Car Insurance Michigan Law

Turning 65 might cause your michigan auto insurance premiums to spike.

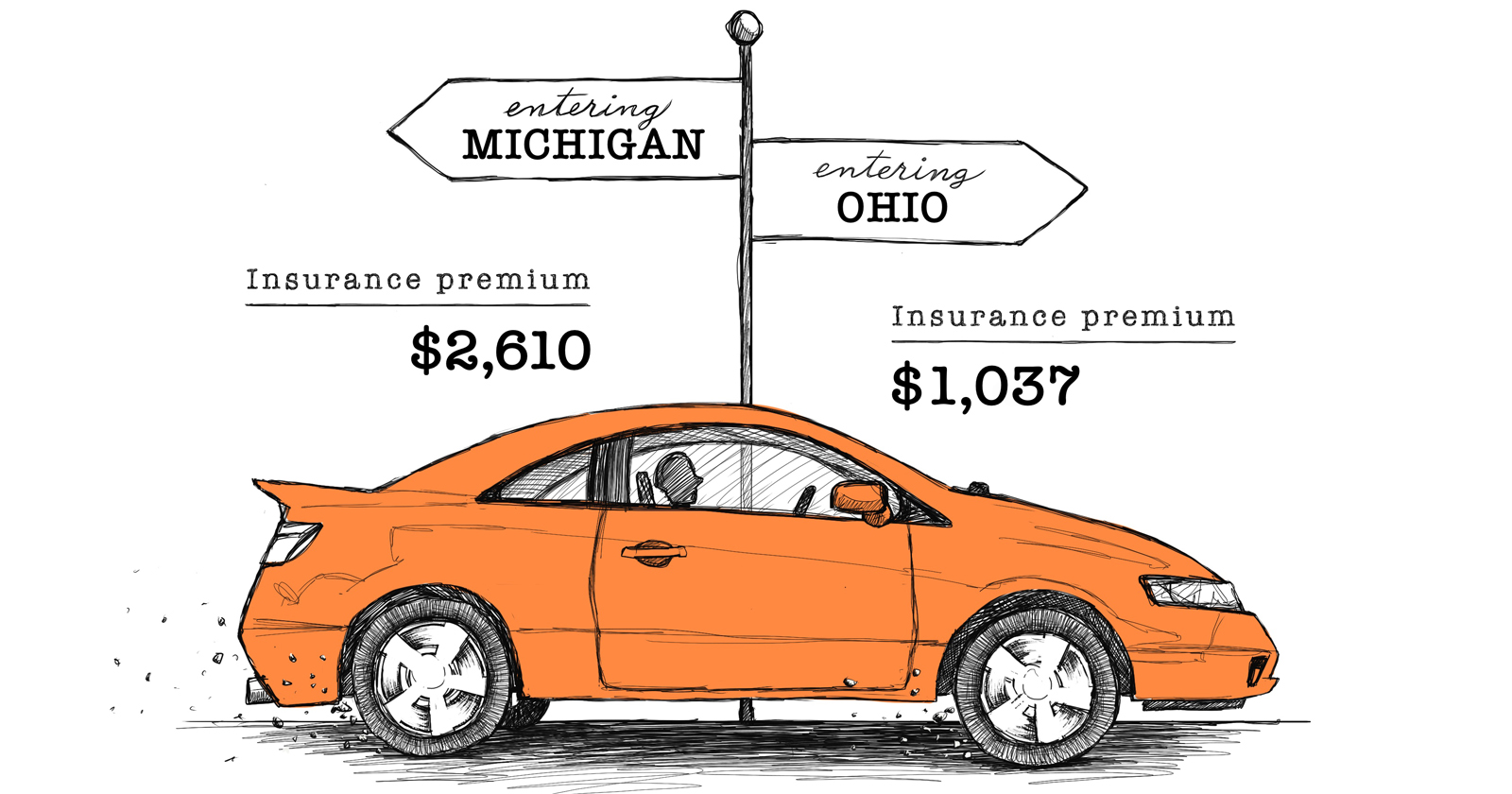

Car insurance michigan law - The driving force behind today s new michigan car insurance law has been the public outcry over the high costs of auto insurance. Governor whitmer signed bipartisan auto no fault legislation to lower costs maintain the highest coverage options in the country and strengthen consumer protections. Auto insurance requirements in michigan.

What is michigan s car insurance reform. That pressure got to politicians on both sides to do something to lower auto insurance prices. The law sets a schedule of fees for medical.

