Car Insurance Estimator Michigan

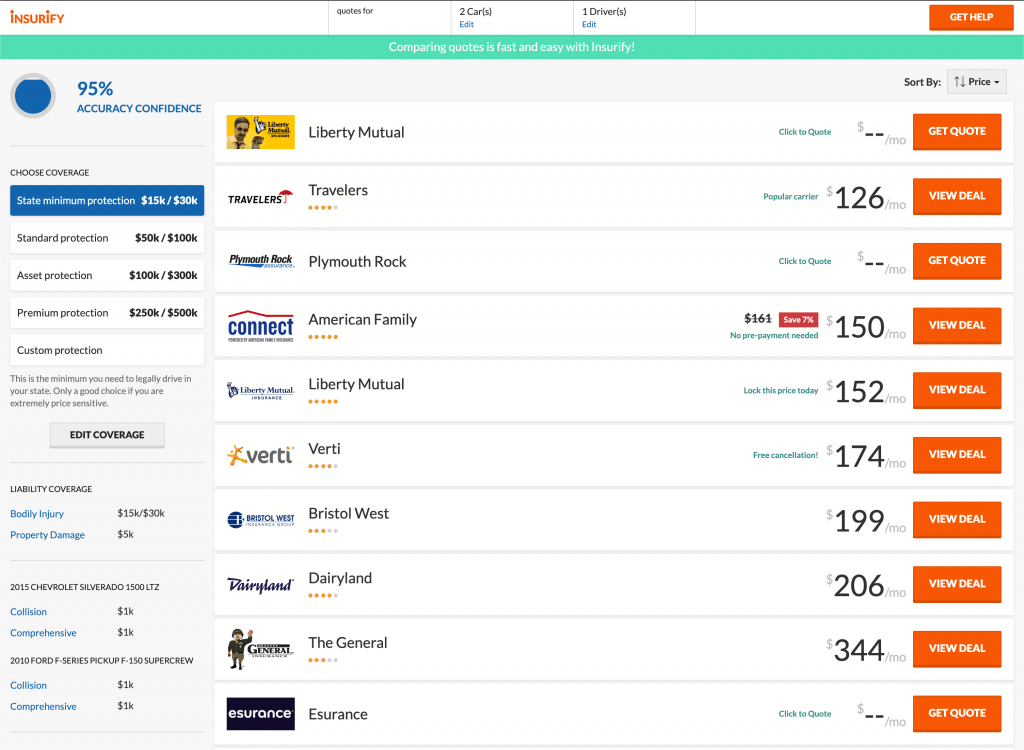

That s why it s important to compare car insurance rates and choose the policy that s right for you.

Car insurance estimator michigan - The formula to calculate your car insurance rate differs between insurers. They must also have personal injury protection and property protection coverage. We ll even suggest liability limits and deductible amounts to you as applicable so you can quote with confidence.

