Auto Insurance Policy

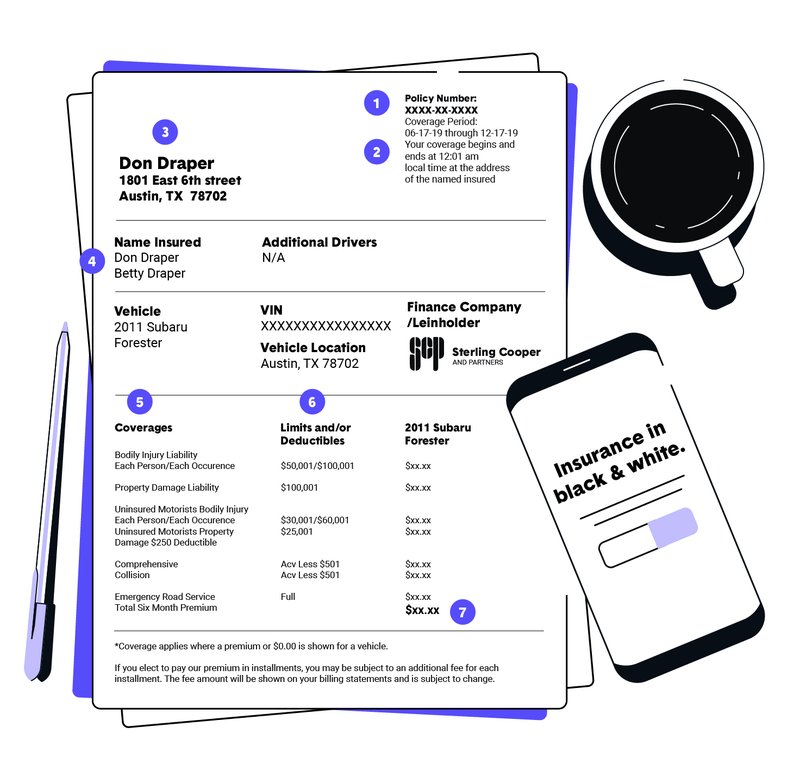

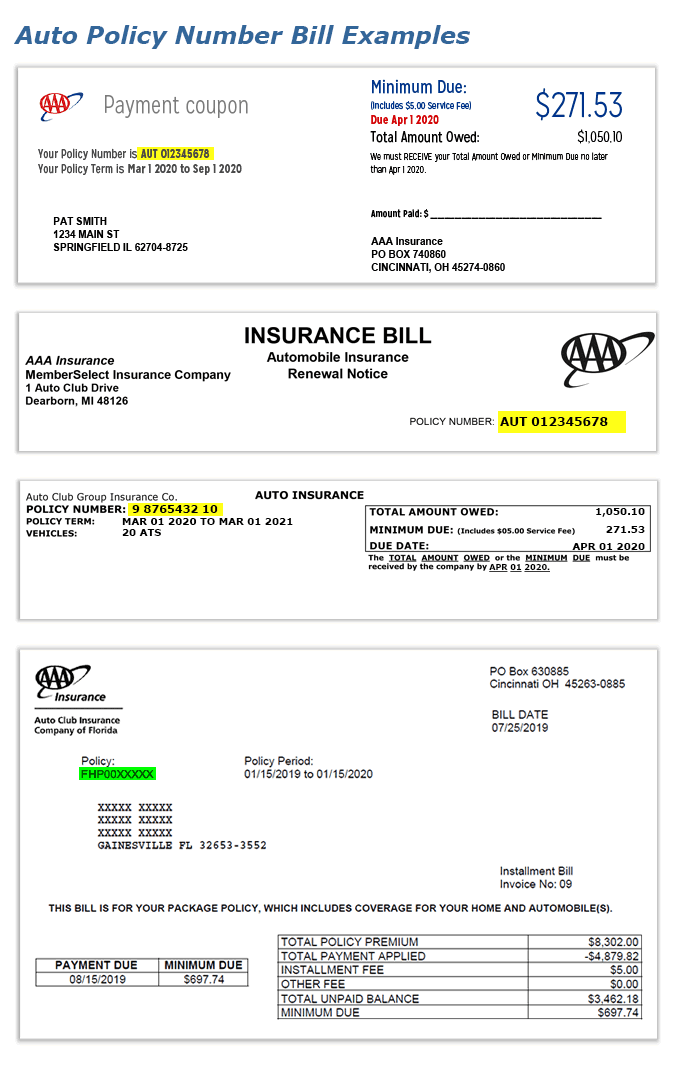

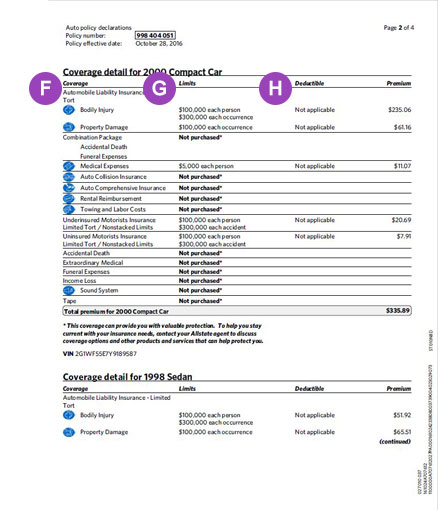

Liability car insurance is the part of a car insurance policy that provides financial protection for a driver who harms someone else or their property while operating a vehicle.

Auto insurance policy - Third party insurance on the other hand covers third party liability only. In other words you want to be sure that the quotes you get are for identical or at least very similar auto insurance policies. Most states require by law that you have basic auto insurance that covers liability.

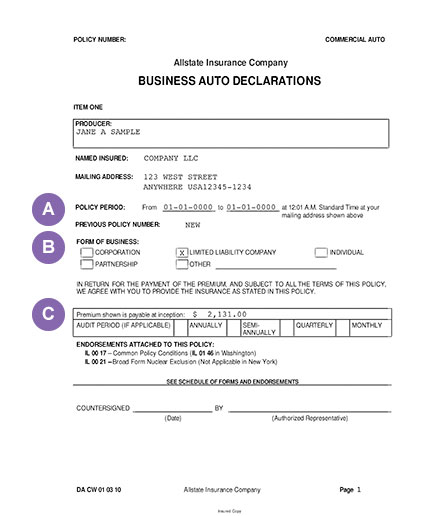

Car insurance is a contract between the motor vehicle company the car owner that provides on road protection against any loss or damages arising due to an accident. Note that each type of coverage is priced separately so there is variability in. Another type of policy that is often required is auto insurance.

There are two types of car insurance policies you can purchase comprehensive motor insurance policy or third party insurance policy. If you re buying a car with a loan you may also be required to add collision coverage to your policy. Once you have a better idea of the type of coverage you re looking for in a policy this will be easy.

