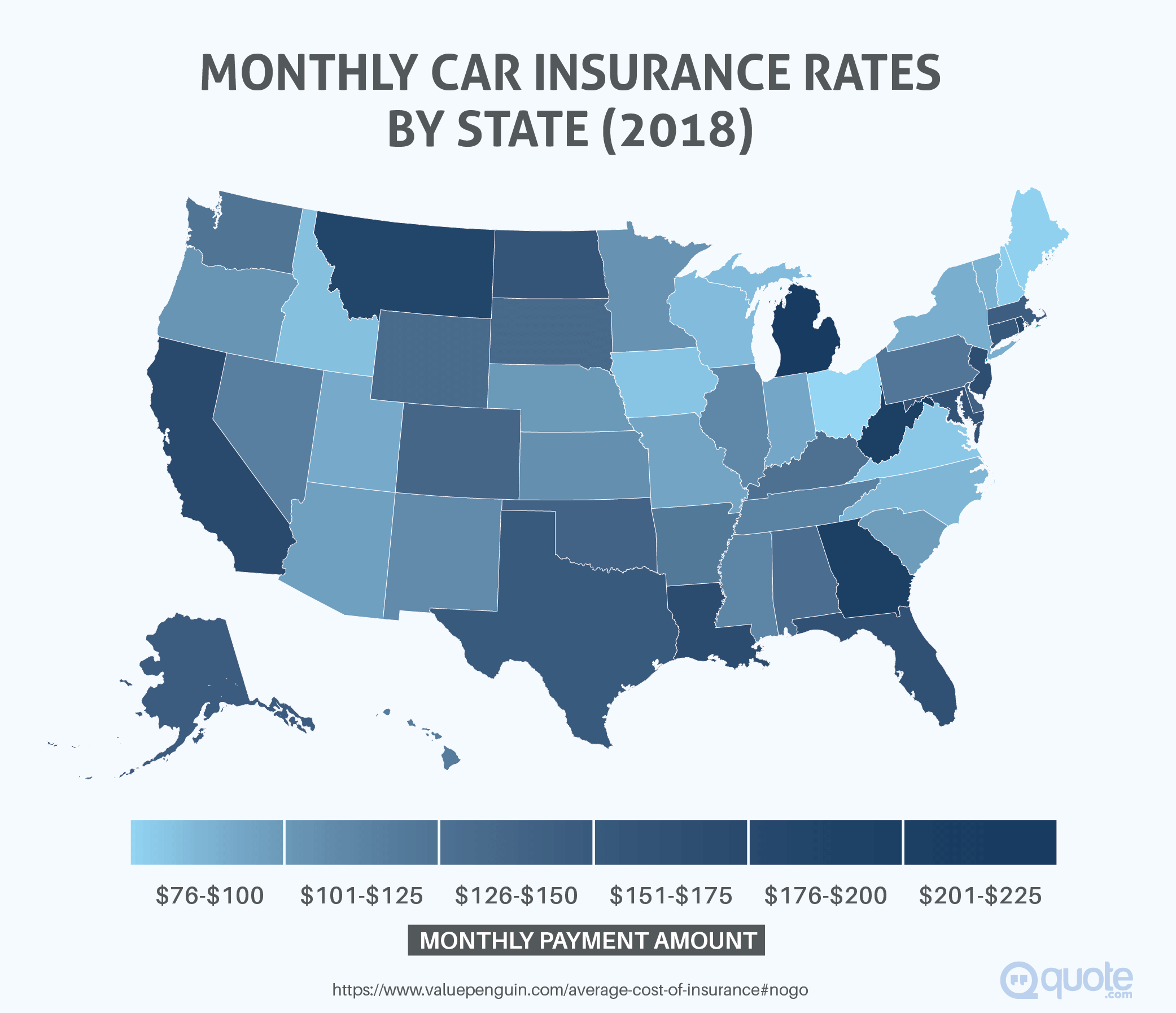

Car Insurance Rates By State 2018

In as the least expensive state for car insurance.

