Car Insurance Policy

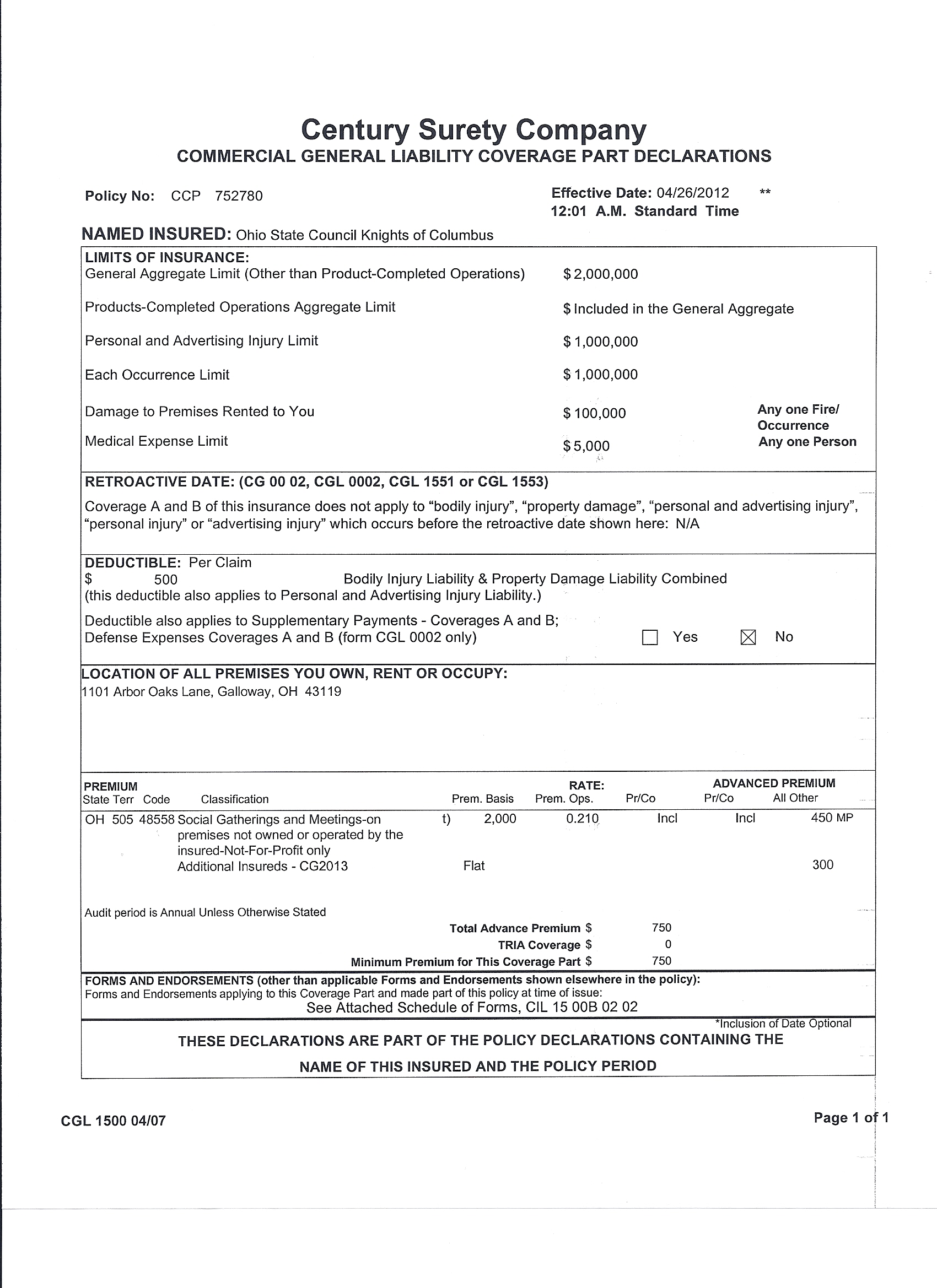

Contractors all risks car insurance is a non standard insurance policy that provides coverage for property damage and third party injury or damage claims the two primary types of risks on.