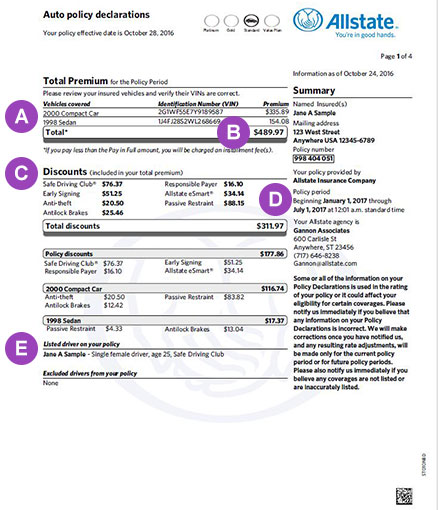

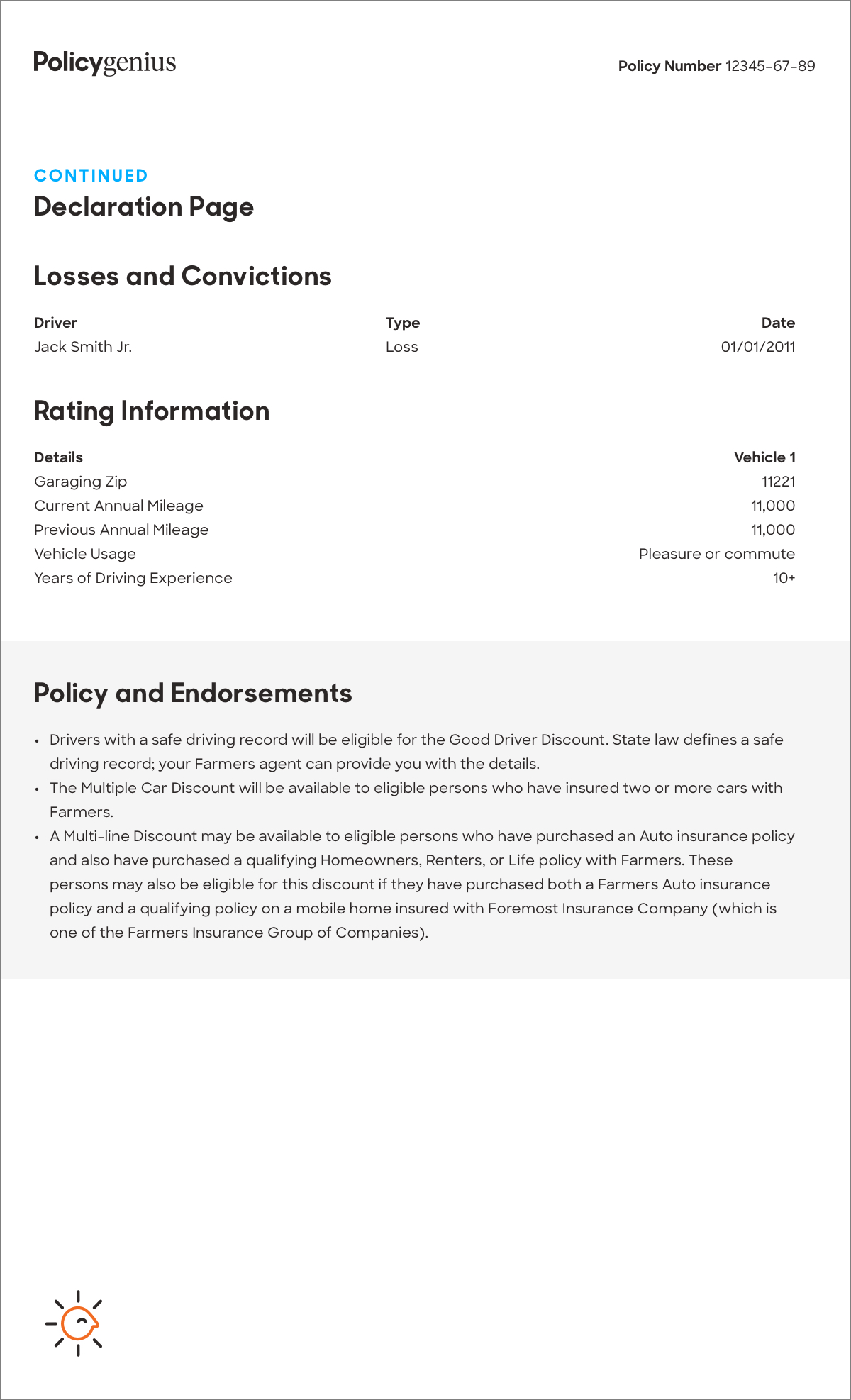

Most states require a minimum amount of auto insurance coverage for most vehicles but you may decide to add additional coverage for extra protection and peace of mind. If you re in an accident liability insurance covers damages to the. When comparing car insurance quotes it helps to compare apples to apples.

Car insurance is a type of vehicle insurance policy that protects your car car owner from any risks damages that may lead to financial losses. A car insurance policy helps provide financial protection for you and possibly others if you re involved in an accident.

:max_bytes(150000):strip_icc()/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg)