Car Insurance Prices By State

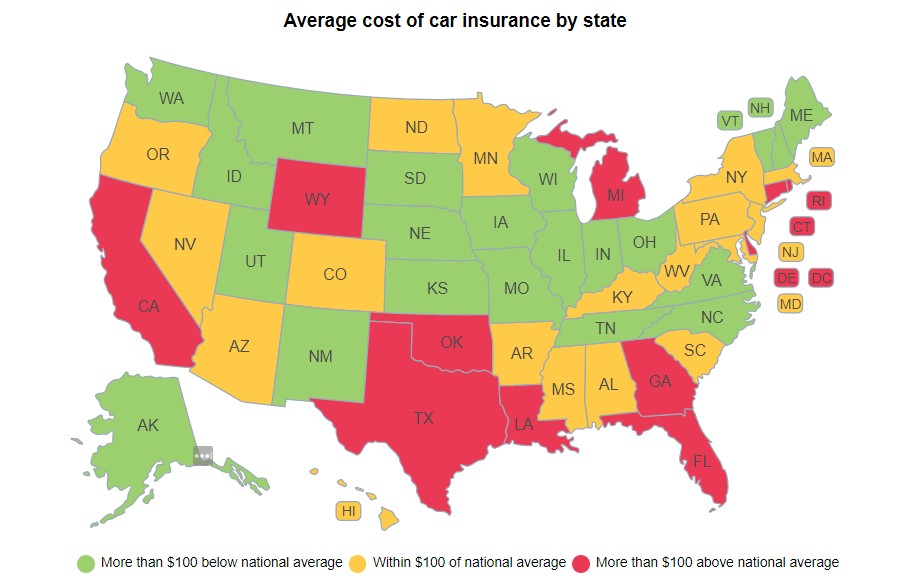

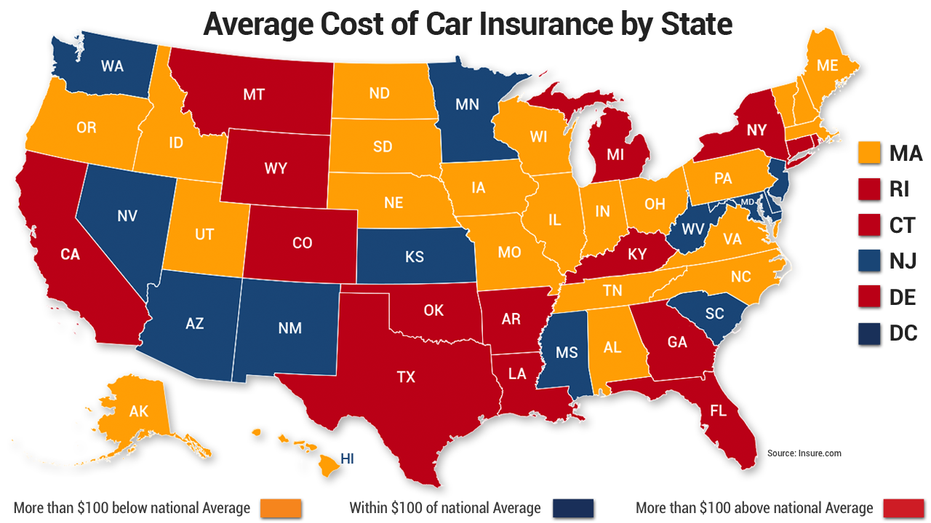

Car insurance by state also varies with the zip code taking into consideration the prevalence of vehicle theft and other crime rates where the insured lives compared to the rest of the state.