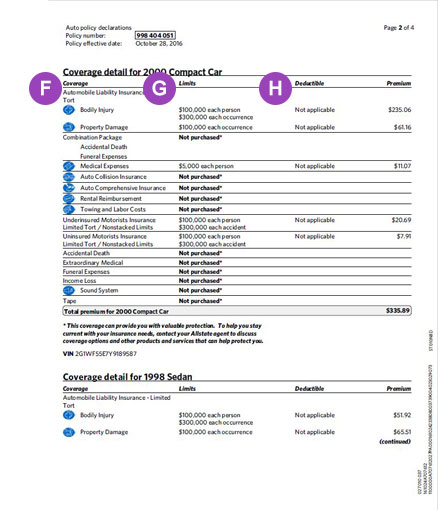

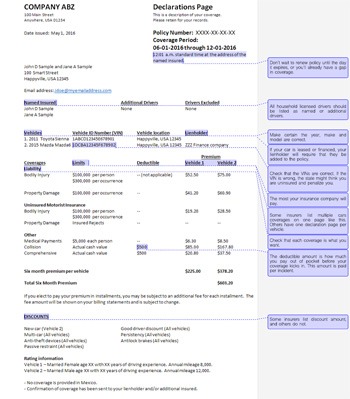

Car insurance policy - If you re looking to buy a car insurance policy you can compare cheap car insurance quotes from a wide range of providers with just a few clicks of the mouse at moneysupermarket. Car insurance policy is a type of insurance policy required to provide protection to your vehicle against any damage which might result into a financial loss. But before making any decision make sure you compare the deals available at different levels of cover third party only third party fire and theft and fully.

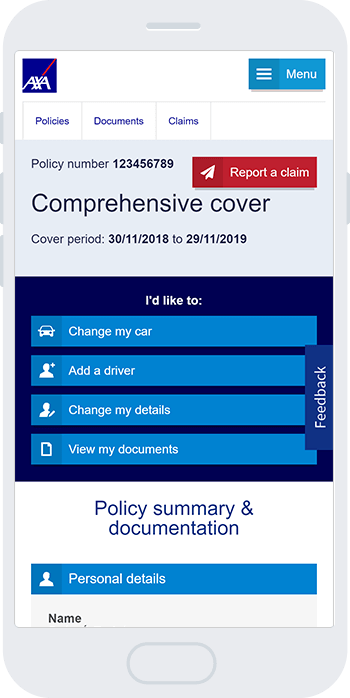

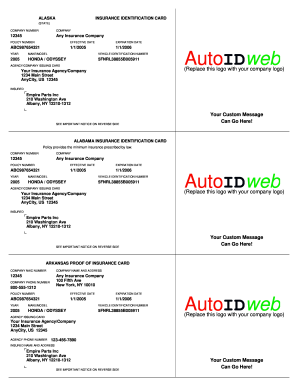

This policy covers liability towards third parties arising out of bodily injury of property damage of third parties involving your car. The insurance branch or the agent can check and get the insurance policy number of your car. However most insurance companies are using the internet to make their products more accessible to customers and have an online presence to cater to different requirements.

Car insurance is required mainly for the following reasons. The motor vehicles act of india has made it compulsory for all vehicles used in public spaces to have car insurance. As per the motor vehicle act 1988 it is mandatory to buy a liability only policy without which one cannot use the vehicle on road.

Your car insurance policy at tata aig is an umbrella of services. This is a traditional method of finding the policy number. It does not only cover your vehicle but also a third party vehicle and damages caused to it in case of an accident.

A car insurance policy will be valid for a particular period. Liability only private car policy. It is advisable to undertake car insurance renewal on time so as to benefit from the no claim bonus ncb.

A third party liability policy is compulsory for all vehicles but you can decide to go for a comprehensive car insurance policy too. Car insurance is a contract between the motor vehicle company the car owner that provides on road protection against any loss or damages arising due to an accident. To buy an online four wheeler insurance be it comprehensive third party or own car insurance it takes just a few clicks to customize and buy the right one.

If policy lapses car insurance renewal can be done within 90 days you may still benefit from the ncb.

/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg)