Car Insurance By State Average Rate

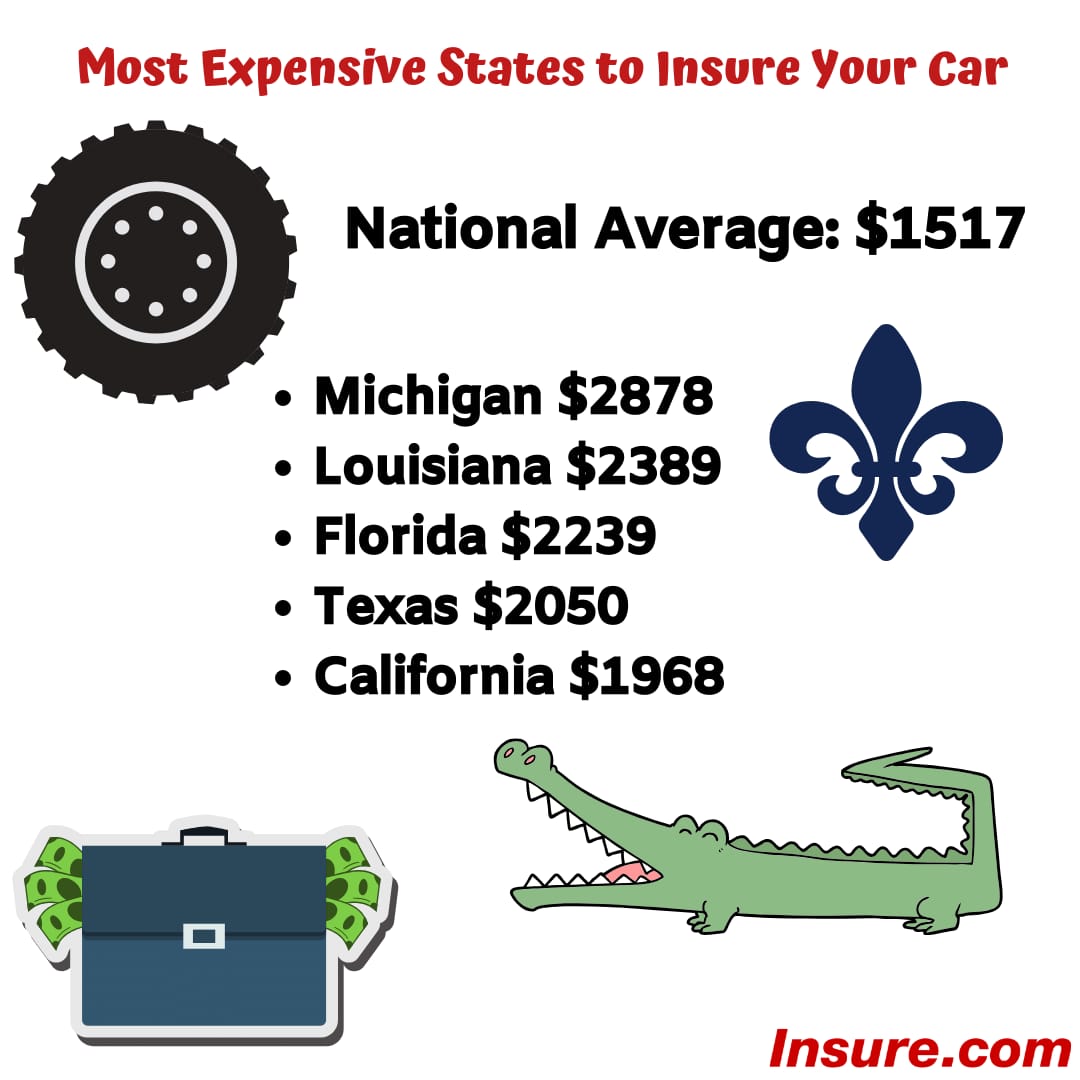

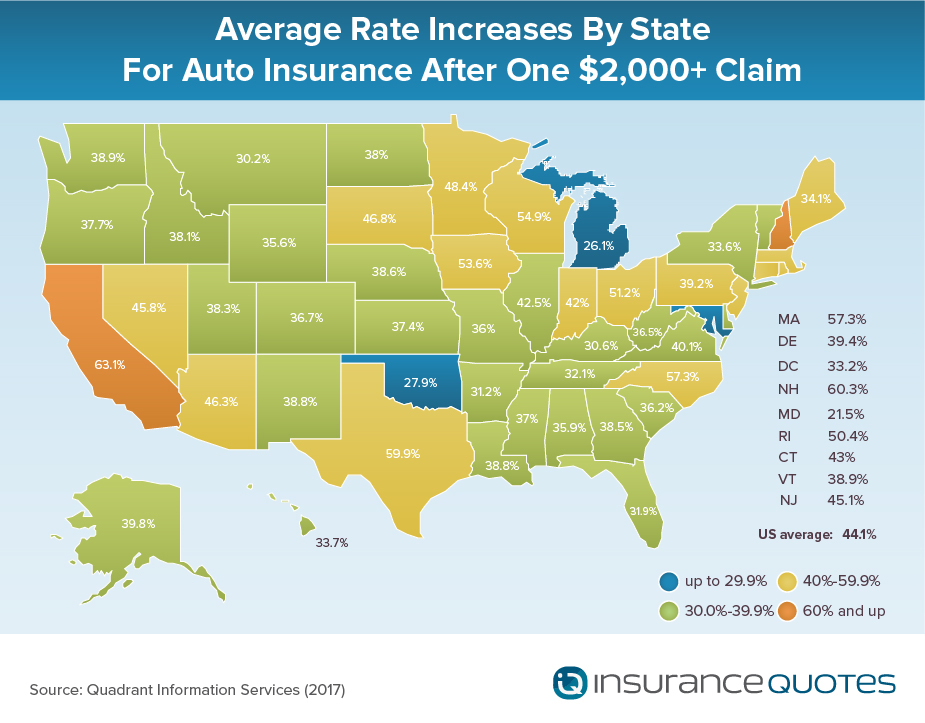

When you compare car insurance rates by state why are some so much more expensive than others.

