Car Insurance Factors Affecting Price

Insurance bajaj allianz motor insurance best motor insurance company in india bharti axa auto insurance car insurance car insurance renewal car loan car prices in india credit cards debit card diesel price difference between comprehensive and third party.

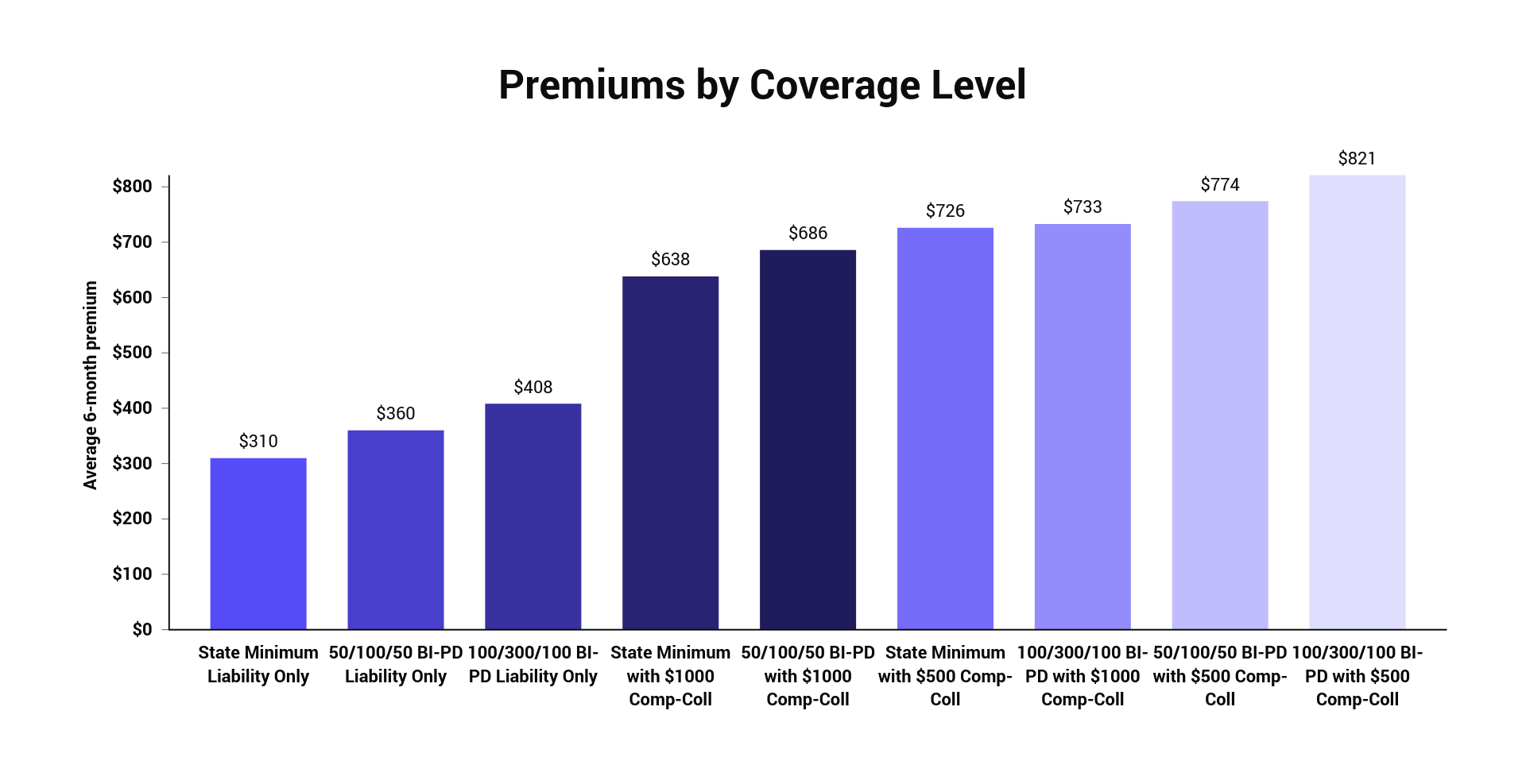

Car insurance factors affecting price - When shopping for car insurance it can be tempting to reduce your rates by choosing lower amounts of coverage or by raising your deductibles these are of course the two most obvious factors that affect the cost of your auto insurance. Factors that affect the price of car insurance. The insurance group process also looks at safety features like locks and alarms to determine.

