Calculator Whole Life Insurance Cash Value Chart

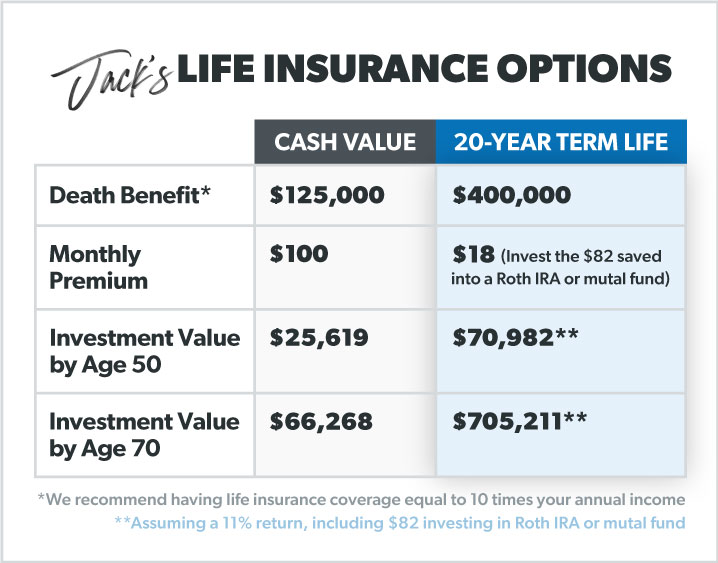

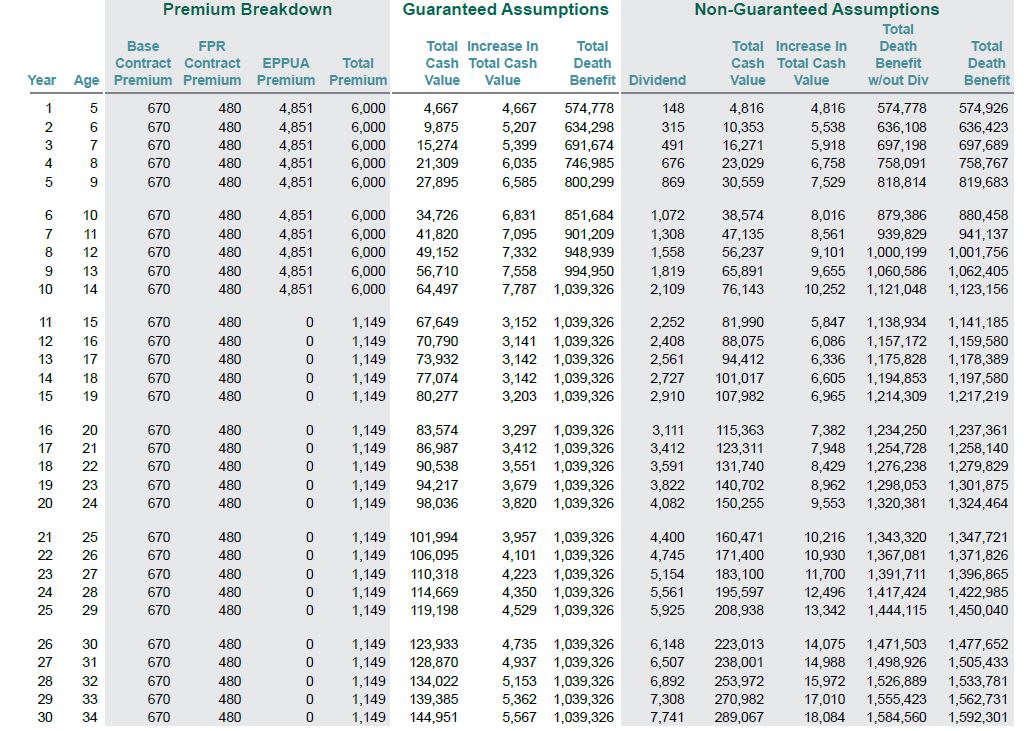

These charts show you the expected appreciation of your cash value over the years.