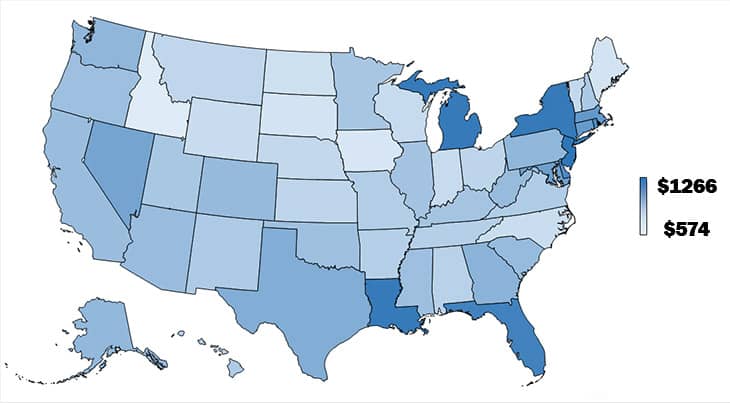

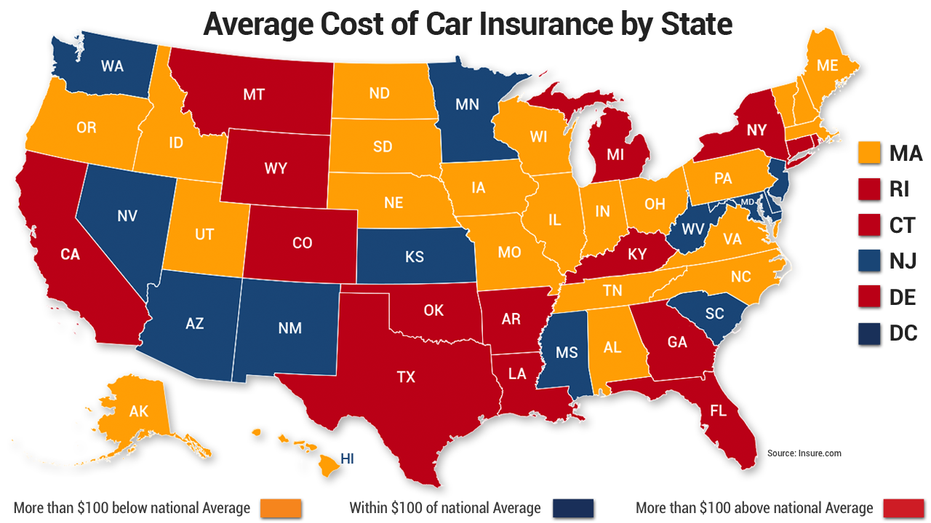

Car insurance by state average rate - Car insurance by the numbers. As you can see average car insurance rates by state vary widely. We examined the average cost of car insurance by state to help drivers estimate how much they should be paying for coverage.

