Car Insurance Mandatory In Canada

If you own or drive a car in alberta by law you must buy insurance coverage from a private insurer.

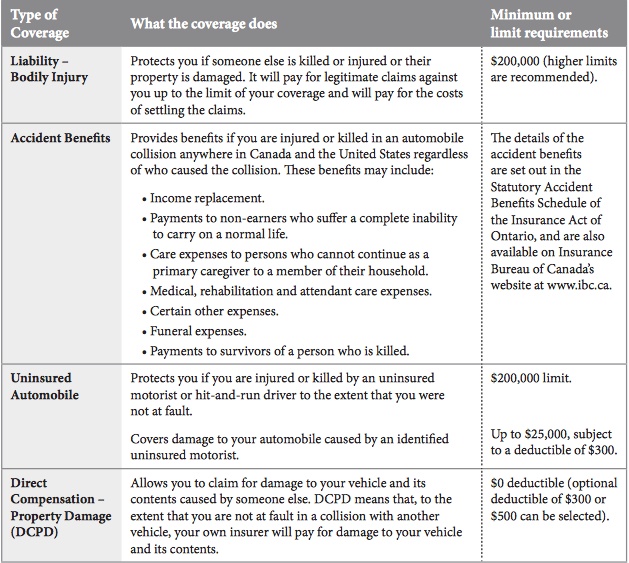

Car insurance mandatory in canada - Car insurance liability coverage is mandatory for driving in canada. Car insurance in canada is mandatory regardless of whether you re driving your personal vehicle or renting one. In the province 200 000 in third party liability coverage is mandatory.

How much does collision car insurance cost. Required car insurance in ontario. But once you are behind the wheel the chance of something going wrong is very real.

Vehicle insurance also known as car insurance motor insurance or auto insurance is insurance for cars trucks motorcycles and other road vehicles its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. The facts of the property casualty insurance industry is published by insurance bureau of canada ibc the trade association representing. Your car insurance policy may also provide you with additional benefits.

Everywhere in canada car insurance is mandatory you have to be insured. If you own a car you must get insurance coverage. Car insurance q a.

You can get different types of car insurance plans including coverage for either or both. In car insurance terms full coverage means all provincially mandated coverage as well as comprehensive and collision. In most cases you are covered by your existing u s.

But because people break the law all insurance policies in provinces with private insurance include uninsured. If you regularly drive a car that belongs to a relative or friend you should make sure you re listed on their car insurance plan. Driving a vehicle is a basic necessity for many canadians.

Beyond that there are other options to consider for your ideal coverage. It covers the owner driver passengers pedestrians and property involved in a vehicle collision. Learn more about vehicle based coverage.

Auto insurance is required by law across canada. While every province in canada requires drivers to maintain a certain amount of car insurance coverage the requirements vary. So if you re planning on driving in and around the country make sure you obtain car insurance for driving in canada or expect to pay a large fine.

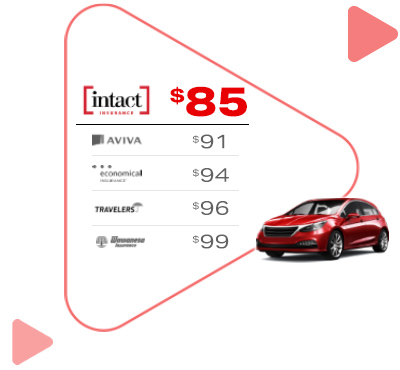

The average cost of full coverage car insurance runs around 264 per month or 3 168 every year. Collision insurance covers the cost of repairing or replacing your car if you hit another car or object. This is sometimes included with your mandatory insurance coverage.