Car Insurance Add Driver Cost

30 money saving motoring tips.

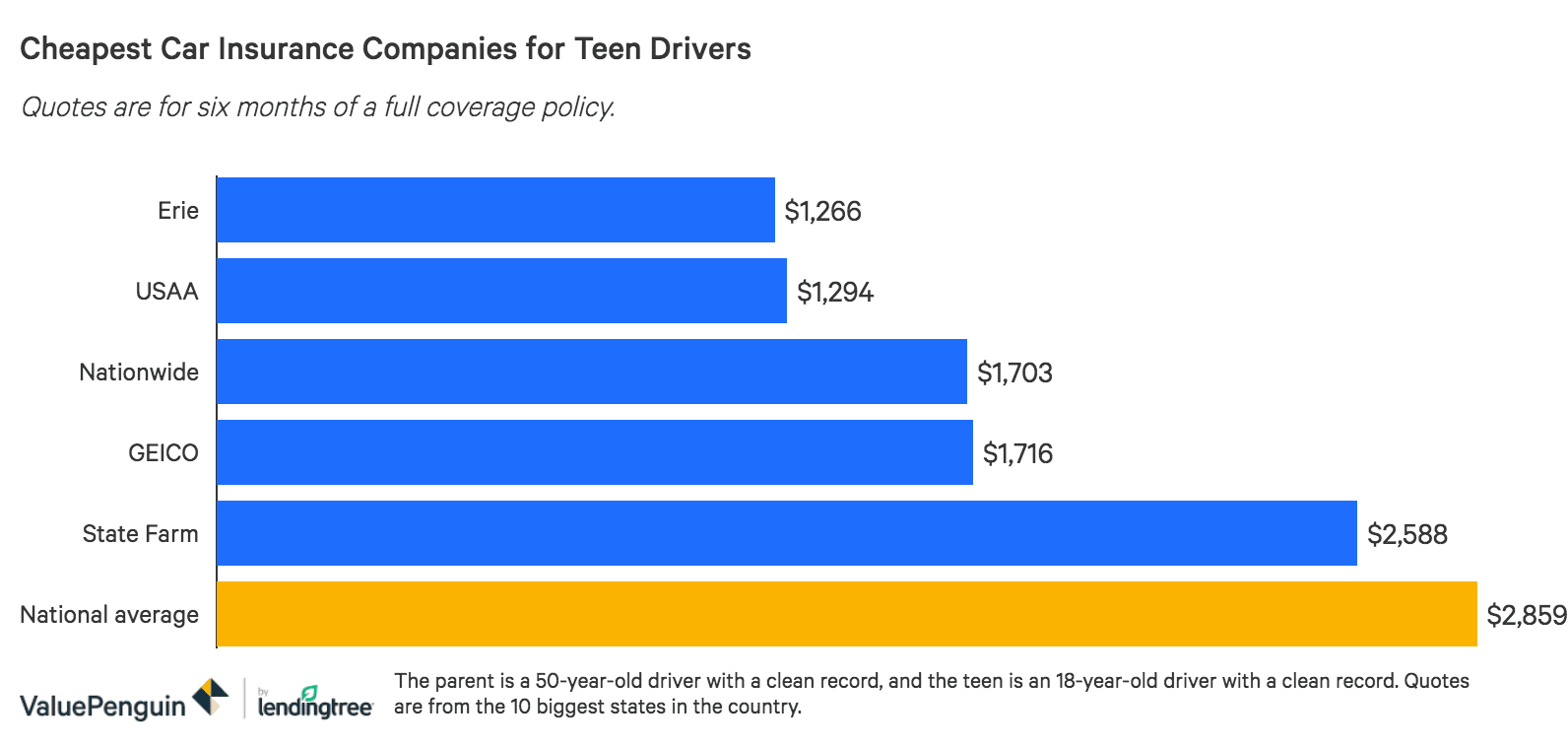

Car insurance add driver cost - However if you add a driver to your policy who has recent accidents or traffic violations the insurance company may charge you more. Adding a teenage driver to your car insurance policy can hike your annual premium by as much as 3 500. How to reduce new driver car insurance costs.

You can also add additional named drivers to your policy on a temporary basis. You ll see below how much it costs to add a 16 year old driver to your policy in your state. These claims cost the industry about 2 billion a year adding 90 to every driver s annual car insurance premium.