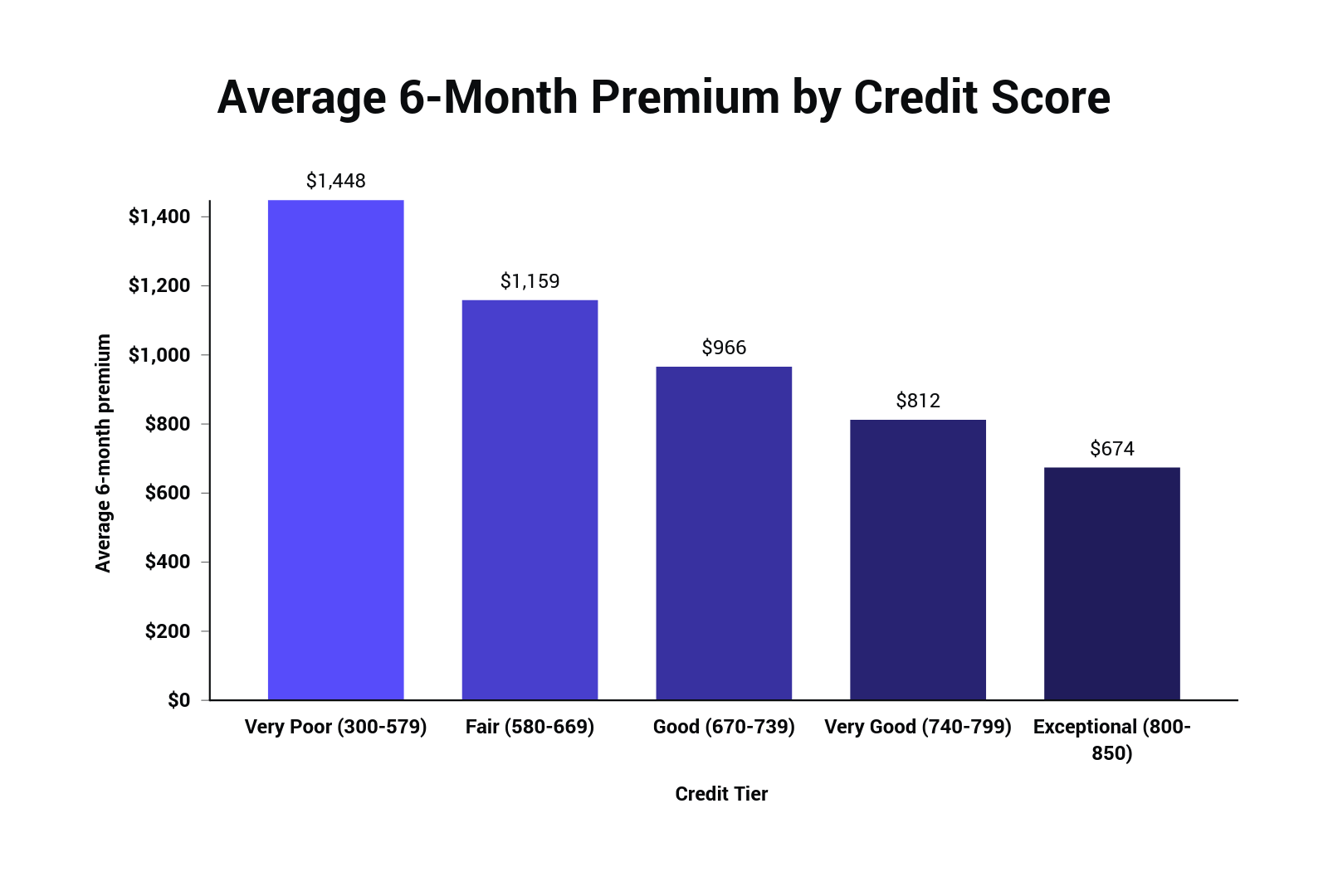

Call us toll free. Michigan 4 837. Read our article to learn more about how you can lower your car insurance premium.

1 099 the average annual cost of auto insurance in the u s. State car insurance rates change dramatically by state and between cities. States set car insurance regulations and minimum insurance requirements which can have a major impact on the rates paid by residents.

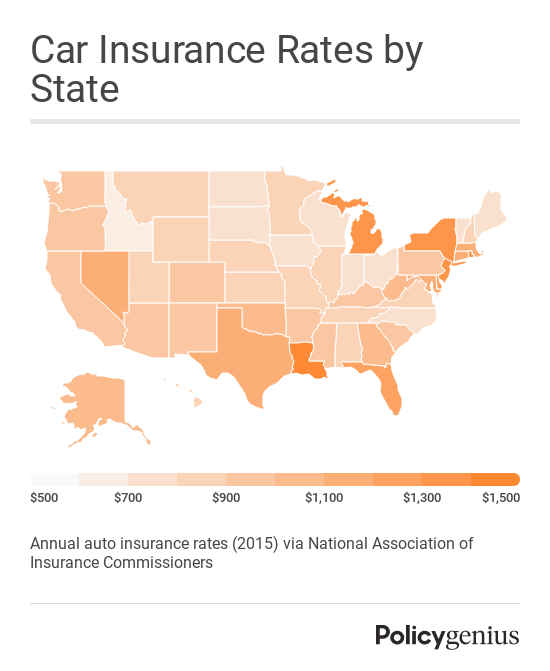

If l ow liability limits are a big part of louisiana s pricy insurance costs michigan has the opposite problem. It s worth mentioning that this annual study rate is just 75 higher than the rate for sample drivers with low coverage. The best way to lower your car insurance rates might actually be to move to another state.

285 billion the amount the auto industry was predicted to have generated in 2019 1. 13 the percentage of all u s. Remember these are just averages.

