Car Insurance Table Ratings

The factors that go into determining a car s group are the following.

Car insurance table ratings - Sports cars and high performance models have some of the highest group ratings out there. Members of the abi and lloyds market association lma make up the group rating panel which meets every month to set new car models to an insurance group. The group rating system is administered by thatcham research on behalf of the association of british insurers abi.

Every new car in the uk is given a car insurance group rating which helps insurers understand which cars will cost more to insure and which cars will cost less. Find cars by insurance group. If there are multiple medium risks or certain individual serious risks you may end up with a table rated life insurance policy.

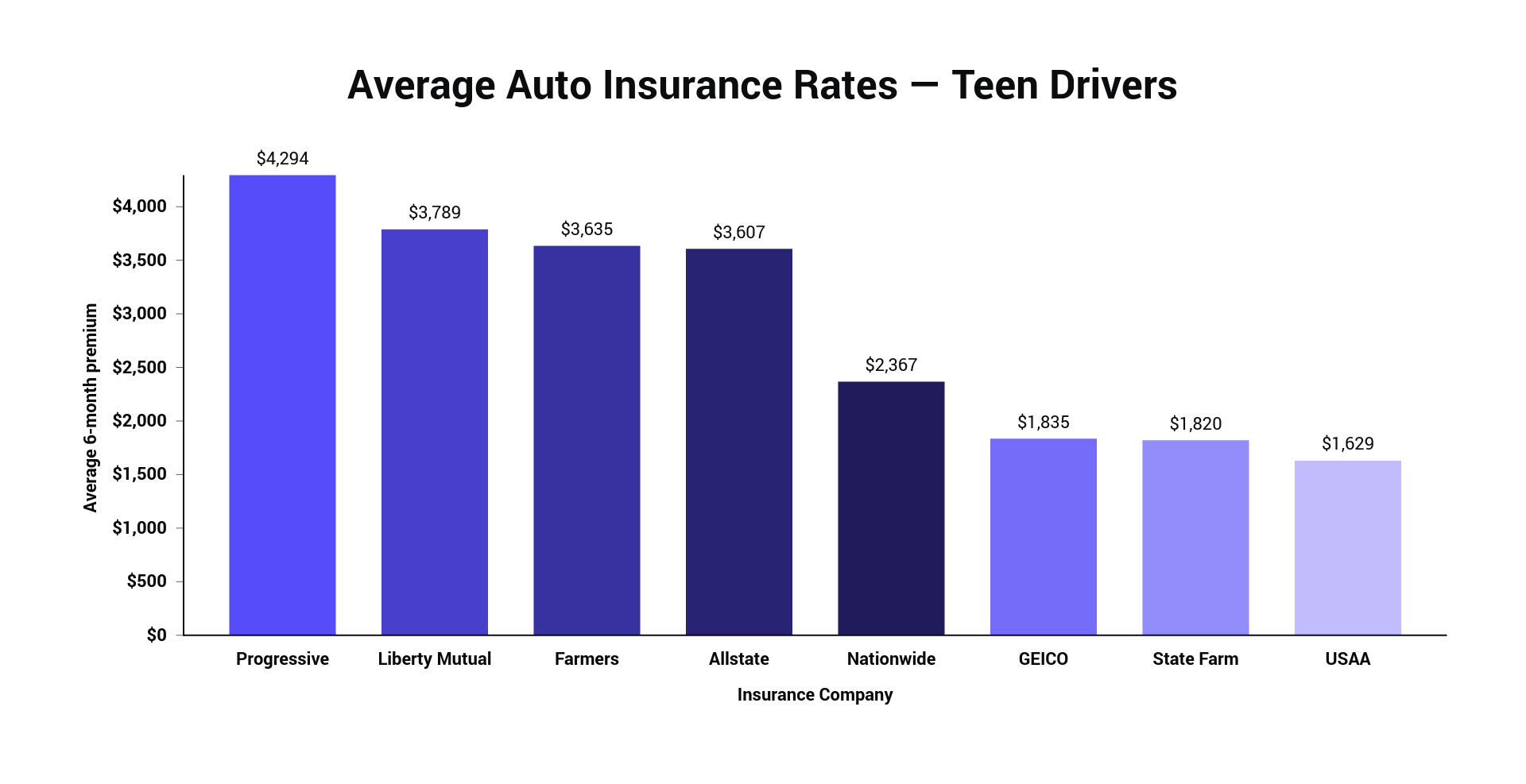

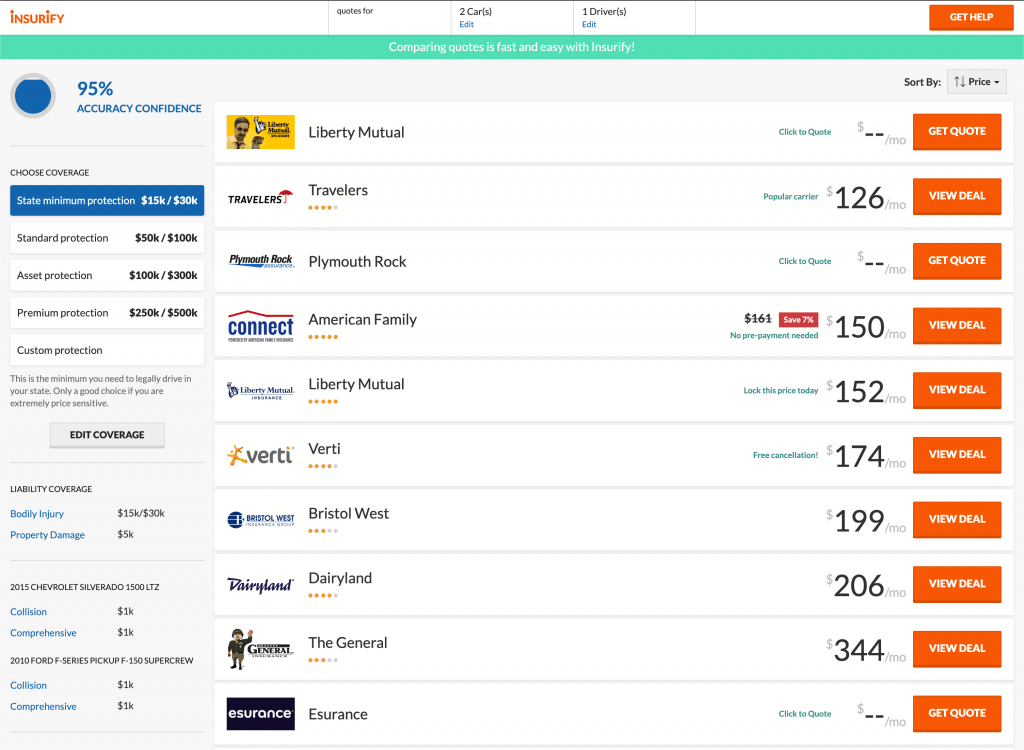

The actual table rating you receive will depend on the specific issue or condition you have and the company you are applying at. Here we give you access to all 50 groups meaning you can find inspiration for which car to buy from a car insurance price perspective. Combined these companies insure just under 80 of the nation s drivers so odds are you ll be looking at at least a few of them in your search.

Cars in the highest groups typically high performance models are likely to cost insurers the most in insurance claims. The group rating panel a group of representatives from the insurance industry meet regularly to determine what car insurance group different vehicles should be in. They use data from thatcham research to identify which cars are likely to cost insurers the most via insurance claims.

Car security size and weight car performance safety and what figures most. Start with group 1 if this is your aim generally. Some of the key factors used to determine an insurance company s rating include financial reserves claims payment history business focus and the company structure and management style.