It was in 1930 that the uk government of ramsey macdonald introduced a law requiring every vehicle user to have at least a third party personal insurance arrangement. Today the car insurance industry in the uk has skyrocketed in size and value. We aim to be your first stop for car insurance questions and to save you money on your car insurance with our free policy quotes from the trustworthy companies in our nationwide network of auto insurance providers.

Free car insurance comparison. Different car models are grouped together based on their price when new performance repair costs and the price of body shell and replacement parts. For one thing to some insurance companies they will more important than to others.

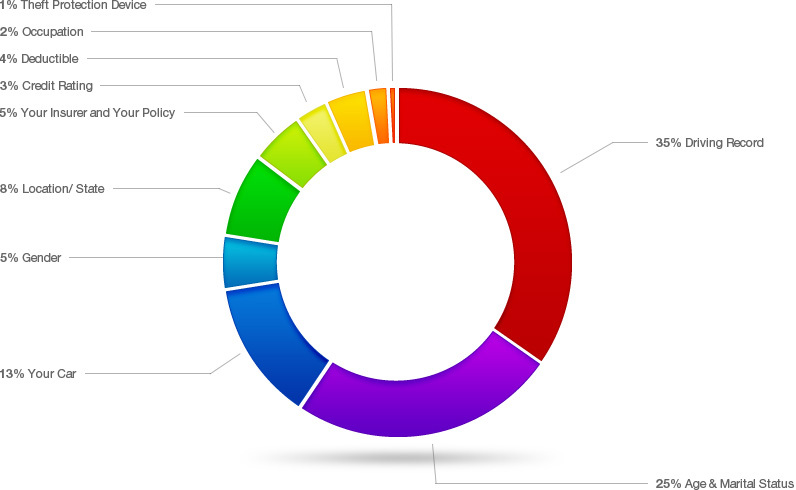

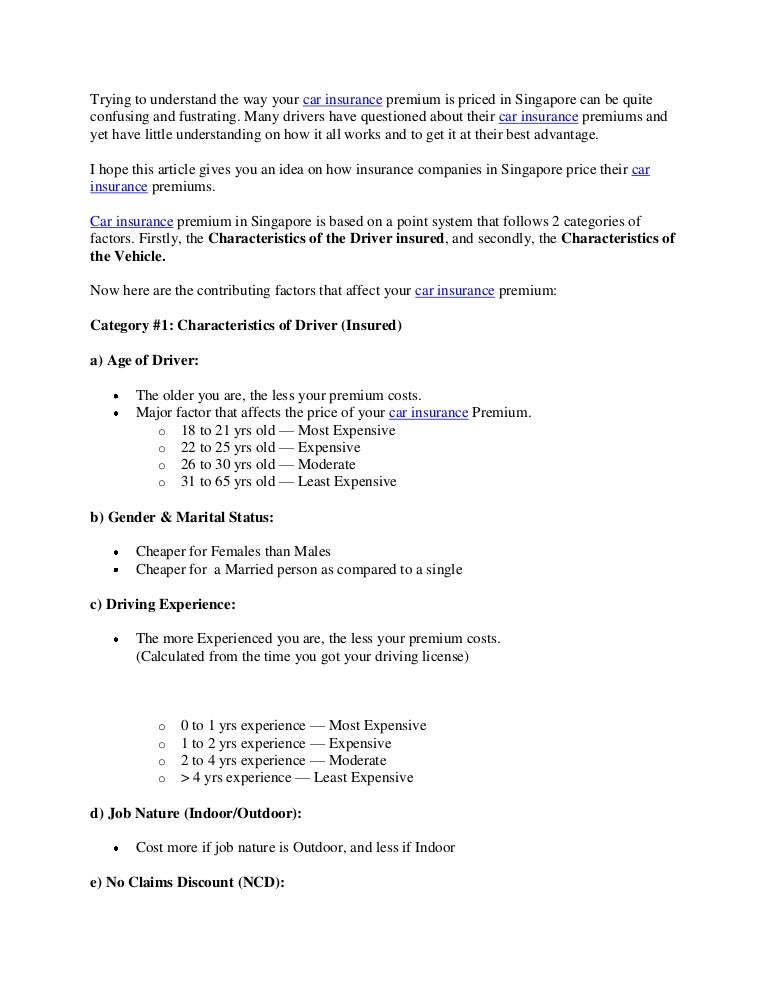

There are many factors that affect your car insurance rates including in most states your age gender where you live your credit and driving history and the type of car you drive among others. You may not realize it but your overall rate is also affected by many more different factors some of which you can control and many of which you cannot. Top factors affecting your car insurance premium in india loans.