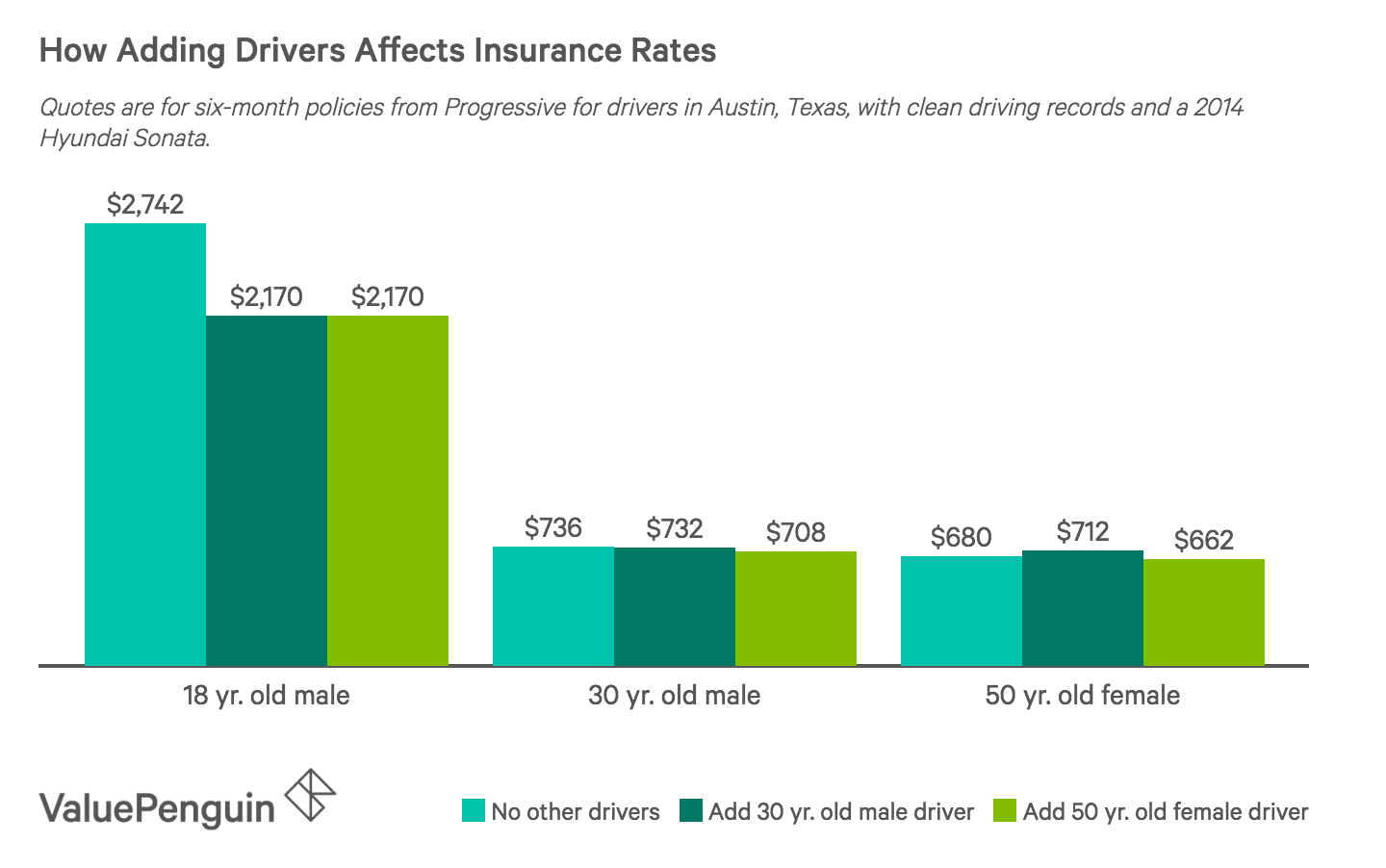

Adding an experienced driver with a clean record to your car insurance policy typically will not cost you more money. Rather consider a separate learner driver policy although it is going to prove expensive. The cost of adding a driver to your car insurance.

It could take your premium down or in the case of adding a young driver potentially increase your premium. An alternative to adding a driver to your existing policy is to take out a separate temporary car insurance policy covering from one to 28 days. Here at allianz we allow you to add additional drivers to your policy on a permanent or temporary basis.

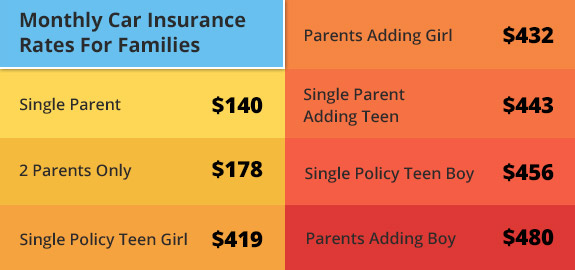

Car insurance for young drivers is expensive as you ll see in the table below but you can still save by putting the teen on your policy rather than getting him or her their own coverage and by garnering all the discounts you can for young drivers. Adding a driver to your car insurance policy will have an impact on your rates. Each state has specific requirements for the type and amount of car insurance coverage that drivers must carry.

Adding additional drivers to your car insurance policy is a pretty common requirement whether it is your spouse partner or children. How to add your teen driver to insurance 01 27. Adding a driver to your car insurance in terms of this scenario is not going to work.

How much more will depend on how risky the insurance company considers the additional driver. Your insurer will consider their. For example some states require drivers to purchase 100 000 worth of liability coverage per accident while others require just 20 000 or 30 000 of liability coverage.

If you only need short term cover for an additional driver for a weekend away or a holiday for example temporary cover might work out cheaper than adding a. Many factors affect the cost of adding a driver to your car insurance. Referral fees when there is an accident details are often sold on by car insurance companies to personal injury lawyers which lead to the increase in compensation claims.

In addition adding a named driver to your policy may affect your annual premium and this is largely down to the risk profile of the individual you are adding.