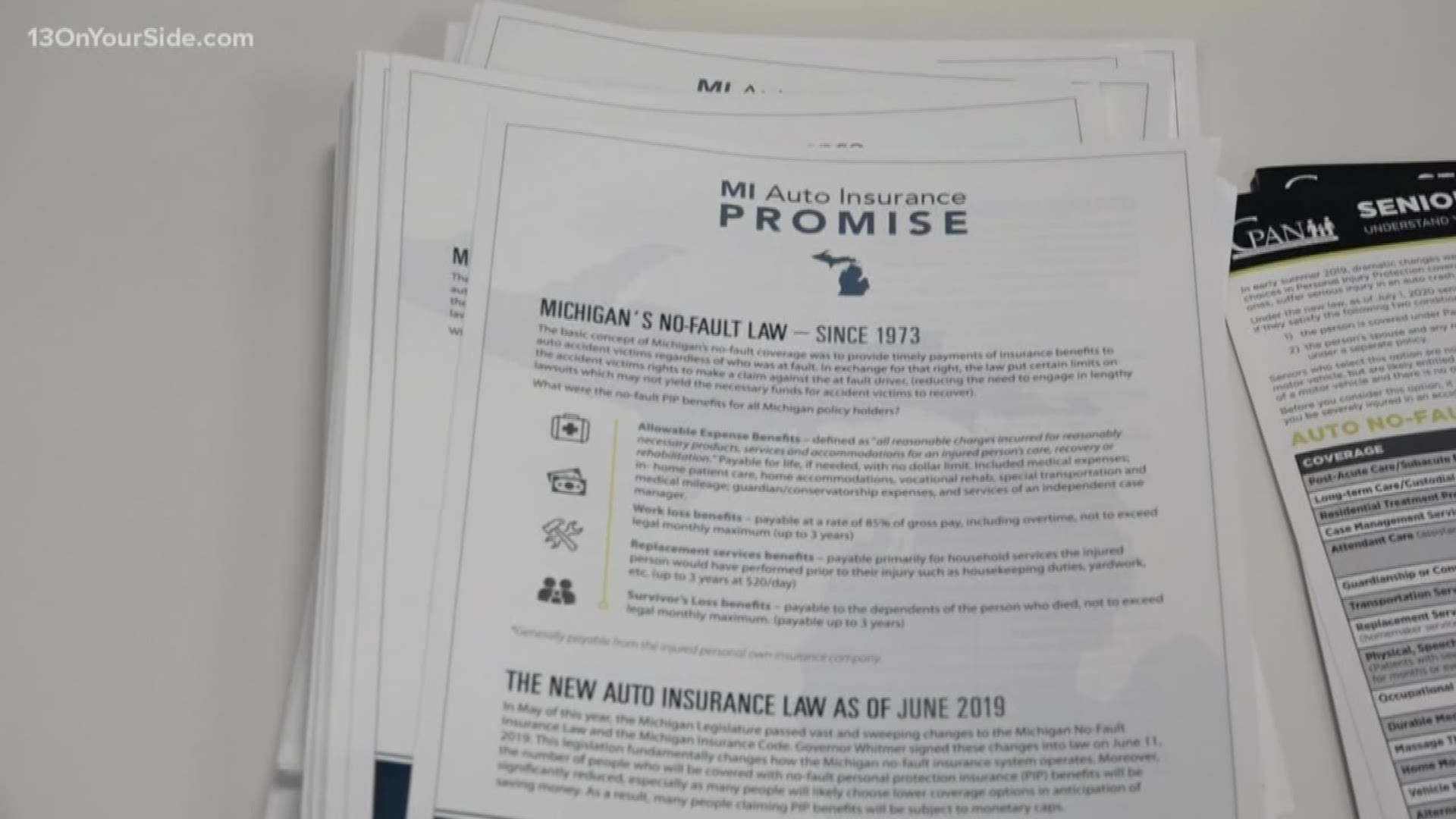

Michigan s new car insurance law. The new michigan law takes effect on july 1 2020. The mcca has already announced that as a direct result of the new law it is lowering its per vehicle assessment starting july 2 2020 which will save michigan drivers at least 120 per car.

Michigan car insurance laws. Stick with unlimited medical coverage go with less or for seniors with medicare opt out entirely. Drivers now must choose among several different medical options for pip protection and what amount of liability also known as bodily injury liability insurance to purchase.

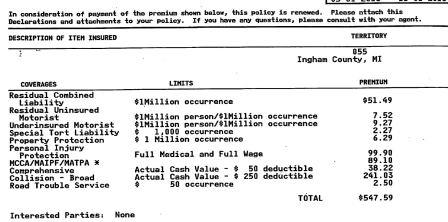

Michigan requires a cost control measure between car insurance companies and health care providers in order to make pip coverage more affordable. Michigan has historically been one of the more expensive states in which to buy insurance. Michigan drivers who renew or buy car insurance face a choice starting july 2.

For policies effective after july 1 2020 and before july 1 2028 the new michigan no fault. Michigan s new no fault law means drivers have more options for personal injury protection coverage also known as pip benefits pip covers medical bills from injuries sustained in an auto accident as well as rehabilitation costs lost wages attendant care services tending to an injured. To be a legal driver in michigan you must adhere to the state s guidelines else you.

Lansing michigan s new auto insurance law will go into effect for policies that issue or renew after july 1 a landmark piece of bi partisan legislation the new law aims to bring down the overwhelming costs drivers in michigan have had to pay to stay insured. Below are our attorneys recommended car insurance coverage options to purchase for the new michigan no fault law. Companies are required to reduce statewide average premiums for eight years and a new fee schedule for medical provider reimbursements will.

10 things to know about new auto insurance reform.

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/cloudfront-us-east-1.images.arcpublishing.com/gmg/5EAEU4J2JVF5THOGXC7YFZR5OQ.jpg)