Car Insurance Claim Letter Sample

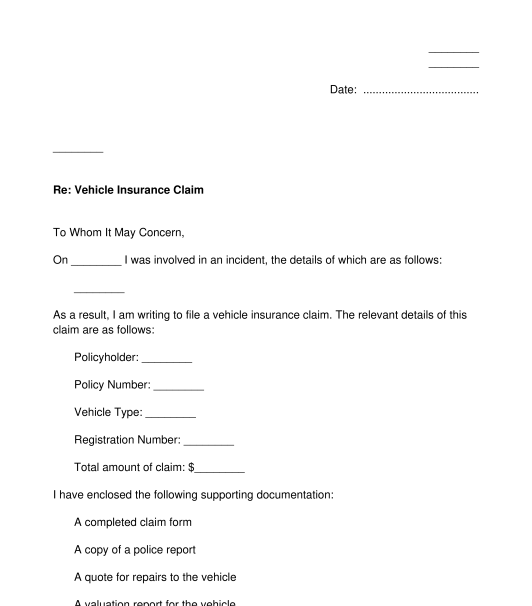

I have an insurance policy for my car and the insurance number is 195846.

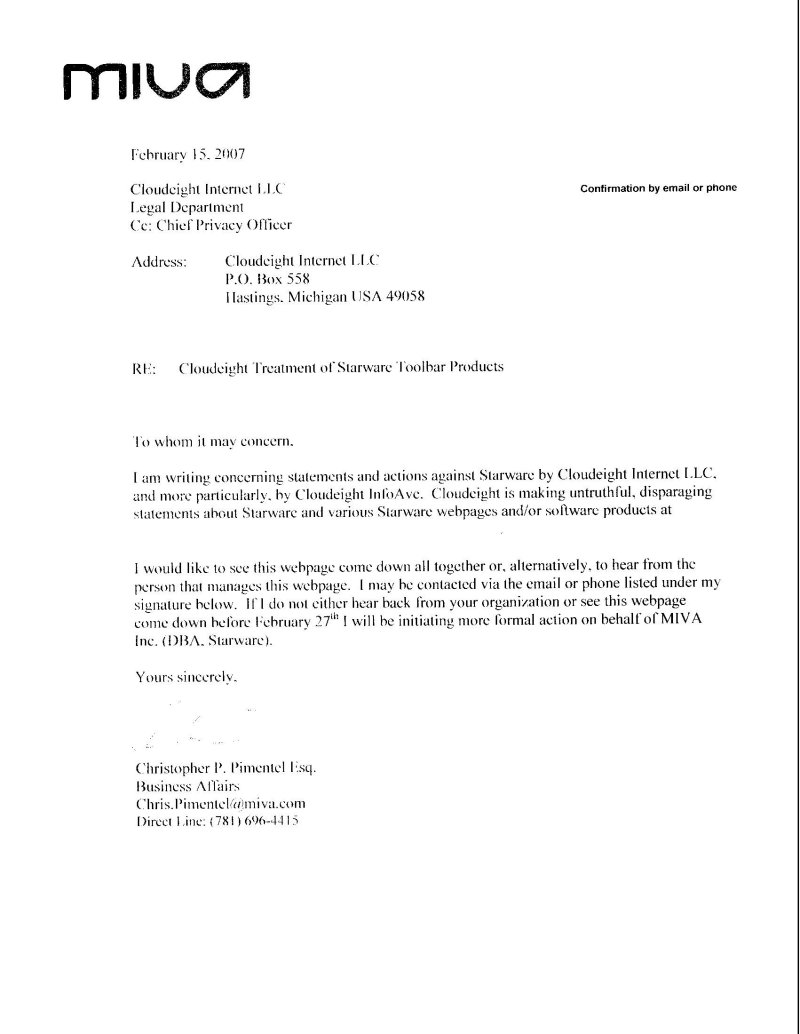

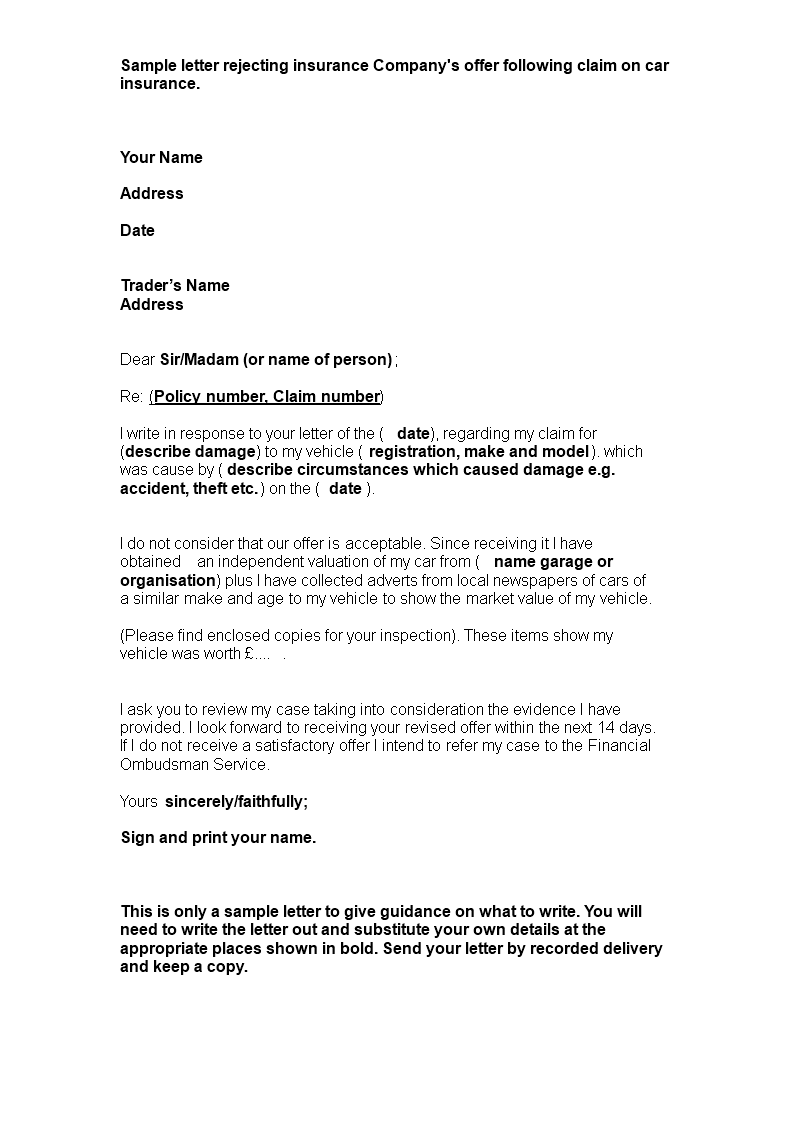

Car insurance claim letter sample - You should always demand more than you think your claim is worth. Car accident claim demand. Any receipts should be enclosed with the letter a claim demand of a certain amount of money that the claimant requires to settle the claim.