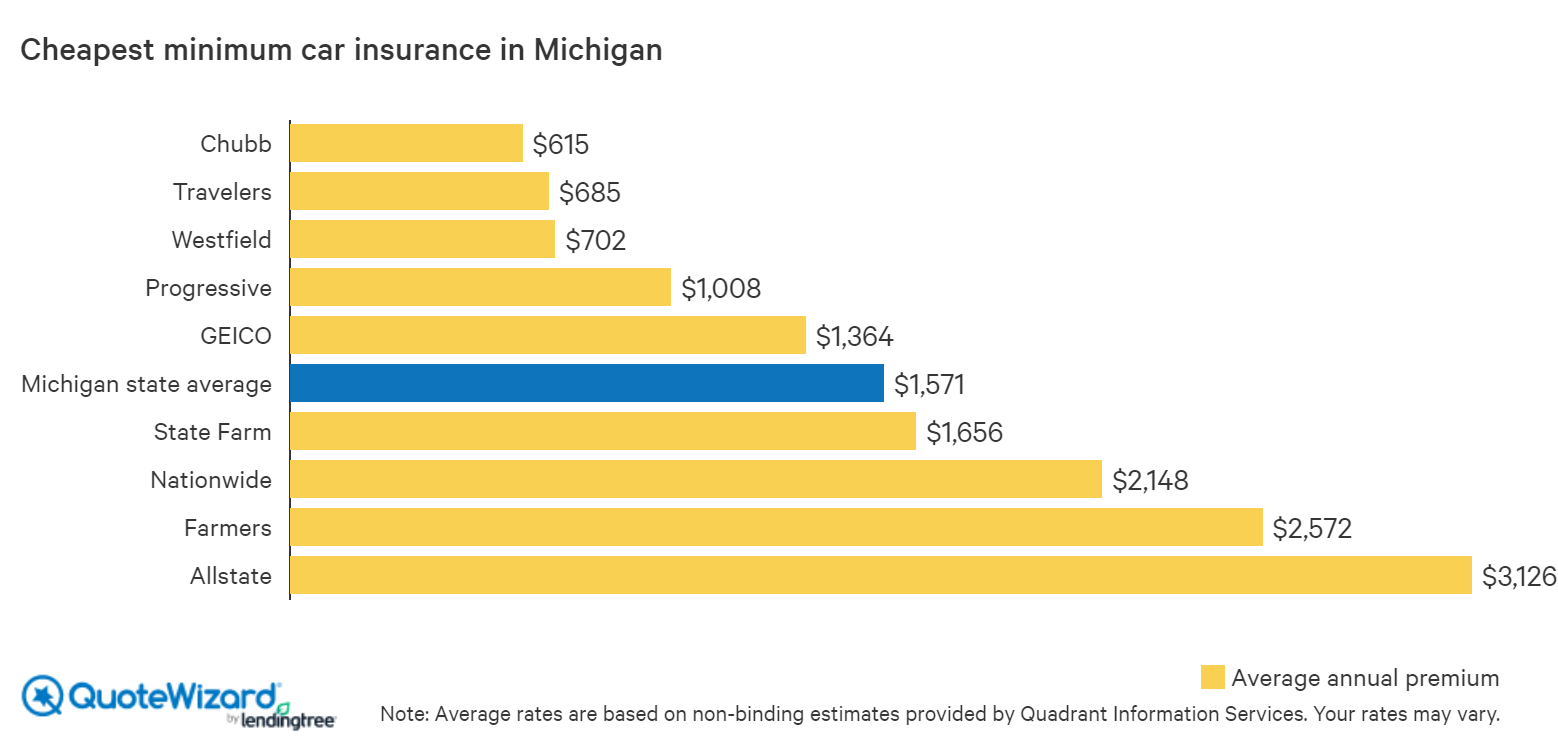

We researched the cheapest insurers in michigan to see how you can save money on car insurance. The car insurance coverage calculator helps you discover the coverages that are just right for your unique situation. Begin your free online quote.

Describe where you live. To learn how much alcohol puts you at risk for impaired driving use the blood alcohol calculator. Learn more about minimum car insurance coverage requirements in michigan.

Your car insurance costs are impacted by more than just the state in which you live. Michigan drivers are legally required to buy certain types of auto liability coverage. I rent my place.