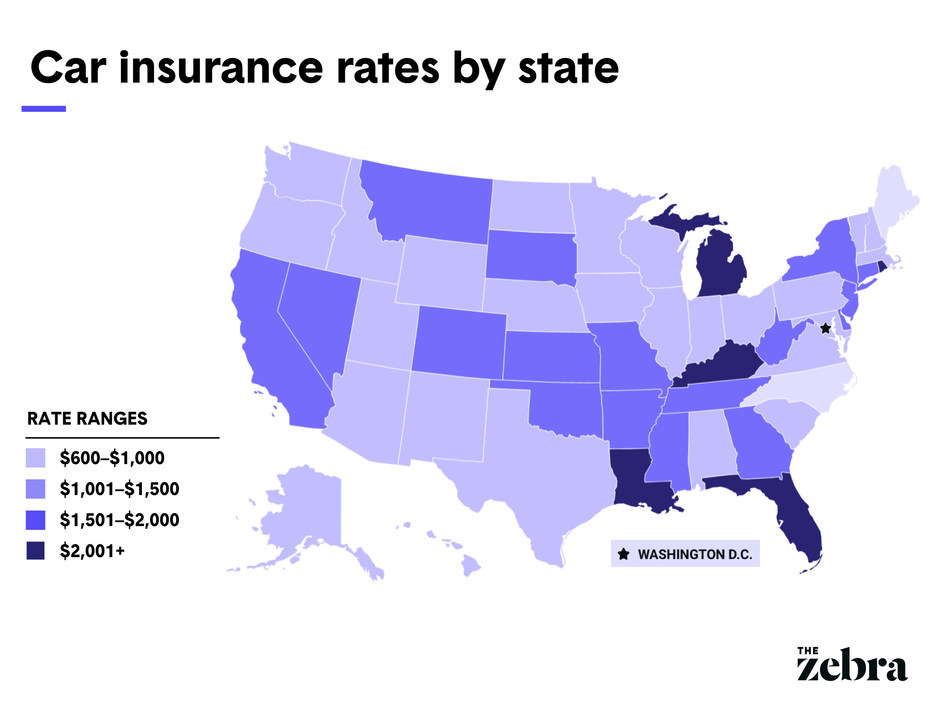

Car insurance prices by state - States set car insurance regulations and minimum insurance requirements which can have a major impact on the rates paid by residents. For example some states require drivers to purchase 100 000 worth of liability coverage per accident while others require just 20 000 or 30 000 of liability coverage. See car insurance rates by zip code plus state laws.

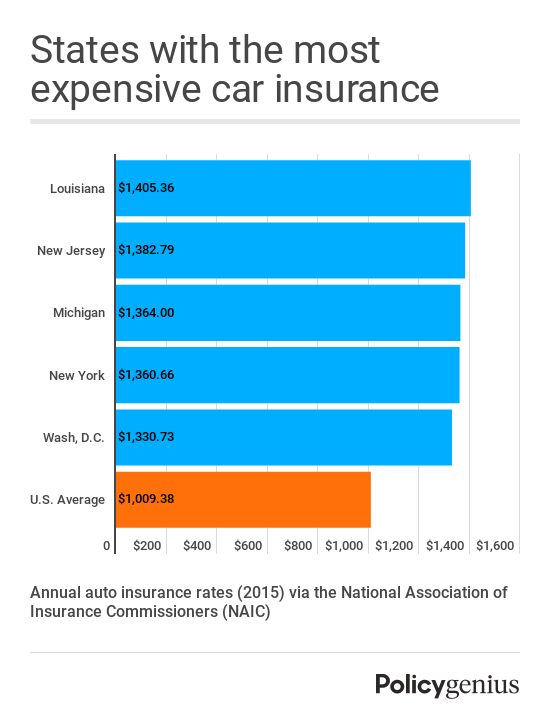

As an example michigan uses a unique no fault insurance system that in many ways is responsible for its high premiums. Michigan is the most expensive with an average yearly premium of 3 466 while maine is the cheapest at 1 062. Call us toll free.

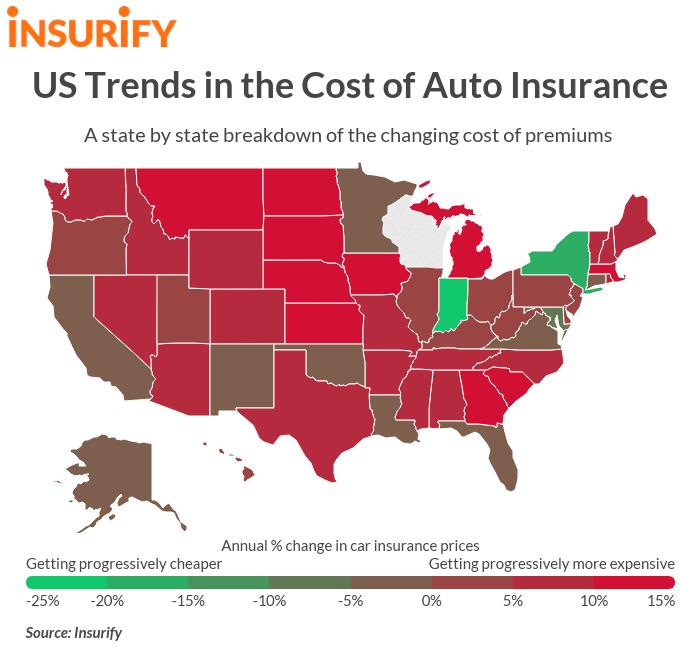

What is the average car insurance cost by state. Within each state insurance rates can vary dramatically from city to city. State required insurance minimums can also raise or lower insurance costs.

Federal way s study rate of 1 360 22 is about 25 more than spokane valley s study rate of 1 023 23 which helps illustrate how location can influence the costs of car insurance. State car insurance rates change dramatically by state and between cities.

.jpg)