Car Insurance Declaration Page Example

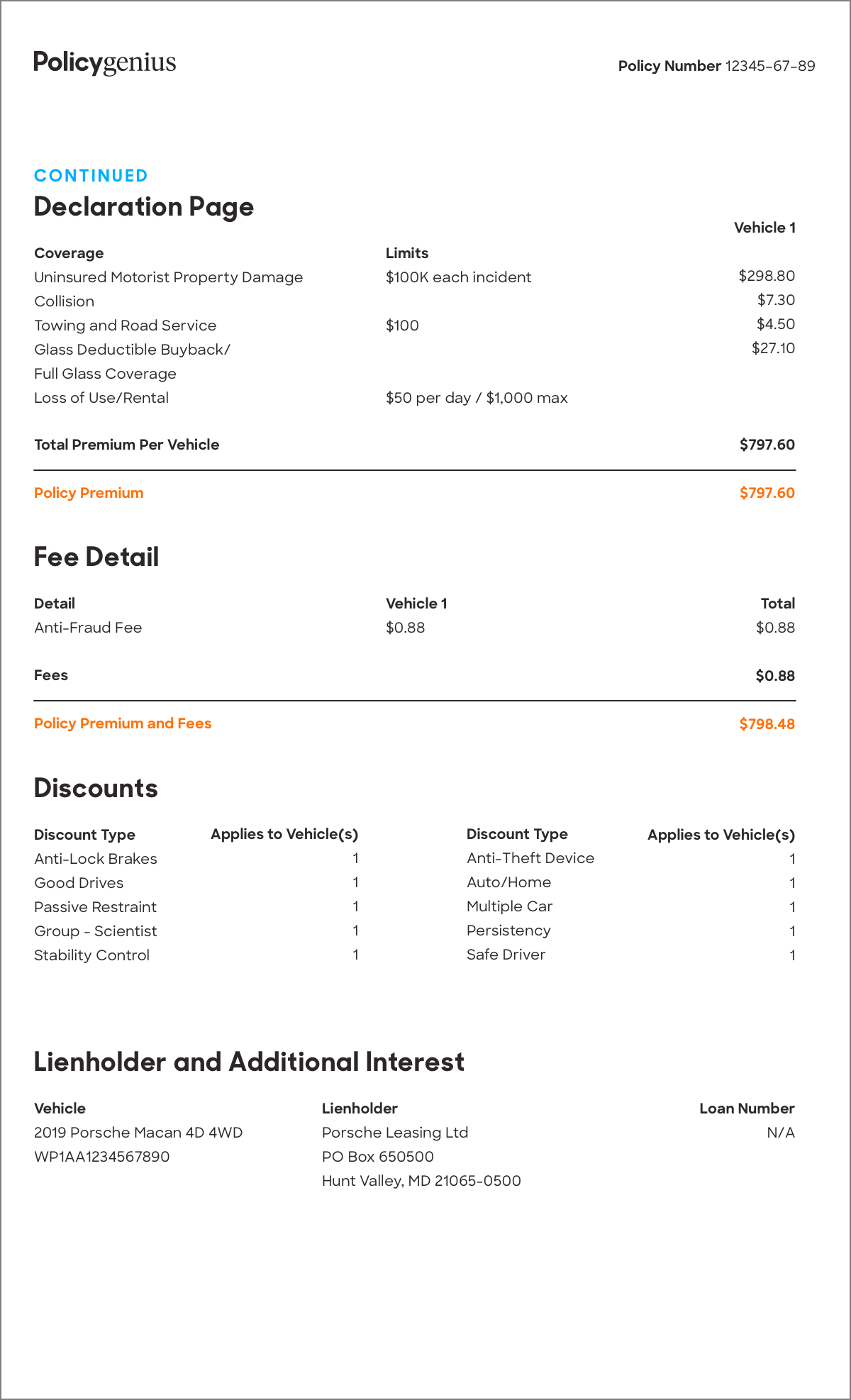