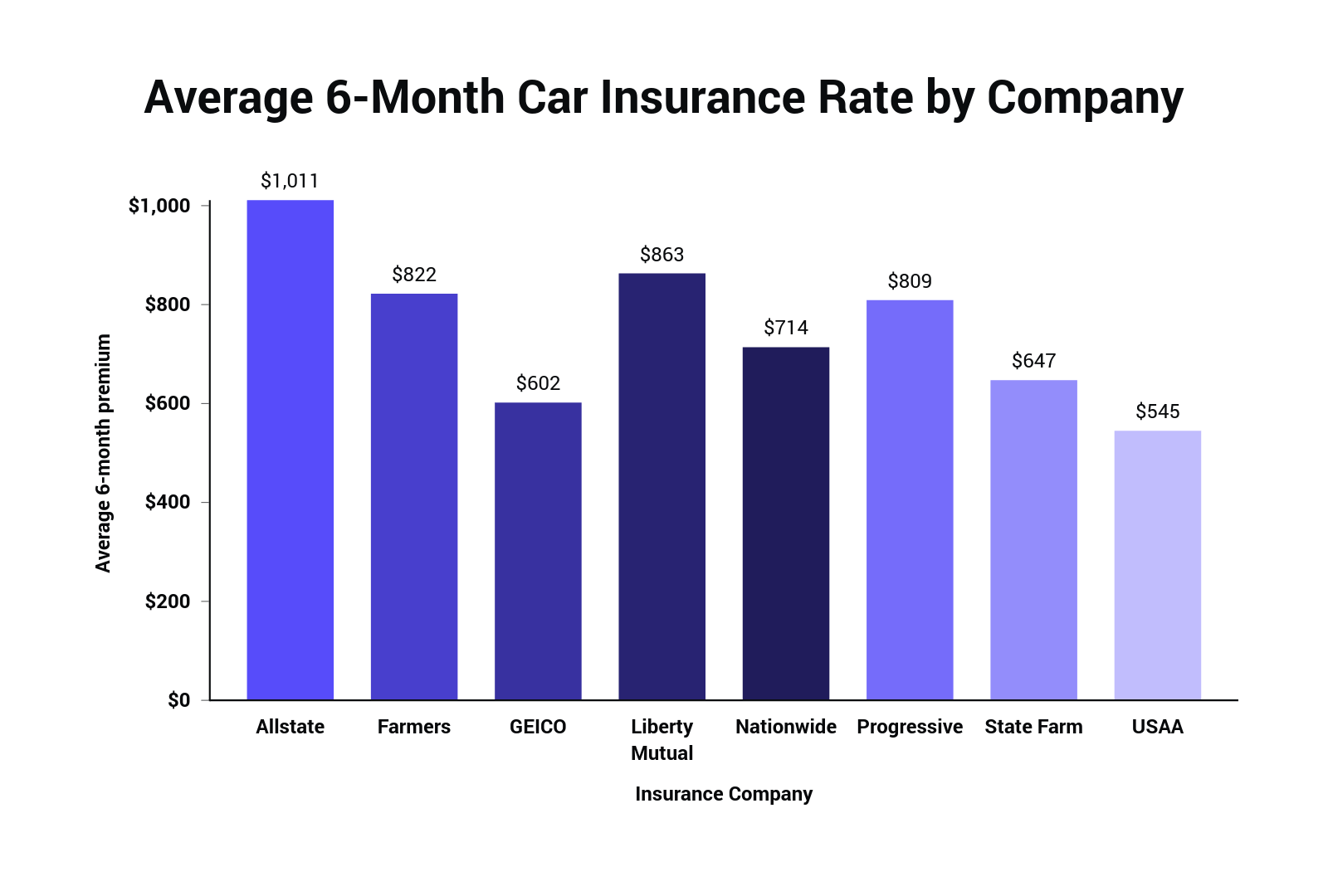

After collecting quotes from top insurers across the country we found the average auto insurance rate to be 2 390 per year or 200 per month. The state requires drivers to carry. Moving from new jersey to idaho for example could save the average driver nearly 700 per year on insurance.

4 486 7 9 of income. State required insurance minimums can also raise or lower insurance costs. See car insurance rates by zip code plus state laws.

26 7 the percentage of drivers without car insurance in florida the state with the highest. As an example michigan uses a unique no fault insurance system that in many ways is responsible for its high premiums. Idahoans pay the least for car insurance while new jerseyans shell out the big bucks for coverage.

