Car Insurance Coverage Limits Recommendations

State minimum insurance requirements are the car insurance requirements for each state by law for their residents.

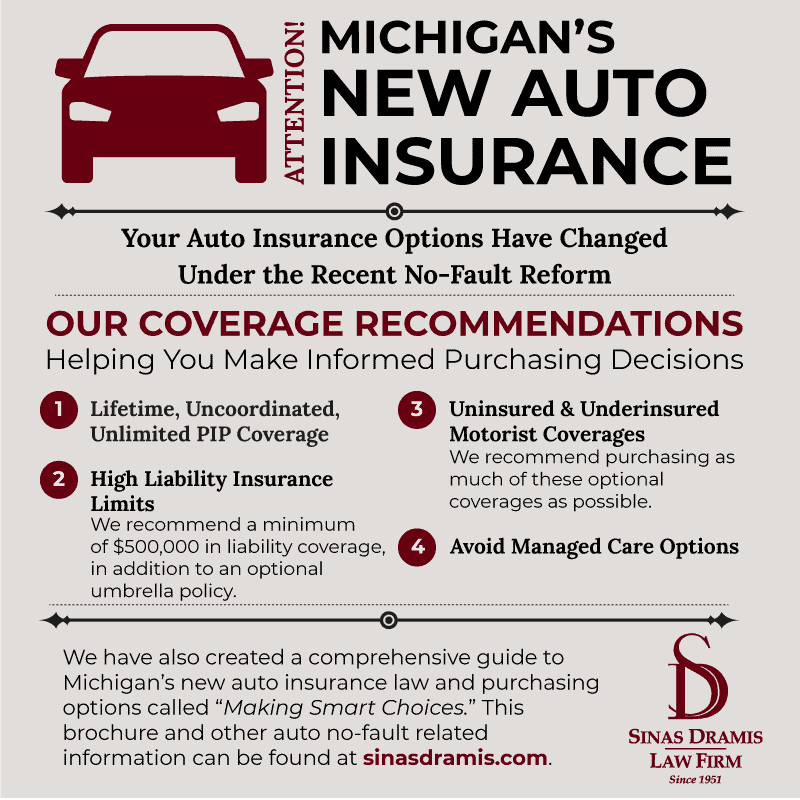

Car insurance coverage limits recommendations - Coverage limits are displayed like 15 45 25 or 15 000 45 000 25 000. By requiring an insurance policy with high coverage limits the lender is protecting your car which under the terms of the loan is legally considered their asset until you pay it off. The higher the insurance coverage limits on your policy the more the insurance company will pay.

250 000 of coverage for bodily injury per person 500 000 of coverage for bodily injury per accident. You can raise your auto liability limits by paying higher rates. When looking at your auto insurance coverage limits you may see something like 250 000 500 000 250 000 or 250 500 250 for your liability coverage.

State minimum liability insurance requirements. You can expect to meet specific car insurance requirements if you lease a new vehicle or buy one with an auto loan. What are car insurance coverage limits.

Auto insurance requirements in tennessee. These minimum requirements for each state can be found at the state insurance commissioner s website we have included them here for your easy reference just scroll down to your state and check it out. For example your health insurance cannot exclude auto injuries from coverage and the deductible cannot be more than 6 000.

Liability car insurance is the coverage that pays to repair the damage you cause to other people and their things. Personal injury protection pip or no fault insurance. If you are looking for basic car insurance required by your state you will most likely only need liability insurance which will cover bodily injury and property damage if an accident occurs.

The minimum limits required are 15 000 for the death or injury of any one person in a car accident and 30 000 for the deaths or injuries if multiple people are involved. Tennessee law requires drivers to carry liability coverage at the very least. To be considered a legal driver all tennessee motorists are required to have a minimum limit of car insurance.

Here s how that breaks down. Minimum limits if driver. If you are comparing policies you might find many insurance carriers abbreviating coverage amounts such as 15 30 for limits of 15 000 30 000.