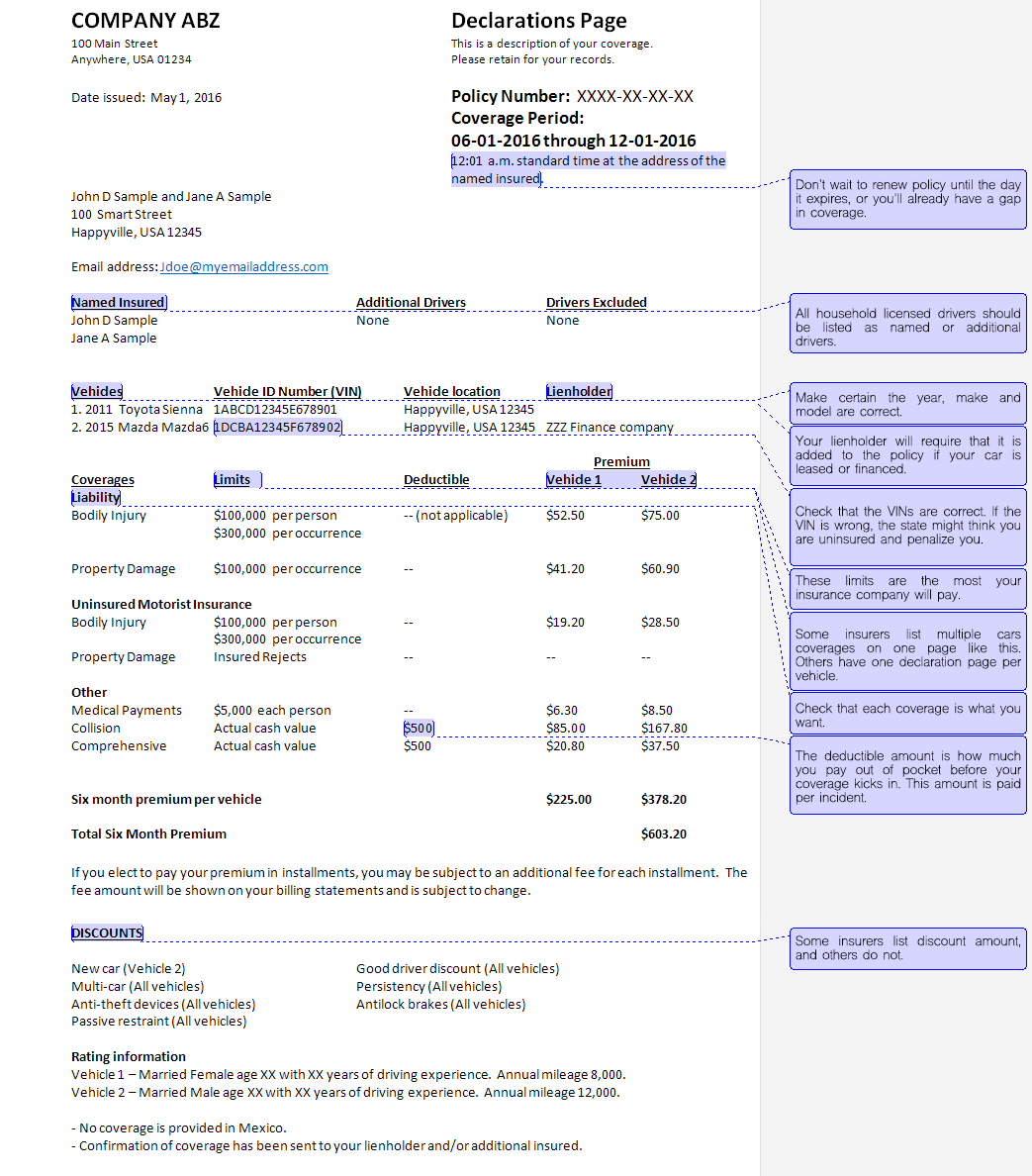

If your vehicle has a lien holder they must be on the declaration page.