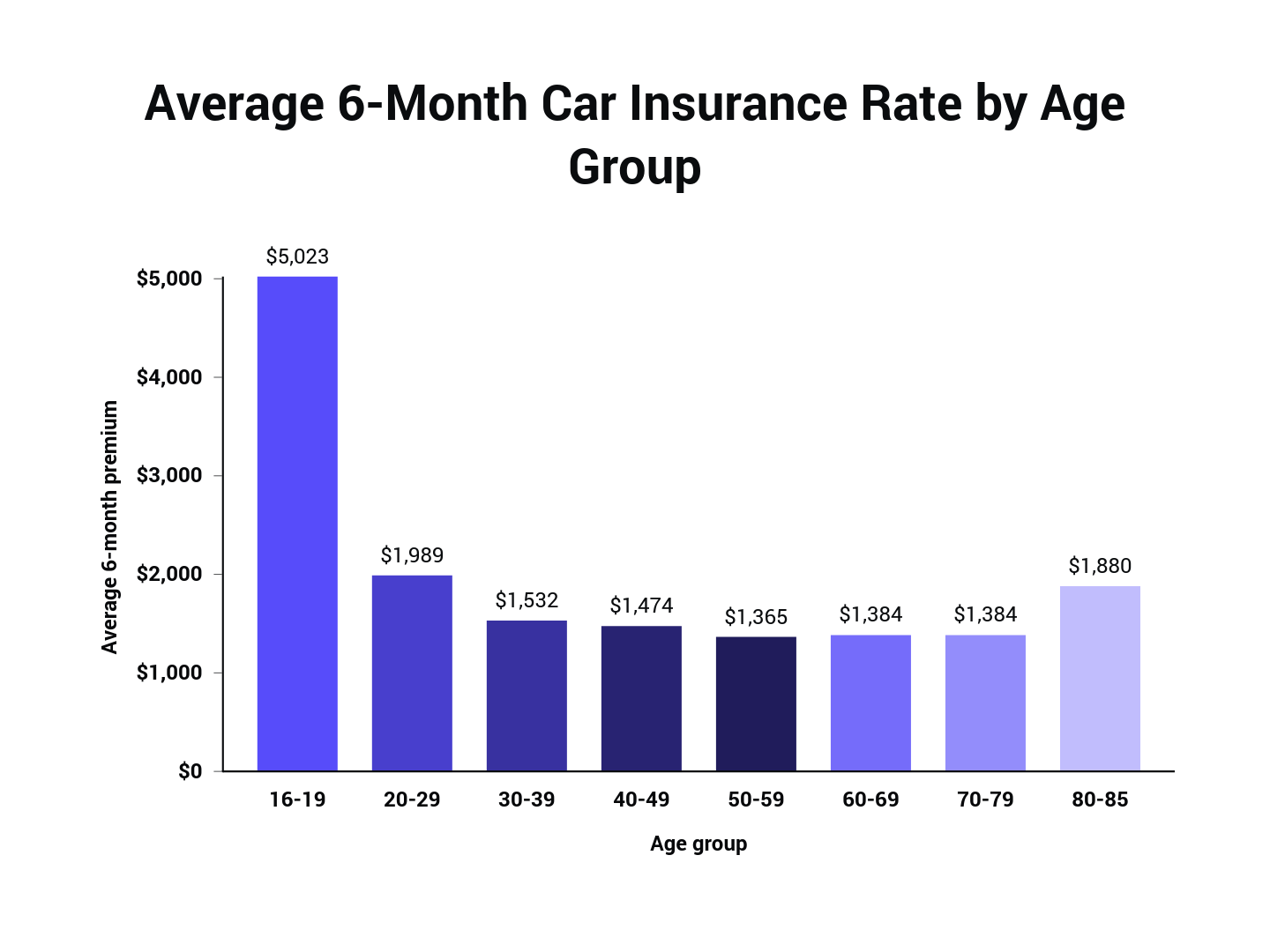

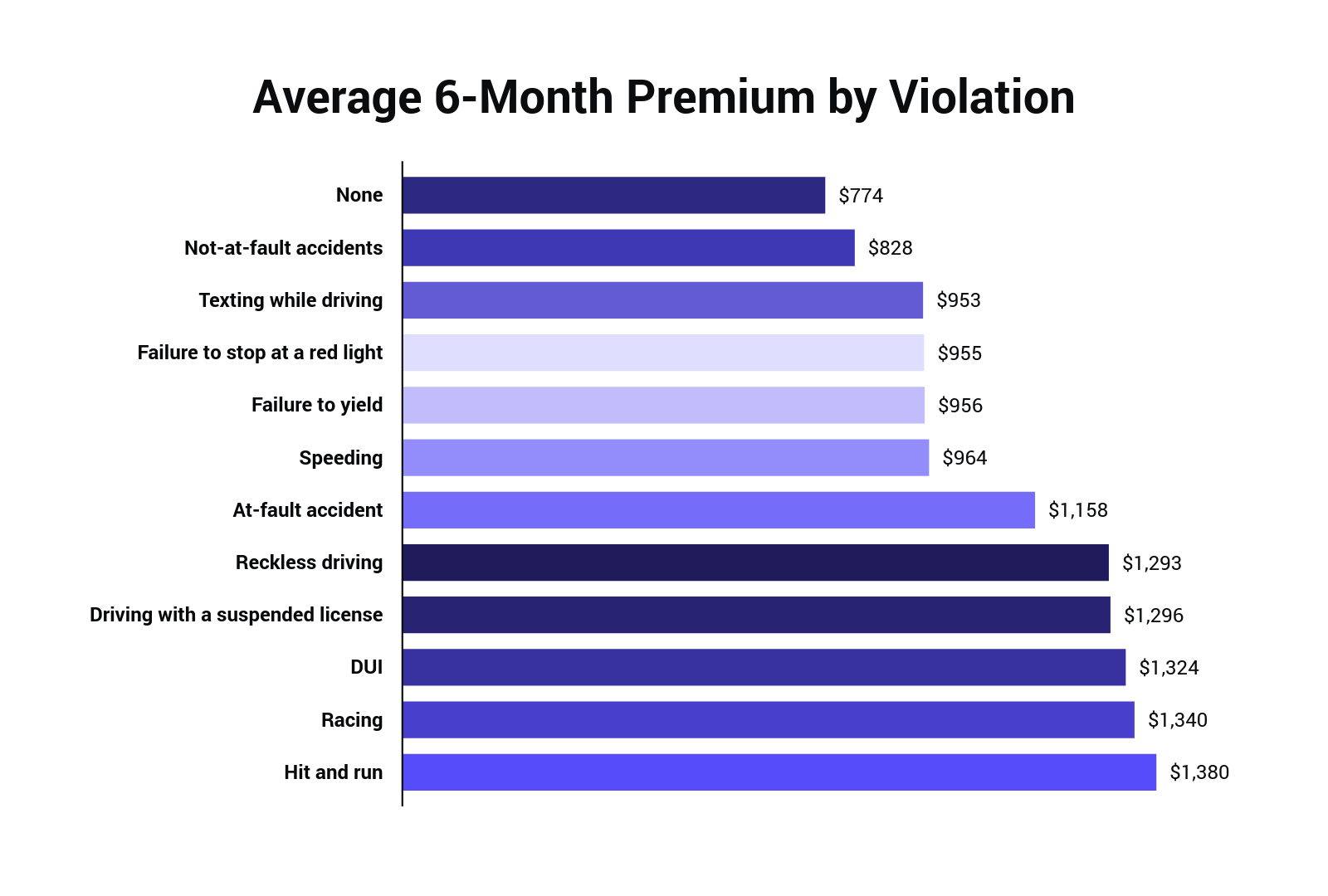

The average car insurance rate changes from state to state and depends on your age vehicle and driving history.