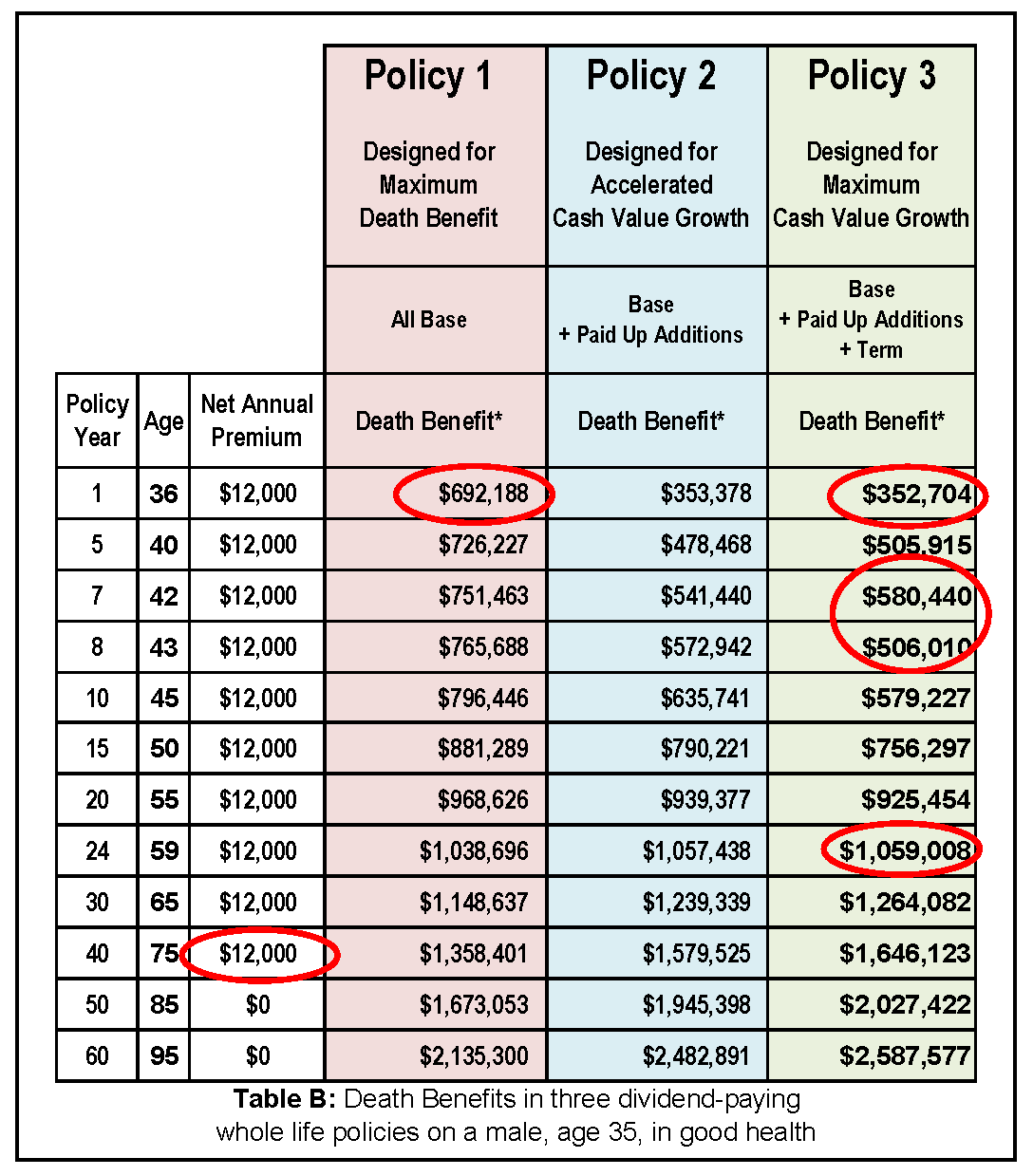

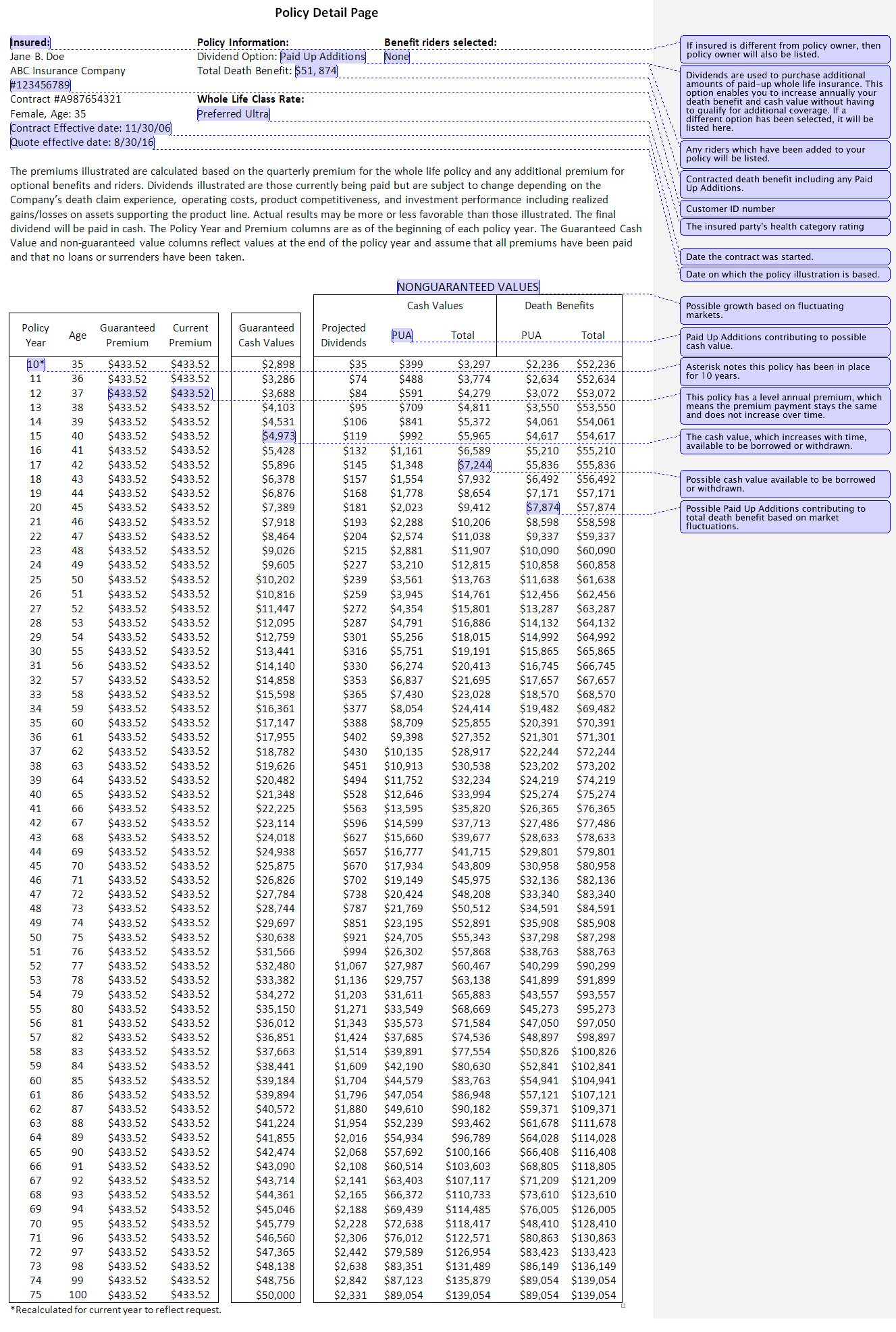

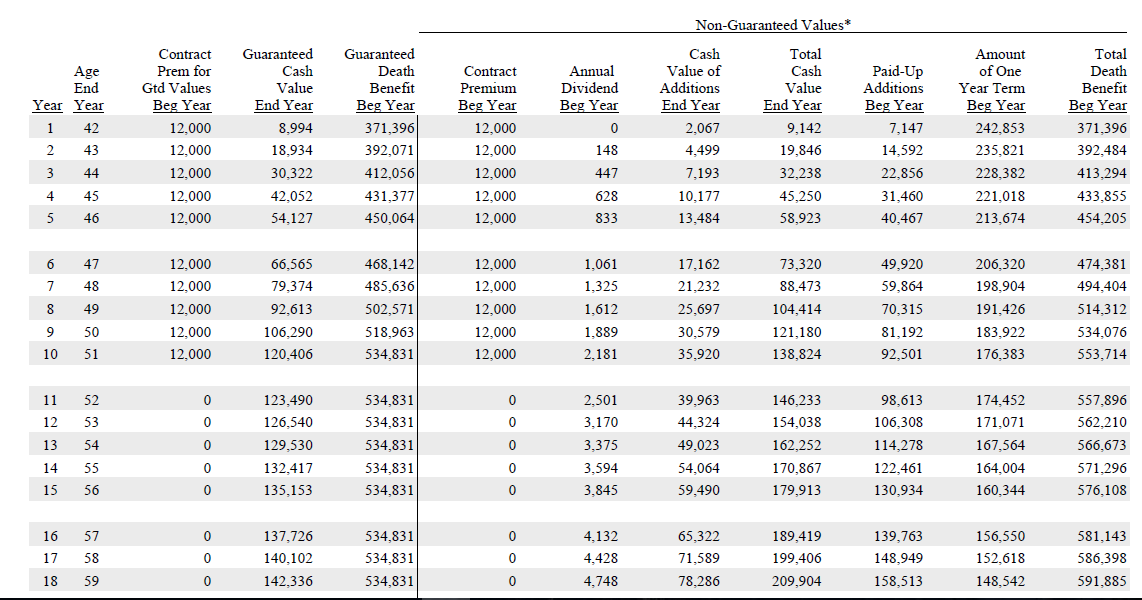

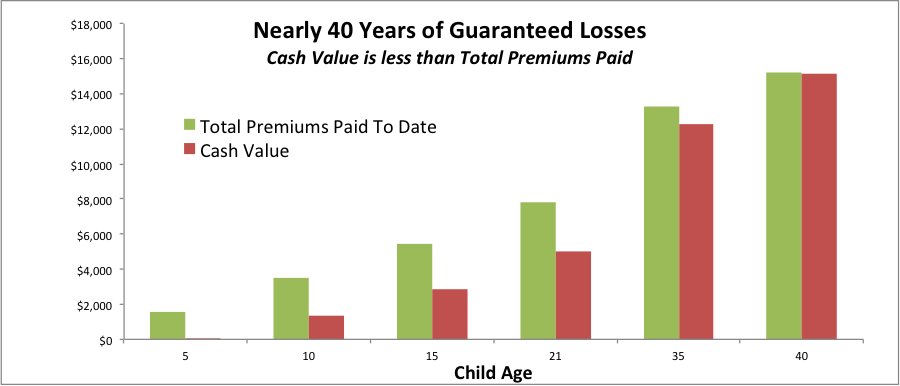

Calculator whole life insurance cash value chart - The following charts illustrate how much cash value a 35 year old nonsmoking male with a preferred rate 100 000 whole life insurance policy could build up over his lifetime. Whole life insurance cash value you can cash in either a portion of the cash value accumulation or receive the full amount if you surrender the whole life policy. However insurance companies may place restrictions on the timing of cash withdrawals and the termination of policy coverage.

Aflac provides supplemental insurance for individuals and groups to help pay benefits major medical doesn t cover. Cash value life insurance also known as permanent life insurance includes a death benefit in addition to cash value accumulation. Find out how much you really need to protect your loved ones.