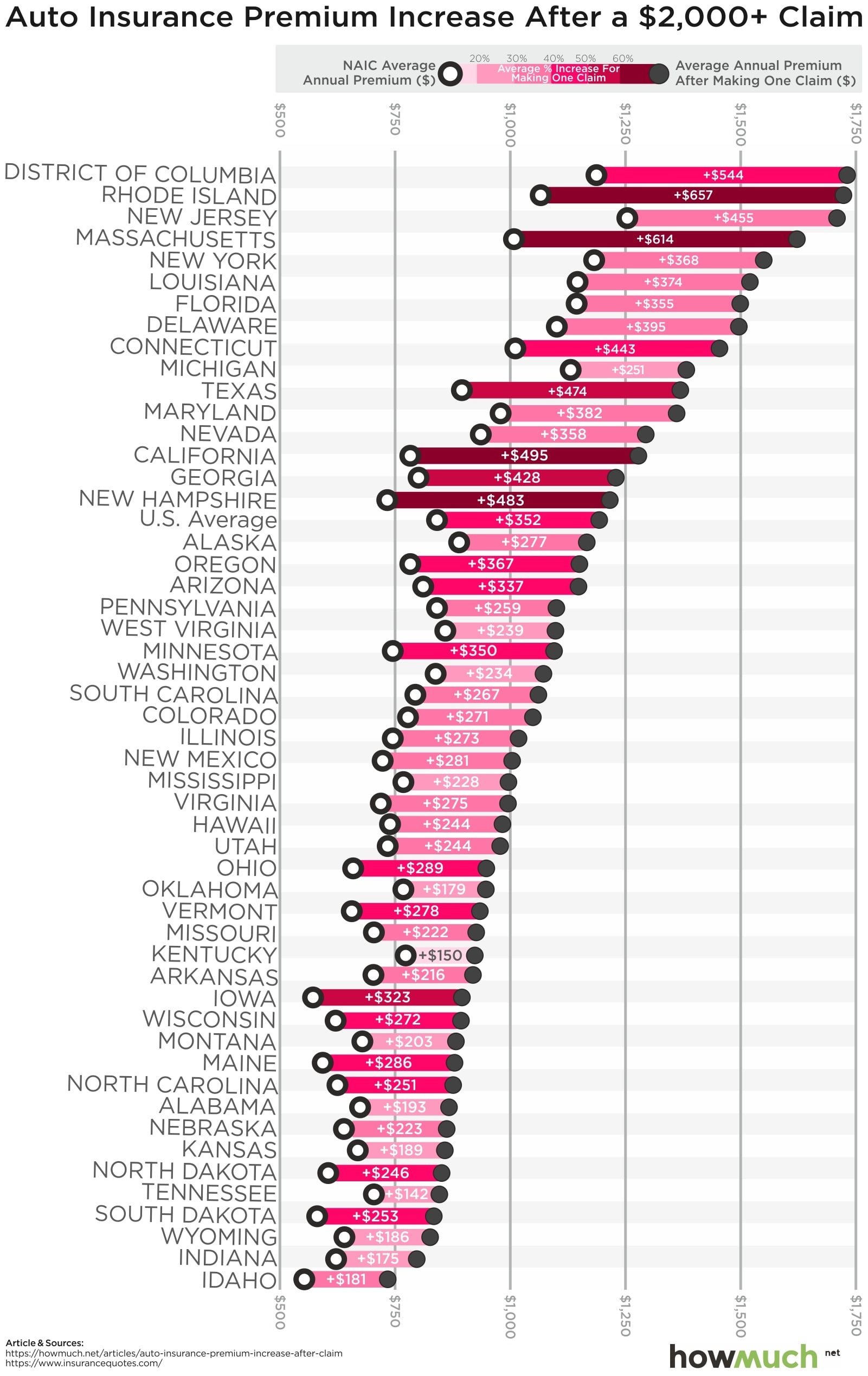

Car insurance rates by state 2018 - Moving from new jersey to idaho for example could save the average driver nearly 700 per year on insurance. States set car insurance regulations and minimum insurance requirements which can have a major impact on the rates paid by residents. Average car insurance rates by state may vary based on legal regulations and insurance companies efforts to price accurately based on these differences.

