Car Insurance Deductible Per Claim

Average car insurance deductibles.

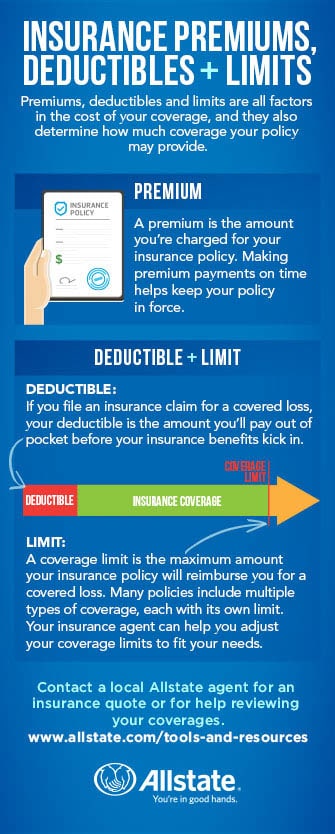

Car insurance deductible per claim - This means that if you have a 500 collision deductible and file a claim for 5 000 in damage to your car you re on the hook for the first 500 and the insurer pays the remaining 4 500. You will pay 500 toward repairs and your policy will cover the remaining 2 500. For instance if a tree falls on your car causing 1 000 in damage you don t get a 1 000 check from your insurer.

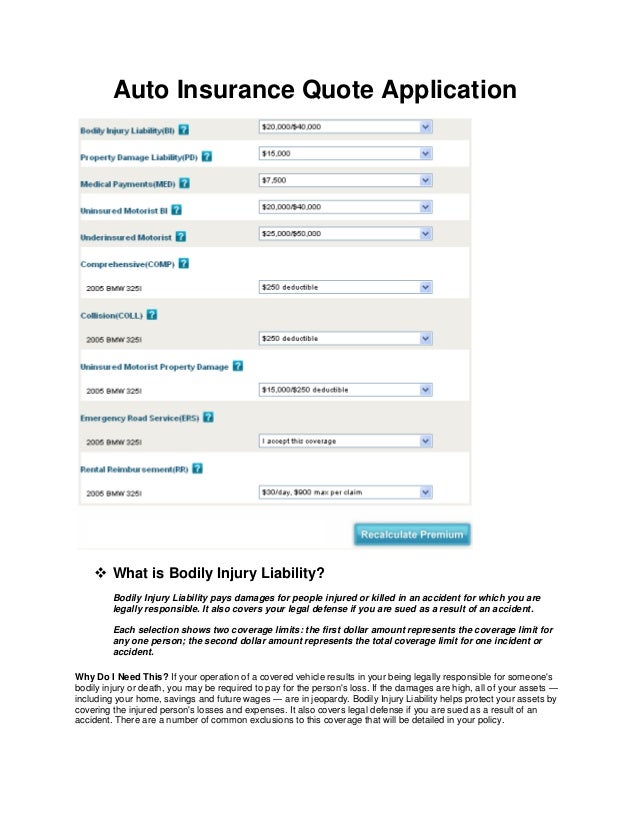

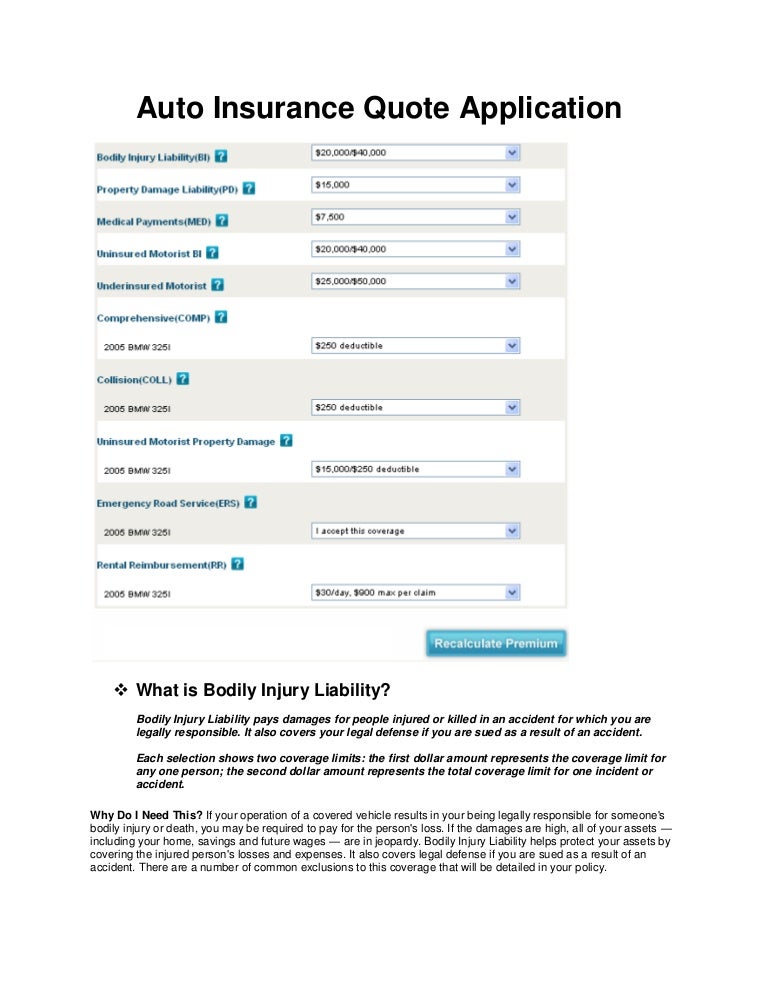

The most common auto insurance deductible levels. Your car insurance deductible is usually a set amount say 500. You damage your car in a covered accident.

An auto insurance deductible is what you pay out of pocket on a claim. It will cost 3 000 to repair. Essentially when you have a car accident and file a claim your claim payment will be reduced by the amount of your deductible.

Unlike in car or home insurance where the deductible is paid per claim the deductible in health insurance can be spread out over the year. It s one of the most common car insurance questions and may be the easiest to answer. For instance if you have a 500 deductible and 3 000 in damage from a covered accident your insurer would pay 2 500 to repair your car.

You will likely not be required to pay your deductible if you are found to be of no fault for causing the accident. Insurance companies give drivers different deductible amounts to choose from and most options fall between 100 and 2 000. If you have a 500 deductible and file a claim with your insurance company your insurer would pay the remaining 2 500.

When you get into a car accident you may or may not have to pay your car insurance deductible when filing a claim. Let s say the collision coverage on your car insurance policy has a 500 deductible. It really comes down to these situations.

Car insurance deductible not at fault. For instance your comprehensive deductible will be applicable if your car incurs damages due to fallen tree branches after a typhoon. For example florida is the only state that uses calendar year deductibles for hurricane insurance claims.

For hurricane damage the deductible may apply per season or by calendar year. A car insurance deductible is the amount of money you are required to pay when you file a claim for an insured loss. For flood insurance claims there may be separate deductibles for your building structure and contents.