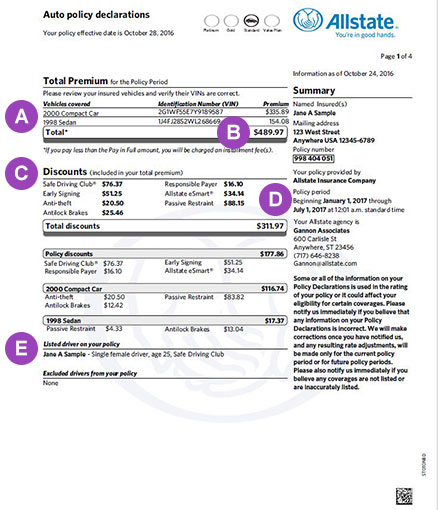

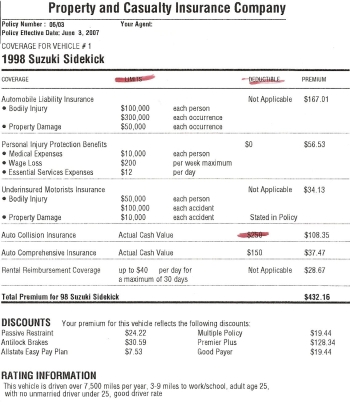

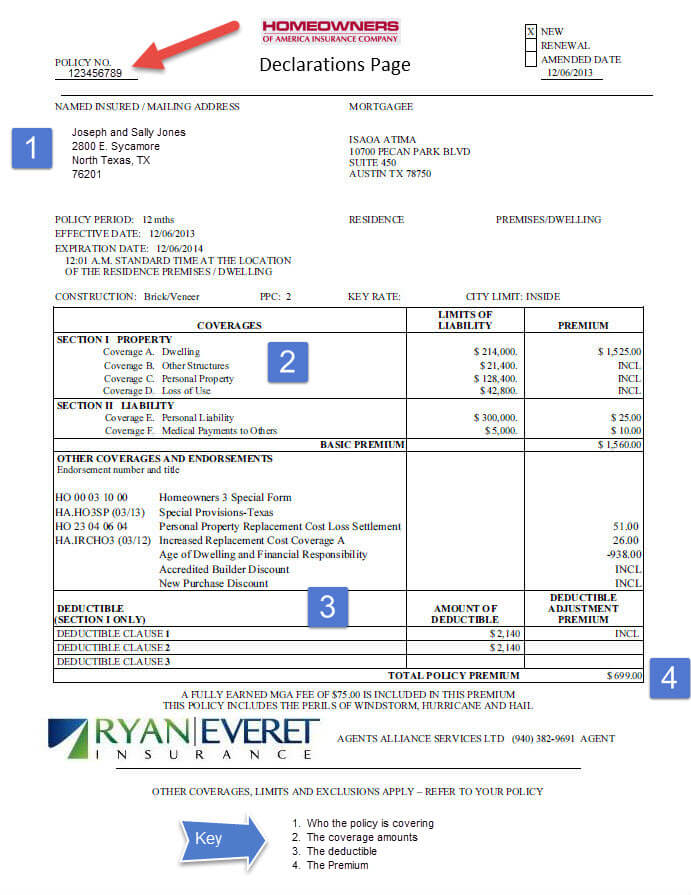

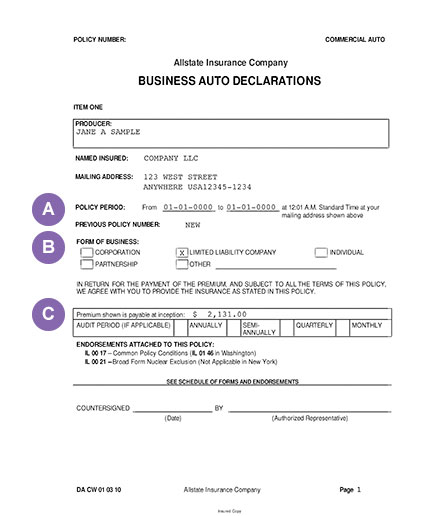

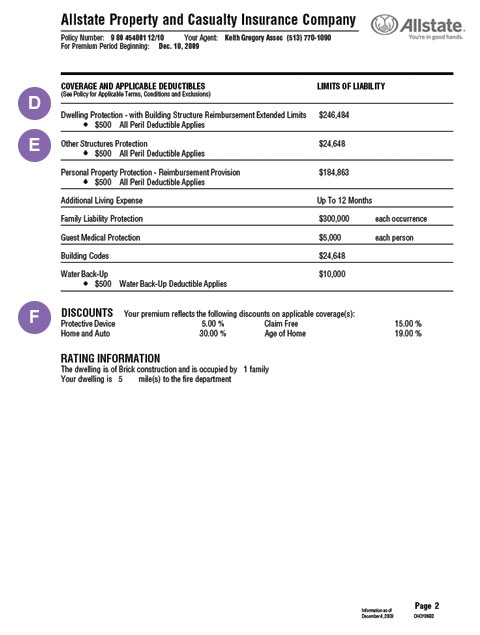

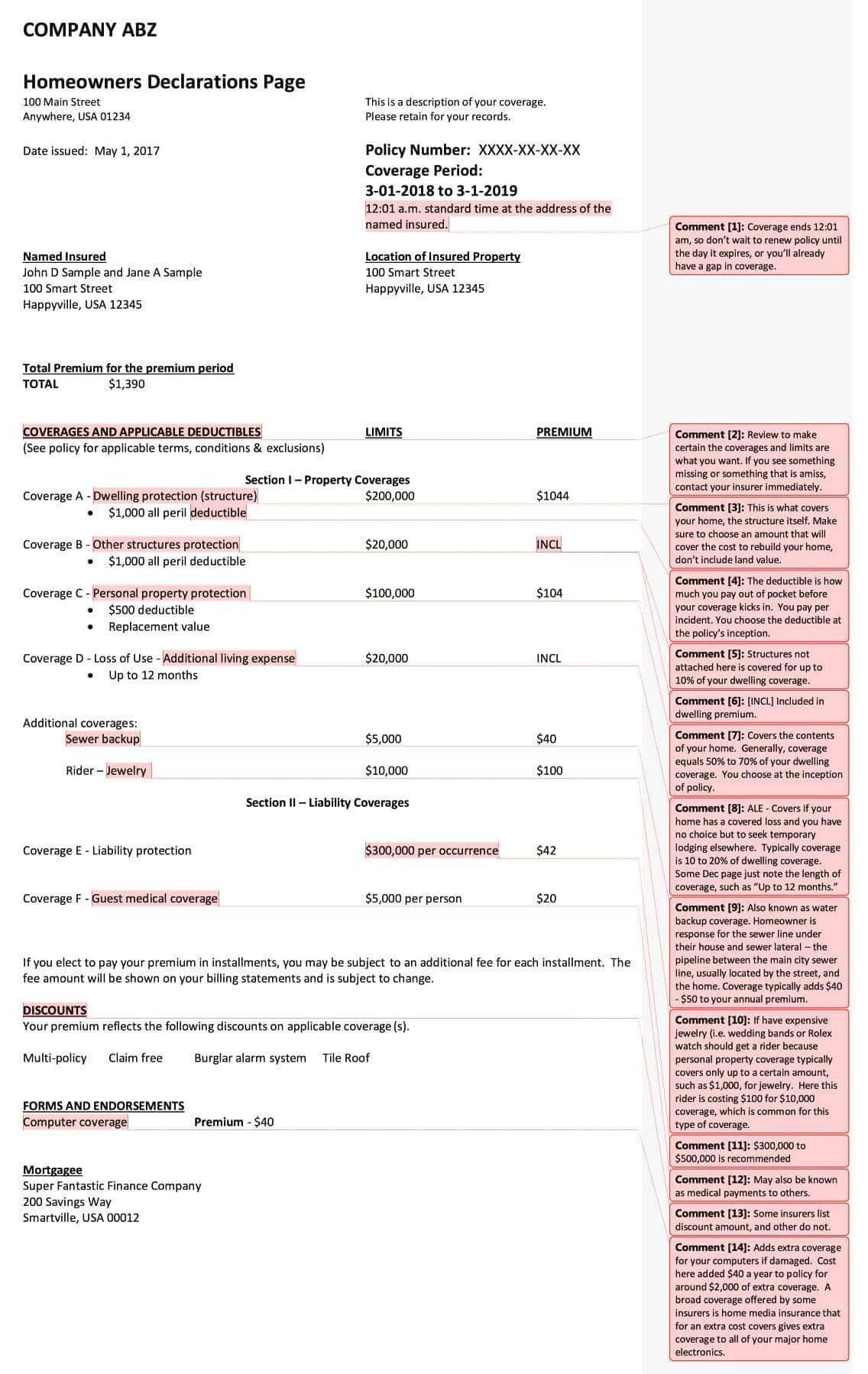

Car insurance declaration page example - An auto insurance policy declarations summarizes your policy and the coverages limits and deductibles you ve chosen to purchase. When it comes to having proof of homeowners coverage and understanding your policy specifics there is nothing better than a homeowners insurance declaration page. It is a good idea to review the information for accuracy and to keep a copy of your declarations page for your records.

