Car Insurance Ontario

Ontario auto insurance is provided by private insurance carriers and available coverage is broken down into two categories mandatory and optional.

Car insurance ontario - Not only does it defy expectations about the cost to insure it but it also brings a high level of safety features as recognized by the insurance institute for highway safety. This can be attributed to its size the number of drivers on the road and populated market. Driving in ontario may mean that you are headed down the 401 during an icy snowstorm or sitting in traffic on the gardiner expressway gazing at the summer sunset over the toronto skyline.

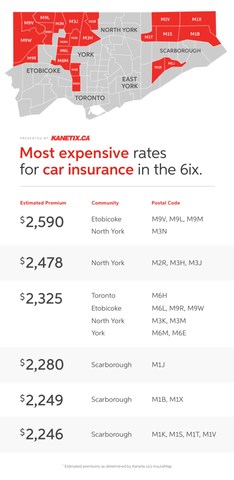

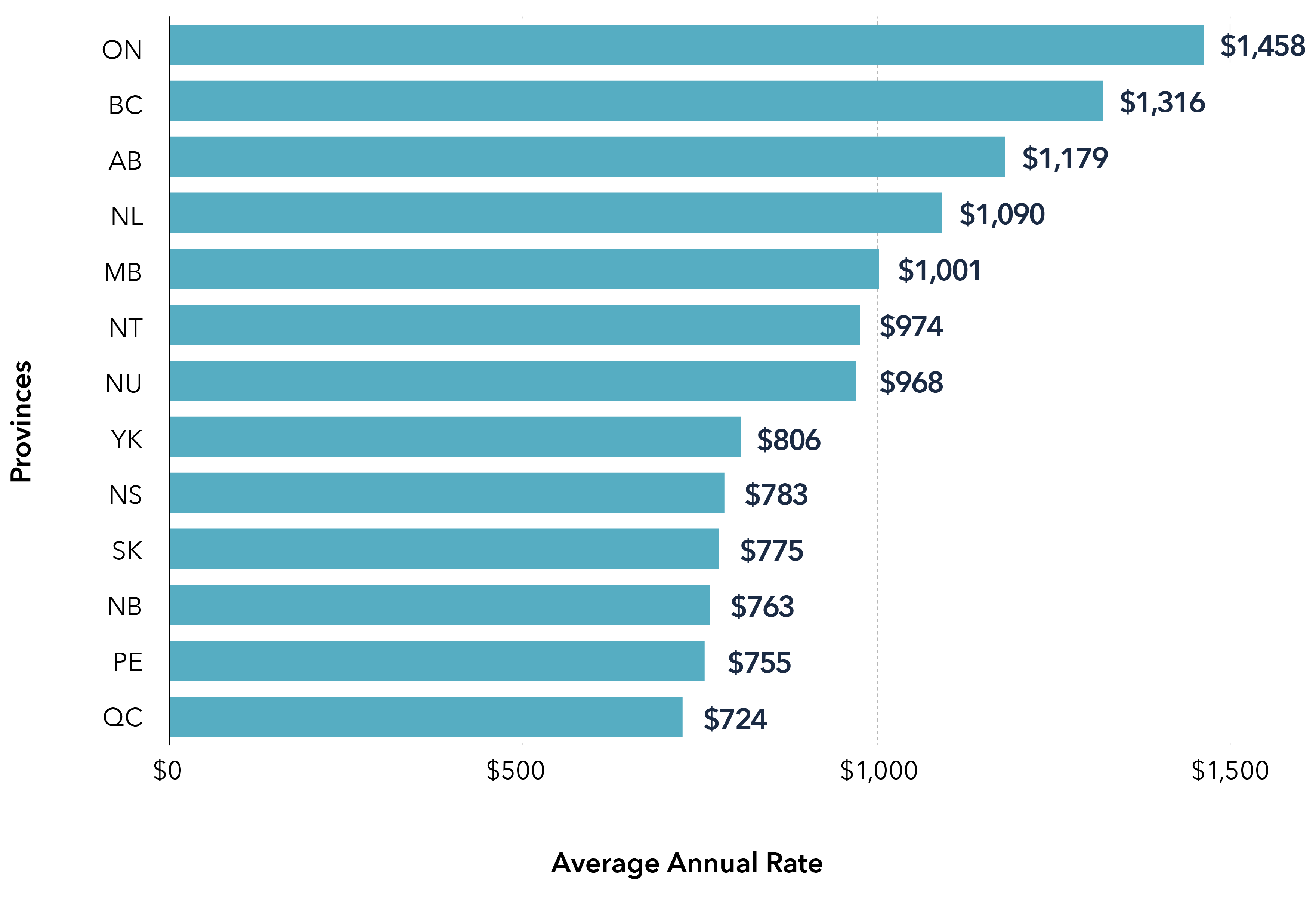

Car insurance in ontario. So with car insurance through johnson we ll always be by your side from your work commute on the 401 to your drive up to the cottage in muskoka. Ontario car insurance premiums are some of the highest in canada due to a greater concern for insurance fraud and different insurance laws.

This can be attributed to its size the number of drivers on the road and populated market. When driving your car feel confident your auto insurance coverage fits your needs. The average cost of an insurance policy for an ontario driver is 1 505 according to 2020 estimates from the insurance bureau of canada.

Car insurance in ontario and across canada is a requirement for all drivers but there are some provincial differences in coverage requirements. Not only does ontario have more drivers than in any other province in canada it also has some of the highest car insurance costs. Some drivers may have to be covered under a high risk insurance company.

But while you might not be able to change your vehicle or be willing to move to another neighbourhood for the sake of car insurance premiums there are ways you can help lower your premiums. Ontario car insurance eligibility and restrictions. Auto insurance is mandatory in ontario but that doesn t mean all vehicles and drivers are eligible for standard market car insurance.

Cheapest cars to insure in ontario 2017 10. Here s what you need to be eligible for standard market personal car insurance in. Limits required by law.

In ontario the minimum liability coverage you ll require for auto insurance must cover third party liability accident benefits coverage uninsured automobile coverage and direct compensation property damage coverage. Ontario auto insurance is a privatized industry meaning you purchase your policy from a private company. In ontario auto insurance is regulated by the financial services regulatory authority of ontario fsra formerly known as the financial services commission of ontario fsco an agency of the ministry of finance.

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/RJ4BJPBB7FFIXGZ3U3VOC4MD7I.jpg)