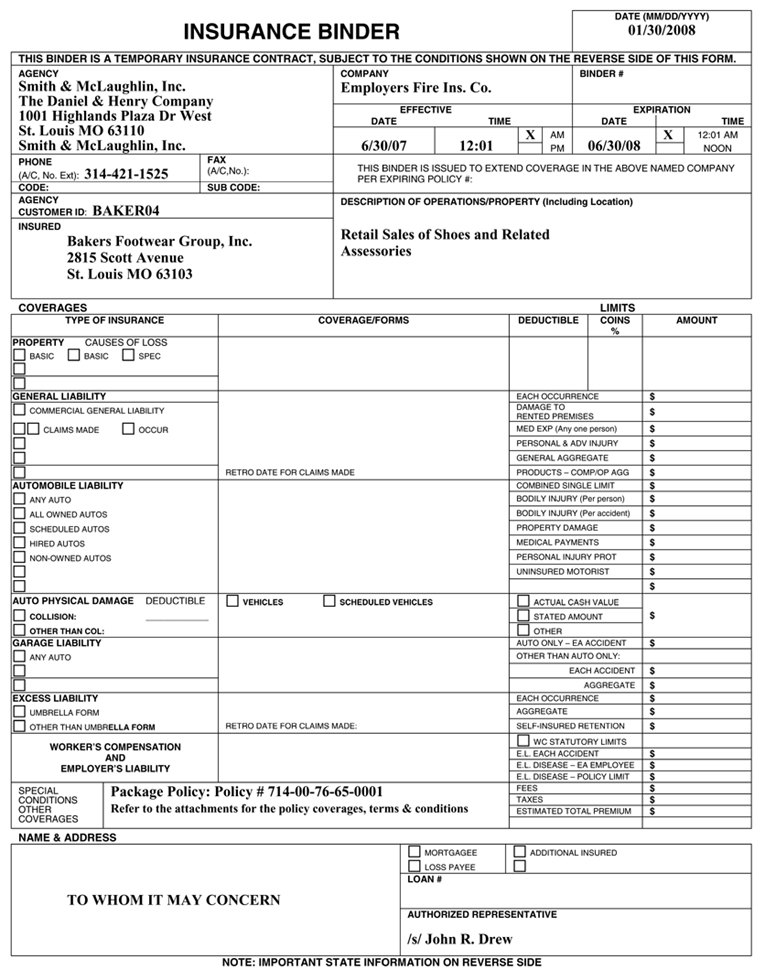

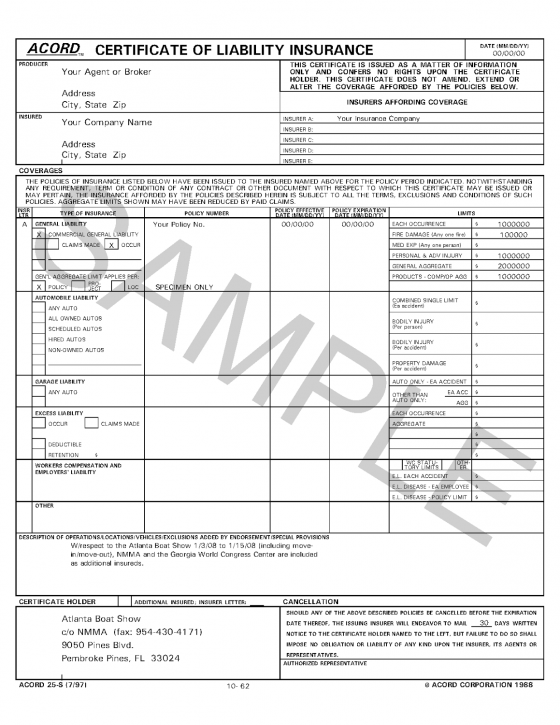

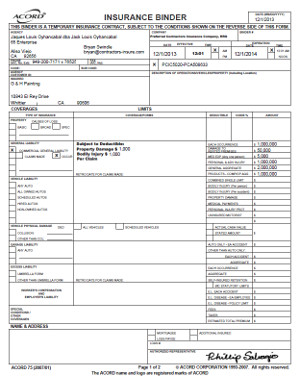

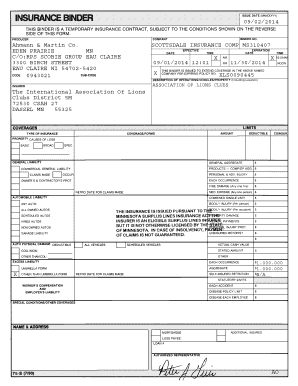

Auto insurance binder example - For example when closing on a house a homeowners or home insurance binder helps finalize your mortgage by providing temporary evidence of insurance. A binder is issued when a policyholder wants or needs evidence of insurance coverage. Except for auto insurance coverage no notice of cancellation or nonrenewal of a binder is required unless the duration of the binder exceeds 60 days.