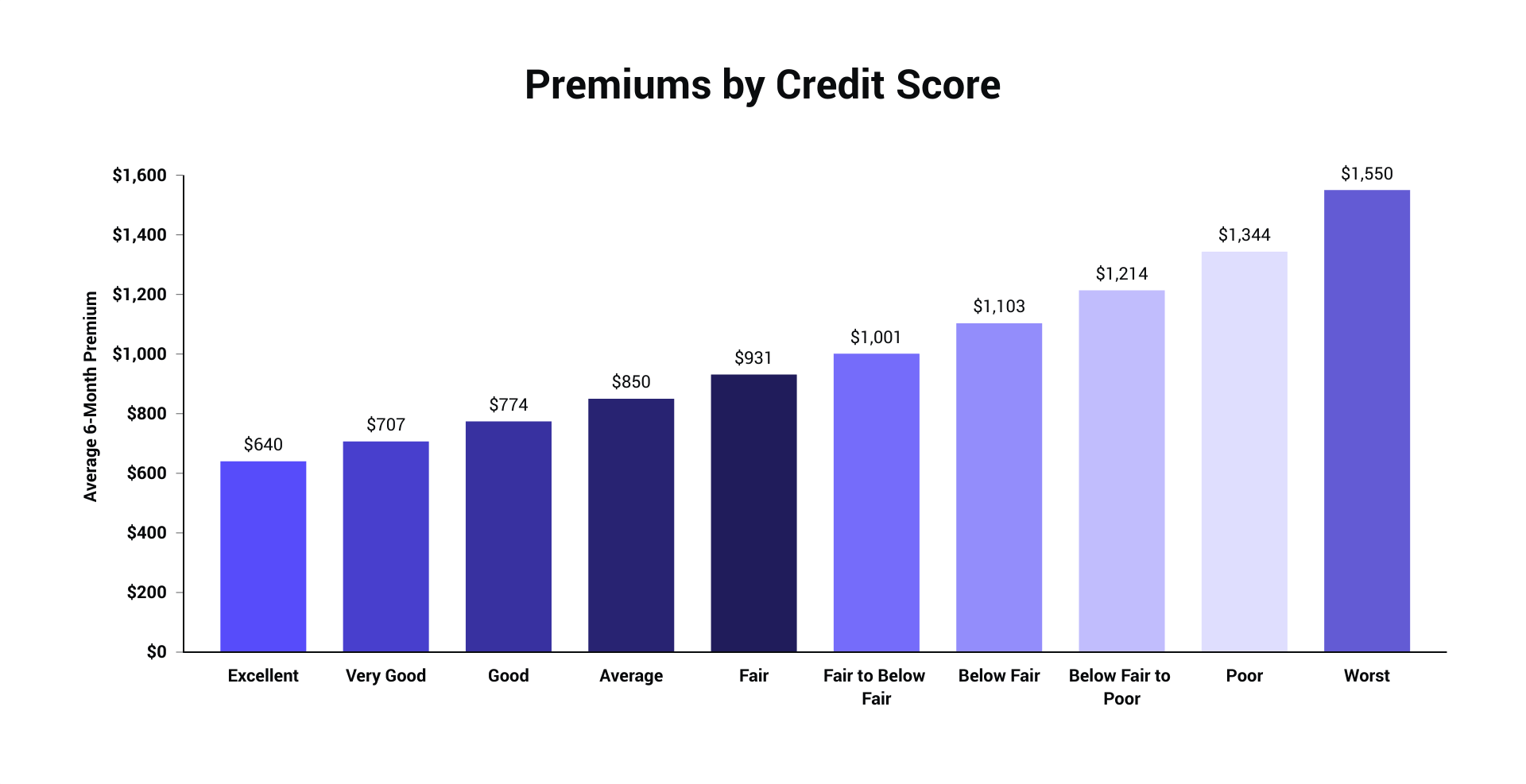

How much more will depend on your rating. This is how table ratings affect your premium. Each insurance rating organization uses its own formula for determining the varying degrees of financial strength ratings and their significance.

This year s edition of how cars measure up presents the results for 2000 through 2018 models where at least 1 500 of each of the models were insured between 2013 and 2018. In the uk cars are organised into groups which are then used by insurance companies when calculating your insurance quote. The results give consumers an accurate picture of how collision and other claims affect the cost of auto insurance for particular makes and models of cars.

If you receive a table rating from an insurance company you are absolutely going to pay more for a life insurance policy. If you receive a table rating of a you will be paying the standard rate plus 25 percent for a life insurance policy.