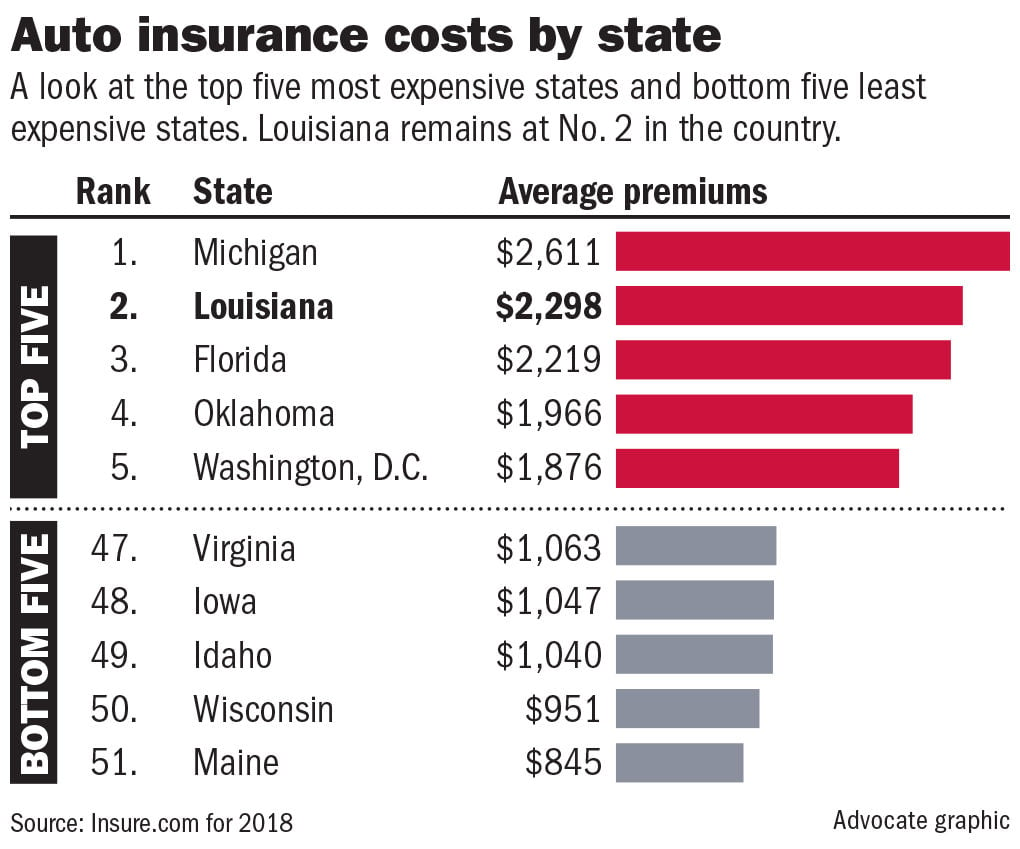

As an example michigan uses a unique no fault insurance system that in many ways is responsible for its high premiums. See car insurance rates by zip code plus state laws. Auto insurance companies posted another year with slim to negative profit margins due to an uptick in costly car accidents and disastrous storms.