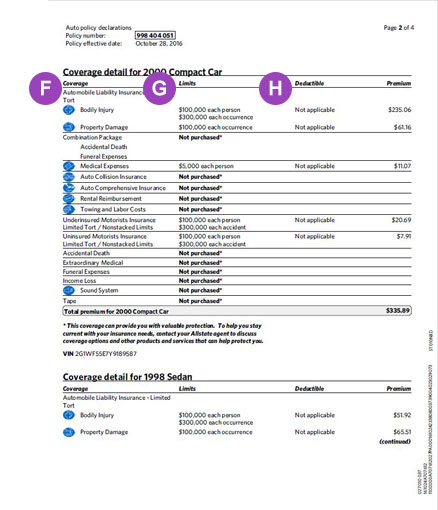

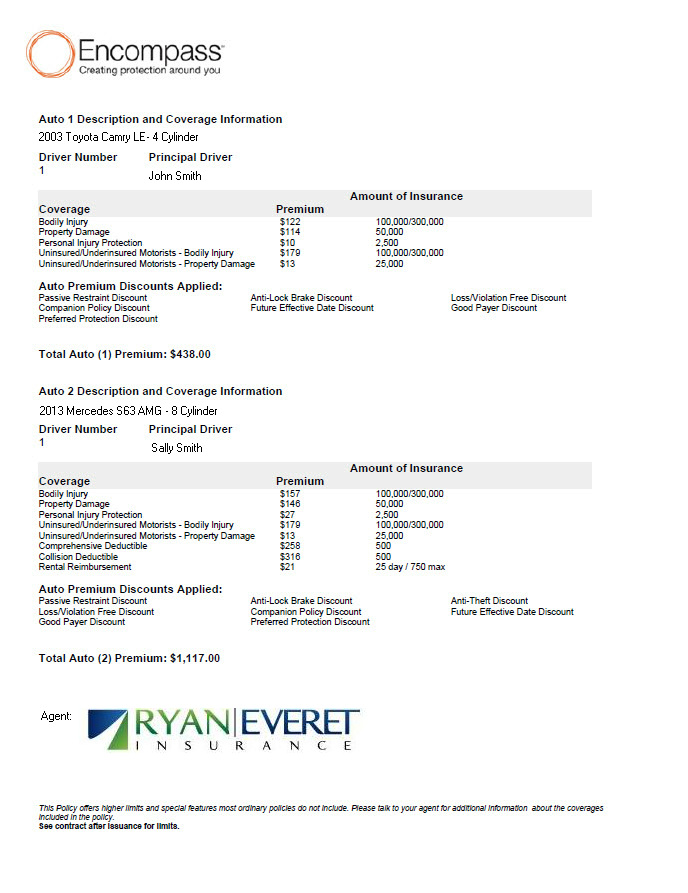

It has the amount of car insurance coverage you purchased in each component liability personal injury collision and comprehensive and uninsured underinsured motorist coverage any optional coverage and any discounts you get. This will typically cover the cost of living expenses like food hotel clothing and other needs. Section ii displays your liability coverage types.

Sample auto insurance declarations page below is a sample auto insurance declarations page dec page with the uninsured motorist policy limits that we recommend. Next to each vehicle you should see a total premium for the policy period. The declaration page that accompanies the policy can be equally confusing.

The named insured i e. You can see that the premium for this uninsured motorist coverage represents only 11 of the total premium. A car insurance declarations page explains how much your car insurance costs and how much you re getting for what you pay.

It can also list the insured vehicles insured drivers and dates your policy is effective as well as any discounts you received. Understanding what a declaration page means is important because it describes the financial protections and coverage you have purchased with your policy. This is vital information that is easy to miss.

The binder of insurance is only a temporary document meant to outline the coverage that is confirmed when you receive your insurance declaration page and policy wording and can be shown as proof of insurance for a new car purchase for example. 250 000 per person 500 000 per accident. Each policyholder who purchases michigan car insurance receives both an insurance policy and a declaration page.

In this post today i will go over the different parts of. In the sample homeowners declaration page the insurance company will cover living expenses under loss of use coverage for up to 12 months with limits up to 40 000. Understanding the layout of the declaration page can make it much easier for you to find the information you need on your policy if you need to file a claim.

The main policyholder and any additional insureds.