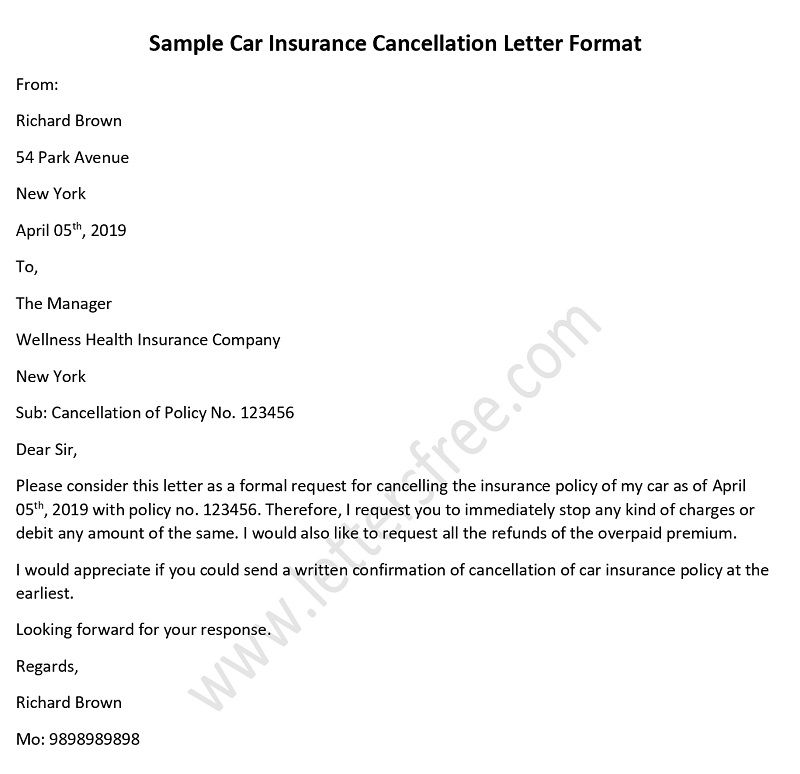

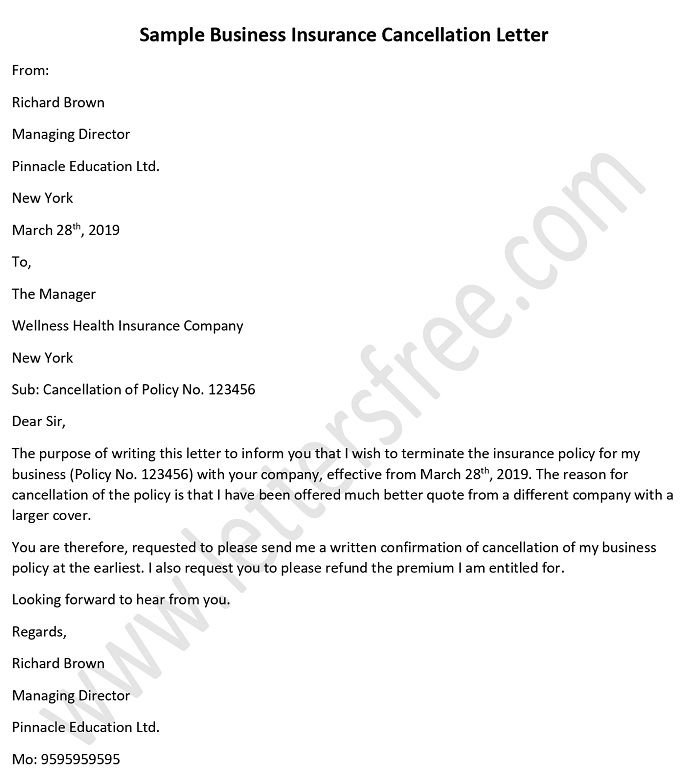

Writing a counter offer letter for insurance settlement with sample by andre bradley july 25 2020 insurance letters when a person submits a claim letter to an insurance company whether it s for a car accident medical malpractice personal injury or other reason the insurance company will respond with a first offer. Usually an insurance claim letter is written to get a claim for a car accident for a medical claim reimbursement or damaged goods. Commonly claim letter is required at the time the claim is claimed from the insurance company whether it could be a car auto fire medical or the life insurance when a loved one passes away and if you are the beneficiary to their life and you need to receive the money claim letter is the first requirement which is applicable for the.

Here s an example of a personal injury demand made by a fictional car accident victim. You can easily adapt the basic letter format to create your own effective demand letter. This business letter can be e mailed posted couriered or faxed.

In this article i will guide you through the proper way of writing such a claim letter to an insurance company. Subject sample letter for the insurance claim. Below you can find the sample template and tips to write an insurance claim letter.

Dear sir madam this letter is concerning the claim of insurance for my car. It is often recommended to demand more than the claim is worth so the claimant is in a good position for negotiating the settlement below is a sample insurance claim letter for a car accident. The auto insurance claim letter is the centerpiece of the negotiation process for the insurance claim.

Writing a claim letter to insurance company is not difficult. This is the communication tool between you and the insurance company and a chance to make your arguments about what injuries are you have and why the other party is responsible and not you. However there are certain important points we should always remember.

Send the letter by usps certified mail return receipt requested to confirm the date the insurance company receives the letter. The letter should contain all the necessary details like when the incident happens how much loss it caused to you etc. The person seeking to cash the claim sends a missive to the insurance company regarding loss of vehicle and requests reimbursement for the same.

Conclude your insurance claim letter with an amount that you require to settle the claim. This way you can negotiate down and get your proper value your insurance demand letter is a critical part of getting the full value for your claim so take your.