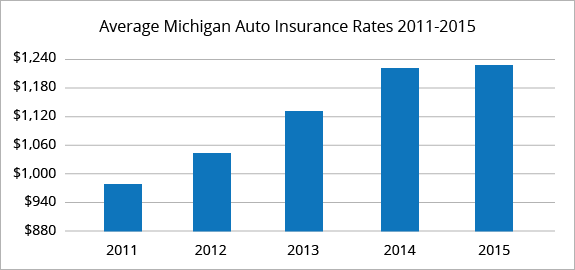

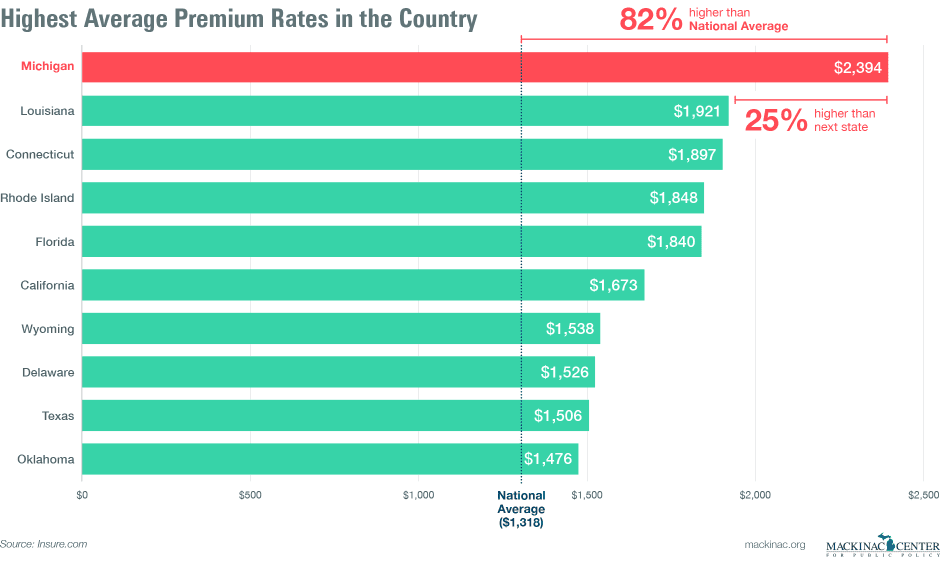

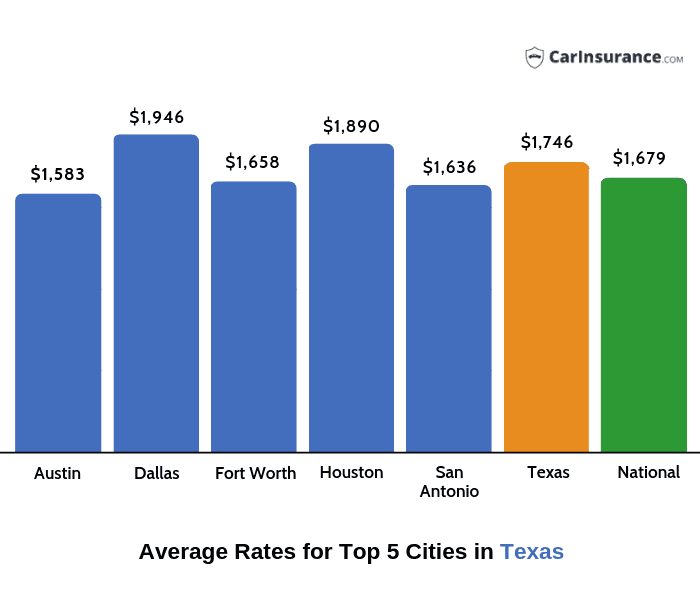

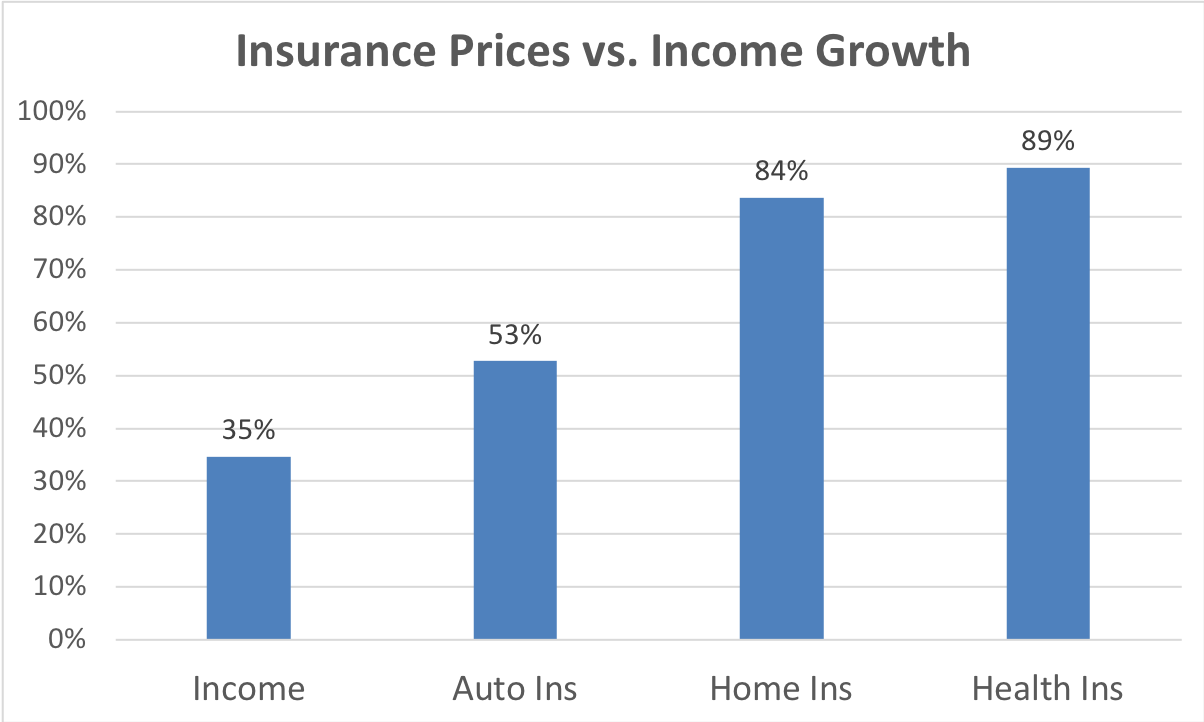

More about auto insurance. Our research found that the overall average annual cost of insurance in michigan is about 2 100 compared to about 1 400 across the country. For 200 000 dwelling coverage with a 1 000 deductible and 100 000 liability limits the average rate of 2 360 in detroit zip code 48213 is the highest in the state.

Try our car insurance estimator and get answers to your questions on which coverage options are best for you. Call us toll free. Michigan has some of the highest car insurance rates in the country.

To determine what types of car insurance you need and how much use the car insurance coverage calculator to see how much a policy costs use the average rates by zip code tool. Ready for a quote. While cost is important it shouldn t be the only thing you consider.

Use our car insurance estimator tool to quickly estimate car insurance cost based on your personal profile. Auto discounts call for a quote 1 800 290 6150. The cheapest car insurance policy may not provide the protection you need on the road.

Average car insurance rates depend upon age as you may have noticed that car insurance rates start dropping at the age of 25. Also get average auto insurance rates for your zip code from reliable companies.