Car Insurance Quotes Ontario Canada

While auto insurance is mandatory across canada not all provinces have the same approach.

Car insurance quotes ontario canada - Whether you re in thunder bay or timmins belairdirect has the car insurance coverage to fit your driving needs in ontario. Car insurance that takes safety to heart. See how safe drivers save more with onlia car insurance.

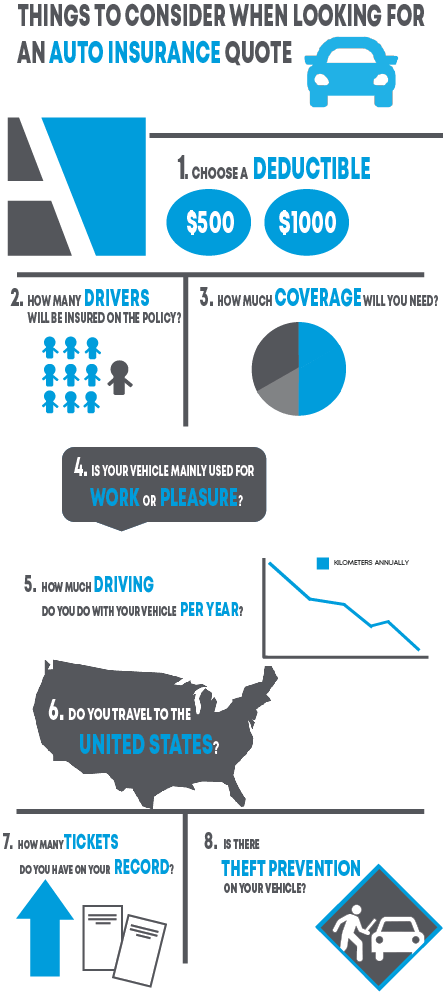

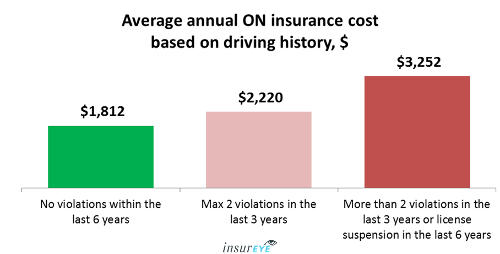

But while you might not be able to change your vehicle or be willing to move to another neighbourhood for the sake of car insurance premiums there are ways you can help lower your premiums. The 10 most expensive cities for ontario car insurance. For consumers who saved on ih the average savings from jan 2018 to nov 2018 was 427.

We offer customized insurance plans multiple ways that you can save and online quotes to make it as easy as possible to choose the right insurance for your needs. Protect your vehicle and your family. In british columbia and manitoba government owned corporations provide auto insurance the same is true in saskatchewan but.

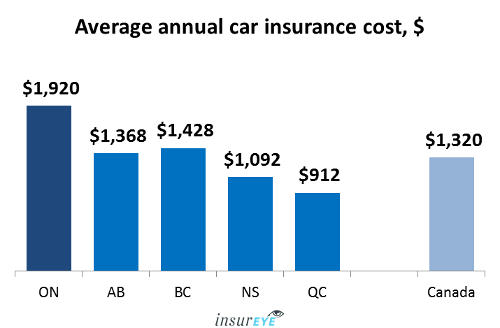

We re here to support you through covid 19. According to the insurance bureau of canada the average annual car insurance premium for ontario is 1 445. See how this compares to the province s most expensive cities for auto insurance.

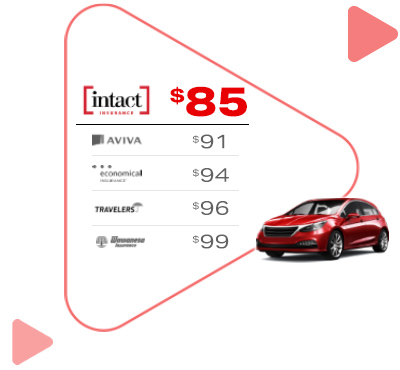

Car insurance in ontario and across canada is a requirement for all drivers but there are some provincial differences in coverage requirements. Get ontario car insurance quotes to compare for a better rate and coverage compare car insurance quotes and start saving today. Belairdirect has the right car insurance coverage for all ontario drivers.

The average cost of an insurance policy for an ontario driver is 1 505 according to 2020 estimates from the insurance bureau of canada. According to the insurance bureau of canada ontario drivers pay an average of 1 505 annually for car insurance or 125 each month. Car insurance in ontario get a quote buy online onlia insurance.

While the province no longer holds the title of most expensive auto insurance in the country that award now goes to british columbia ontario drivers still face rates higher than the majority of canadians. Ontario car insurance premiums are some of the highest in canada due to a greater concern for insurance fraud and different insurance laws. Car insurance providers are regulated under their provincial governing body but in private markets such as in ontario alberta and the majority of canada car insurance companies operate independently from one another and compete just like any other business.

Car insurance companies compete. In ontario alberta and the atlantic provinces drivers must purchase a policy from a private company the same is true for drivers in canada s three northern territories. Vaughan 2 128 47 27 higher than average 3.

Ontario auto insurance is provided by private insurance carriers and available coverage is broken down into two categories mandatory and optional.

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/6ZSXS37WCJABPPHK7A5HJAQBAY)