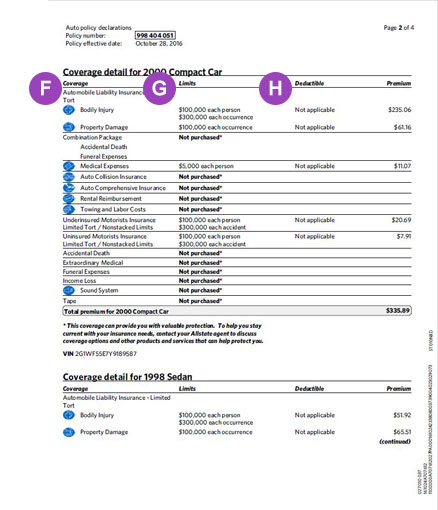

Two of the most common examples of insurance binder use are in cases of purchasing a home or a car. For a car policy you should see a description of coverages such as liability collision or comprehensive coverage with the associated deductibles. An insurance binder is a legal document that provides temporary proof of insurance coverage before an official insurance policy document is prepared.

Keep in mind that the terms of the auto insurance binder letter are not necessarily the same as what your policy will be. More about binders here. Fillable printable insurance binder sample.

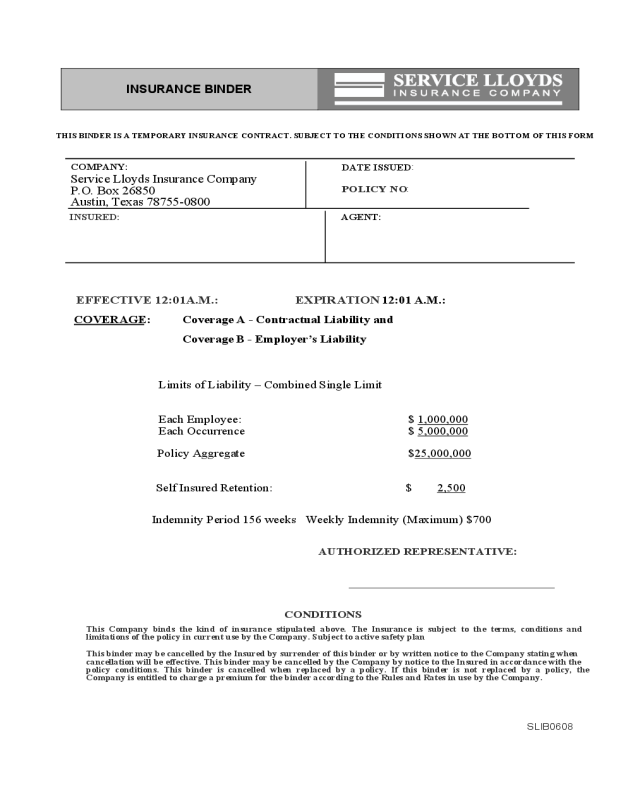

An auto insurance binder letter is temporary proof of insurance that allows you to drive legally during the 30 60 days the insurer legally has to complete the underwriting process. Similarly a lender may require an auto insurance binder to approve an auto loan on a new car. This binder is a temporary insura nce contract.

Service lloyd s insura nce company. Subject to the c onditions shown at the b otto m of this form. How an insurance binder works.

An auto insurance binder letter is a way for you to have temporary car insurance coverage while the underwriting process is being completed by the insurer. Edit download download. Edit download download.

For auto insurance the insurer must give 5 days prior notice unless the binder is replaced by a policy or another binder in the same company. It allows you to drive in the meantime while. For auto insurance the insurer must give 5 days prior notice unless the binder is replaced by a policy or another binder in the same company.

Remember the binder s time span for coverage is quite short and is only meant to provide you with coverage during underwriting. The biggest difference between a car insurance binder and an actual policy is that the binder is temporary. Except for auto insurance coverage no notice of cancellation or nonrenewal of a binder is required unless the duration of the binder exceeds 60 days.