In addition the types of car insurance you buy and car insurance discounts you qualify for also influence how much you pay. Next behind the scenes the company s algorithms go to work to make an educated guess on your risk level and calculate your rate quote. Here are the key variables insurance companies use to determine the cost of car insurance and the price you ll pay in.

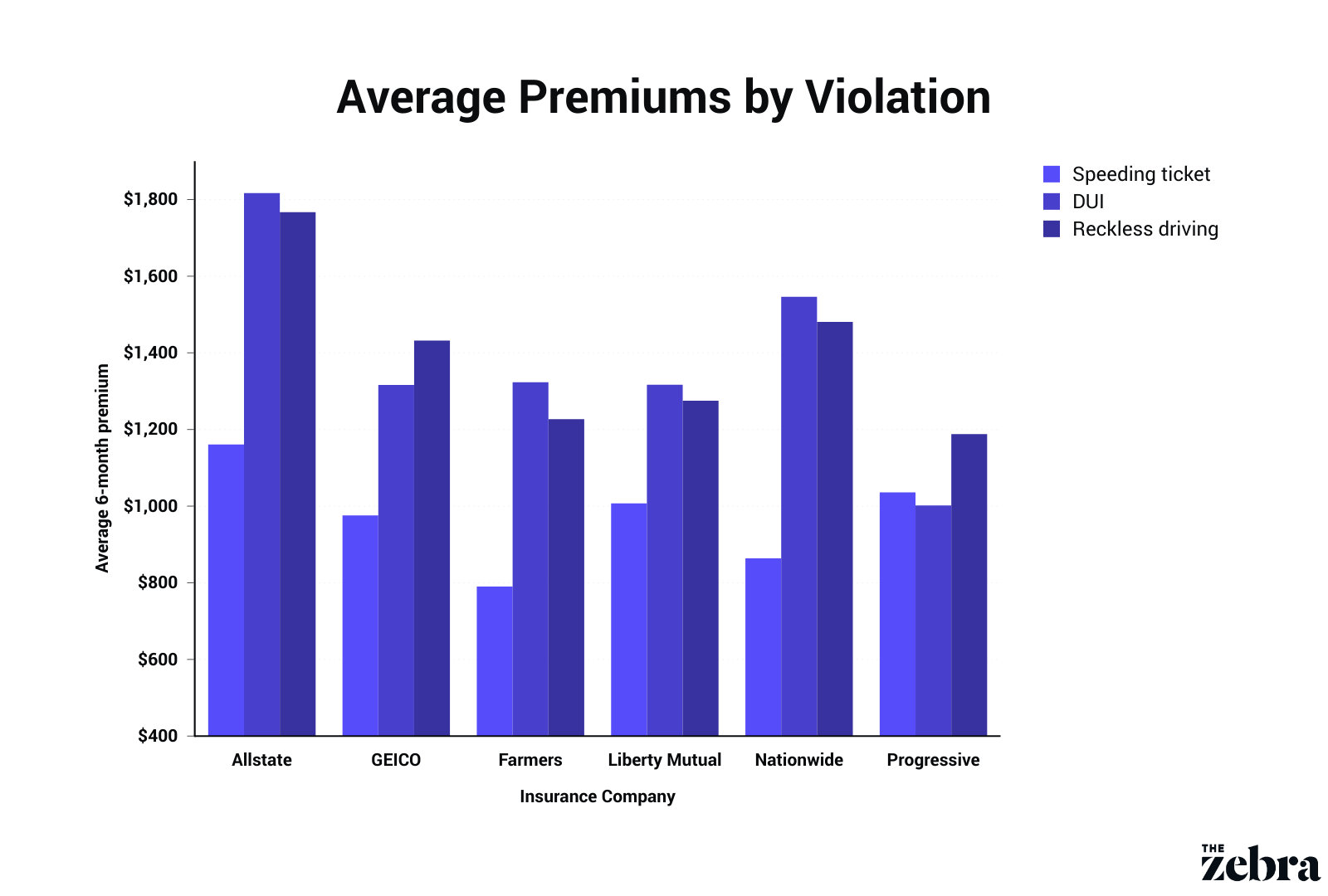

The current age and value of your car affects your insurance premium plus the insurance group that the car is in. These next factors you can consider more as wildcard factors. In addition to the quality of the car another key factor affecting the cost of your car insurance premium is the driver s history.

Information on risk factors that affect car insurance rates are collected by the insurance company as you fill in a quote form. How driving history impacts car insurance premium. In 2017 there was nearly a car for almost every two people in the.

It is important for you as a new driver to know what affects the cost of your car insurance to make sure you know what you need to or can do to keep your costs down. Millions of people purchase car insurance without knowing why they have been quoted the price they ve received.