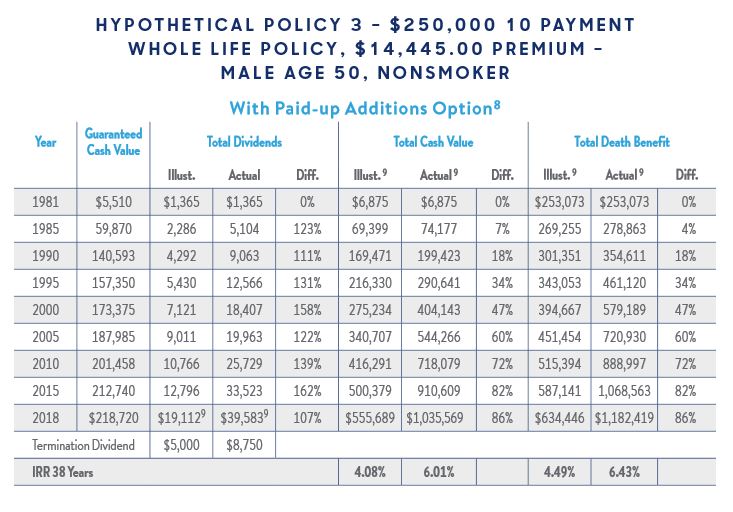

The cash component can be withdrawn reinvested or used as collateral for loans during the policyholder s life. There are certain advantages and disadvantages to tapping the money from your life insurance but in some cases it may be the best choice under the circumstances. For some whole life policies the policy itself will contain a cash value chart.

The longer the policyholder has contributed to the policy the higher the eventual cash surrender value will be. While variable life whole life and universal life insurance. Monthly rates are for informational purposes only and must be qualified for.

The following sample whole life insurance quotes are based on a preferred plus female wanting ordinary whole life insurance to age 100 with an a rated insurance company or better. Aflac offers whole and term life insurance policies that help pay cash benefits directly. You ll see a corresponding amount with each number of years you maintain your plan.

A whole life insurance policy s cash surrender value represents the amount of money a policyholder receives if he chooses to terminate the policy. The calculation of cash surrender value is based on the savings component of whole life insurance policies. The chart shows how much the cash value is expected to appreciate over the years.

The two main types of cash value life insurance are whole life and universal life. The cash value portion is non taxable so long as it does not exceed the amount of total premiums you paid the cost basis when you cash in a portion or surrender the policy. Each line in the chart includes the number of years the policy holder maintains the policy and the corresponding cash value per 1 000 in death benefits.

Policy values and benefits shown are based on a dividend scale that is not guaranteed and could be more or less than what s shown.