Car Insurance Explained Canada

5 types of car insurance coverage explained.

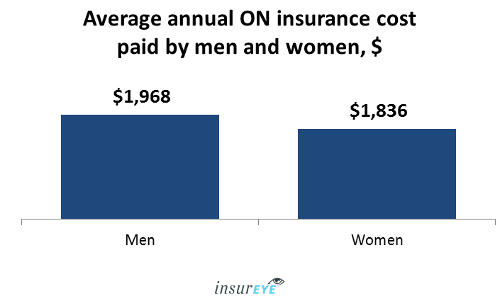

Car insurance explained canada - Having liability car insurance is necessary. These are two different types of people who can help you to obtain auto insurance coverage. The average annual car insurance premium in british columbia is 1 680 nearly 14 higher than the next name on the list ontario 1 445.

Canadian auto insurance coverage explained. There are many insurance companies offering n number of products for customers. In canada the bmo world elite mastercard is one of the top choices for car rental insurance and it s the card i use whenever i rent a car.

You might add an endorsement to your auto insurance policy to cover expensive rims or other equipment. The law is clear. The prime advantage from an insurance company s standpoint is that multi car policies create crossover business.

It is compulsory in all territories and provinces. How bc auto insurance prices compare to other provinces. Rather than treating each car as a single policy every vehicle in a household lists on a single policy.

Or call one of our live agents at 780 809 8486 or toll free at 1 888 633 9898. Simply multi vehicle insurance is a package that covers more than one car. Below is a summary of the insurance coverage included with this card including three types of car rental protection.

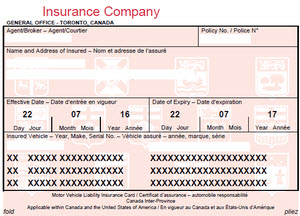

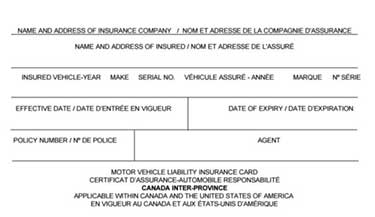

Every canadian vehicle owner must have auto insurance in order to operate your vehicle. Liability car insurance is a form of insurance that covers the costs of injuries and damages to other drivers or property in an accident that you cause. New car guarantee variables.

Click here to start a free no obligation online auto insurance quote. Liability insurance in canada also includes coverage to protect drivers against financial losses they might suffer due to their own medical expenses and the loss of income that they could incur if injured in an automobile accident while. Following a collision you will receive either the sum of money that you used to pay for your now un repairable vehicle or the sum of money that a brand new version of the exact same model of vehicle costs.

If you are caught driving without insurance your license can be suspended your vehicle can be confiscated and you will face a hefty fine. If you are buying the car insurance policy for the first time it will be an overwhelming experience. In short the answer is not well according to a recent report british colombians are paying the highest premiums in canada.

Car insurance and the law in canada.