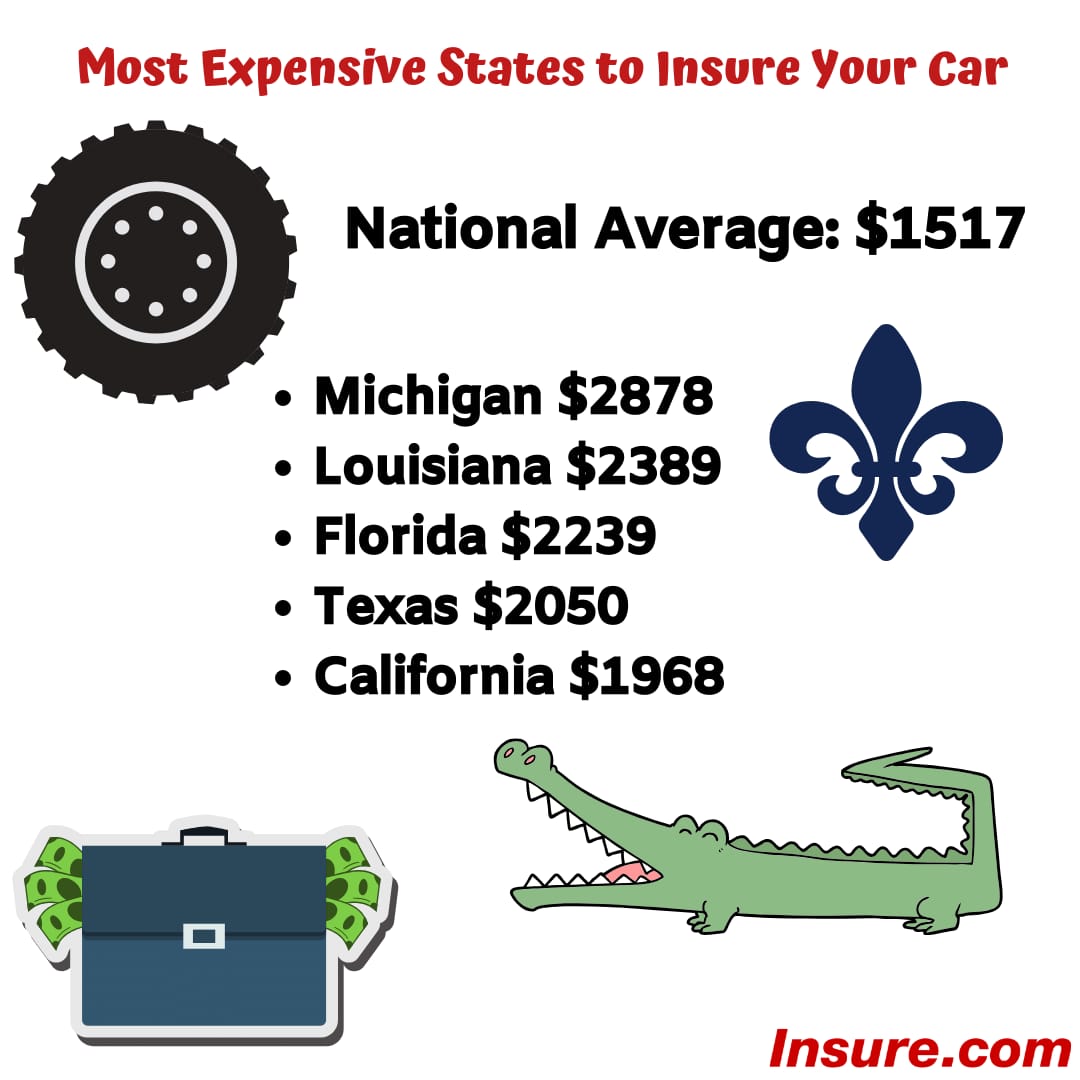

The best way to lower your car insurance rates might actually be to move to another state. If you felt your auto insurance rates increased an unjustifiably high amount in 2015 2016 and 2017 there isn t much good news for 2018. Car insurance rates are higher than they ve ever been with a national average annual premium of 1 427 that s 20 higher than in 2011.

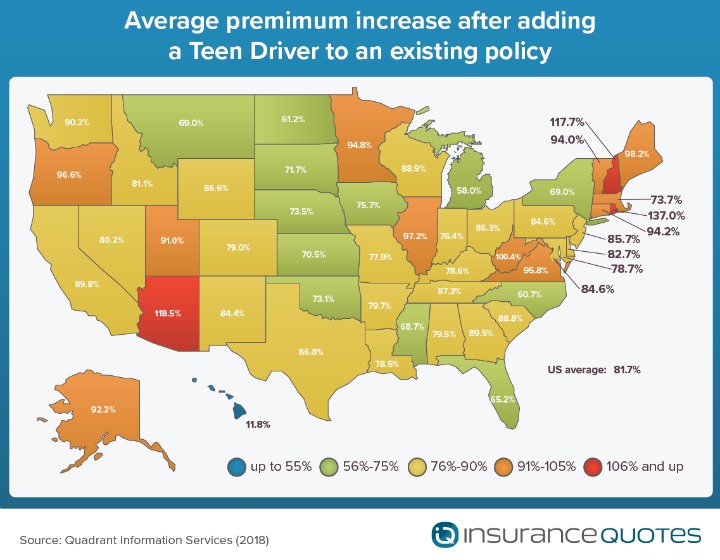

They worked with quadrant information services to calculate car insurance rates for a 40 year old man seeking full coverage from 6 different major carriers. You can use our average car insurance rates tool to find out what people pay for car insurance in your zip code or state. In north carolina the state sets a cap on car insurance rates.

State car insurance rates change dramatically by state and between cities. So what is the state of auto insurance in 2018. That mirrors previous years 30 in 2017 and 26 in 2016.

As a result insurers compete by offering a ton of. The average car insurance premium in the state hit 2 239 in 2018 which is 874 or 64 higher than the national average premium of 1 365. Alabama 1 358 alaska 1 152 arizona 1 247 arkansas 1 458 california 1 713.

Call us toll free. They tabulated the price quoted in 10 zip codes for every state looking for the average of a 2018 model year version of america s 20 best selling vehicles. State required insurance minimums can also raise or lower insurance costs.

For instance drivers in no fault states such as michigan and florida often pay more for insurance than do drivers in. In 27 states the most stolen model in 2018 was a chevrolet or ford pickup truck. How where you live impacts auto insurance rates one of the primary factors used in car insurance pricing is location.