Car Insurance Types Explained

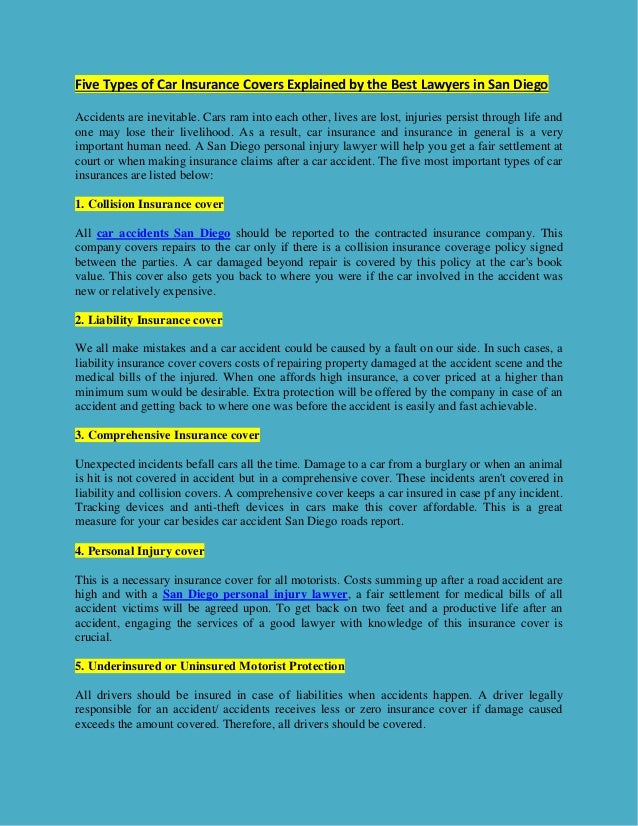

Most countries make liability insurance mandatory for car owners so this is a pretty basic car insurance coverage that you could get.

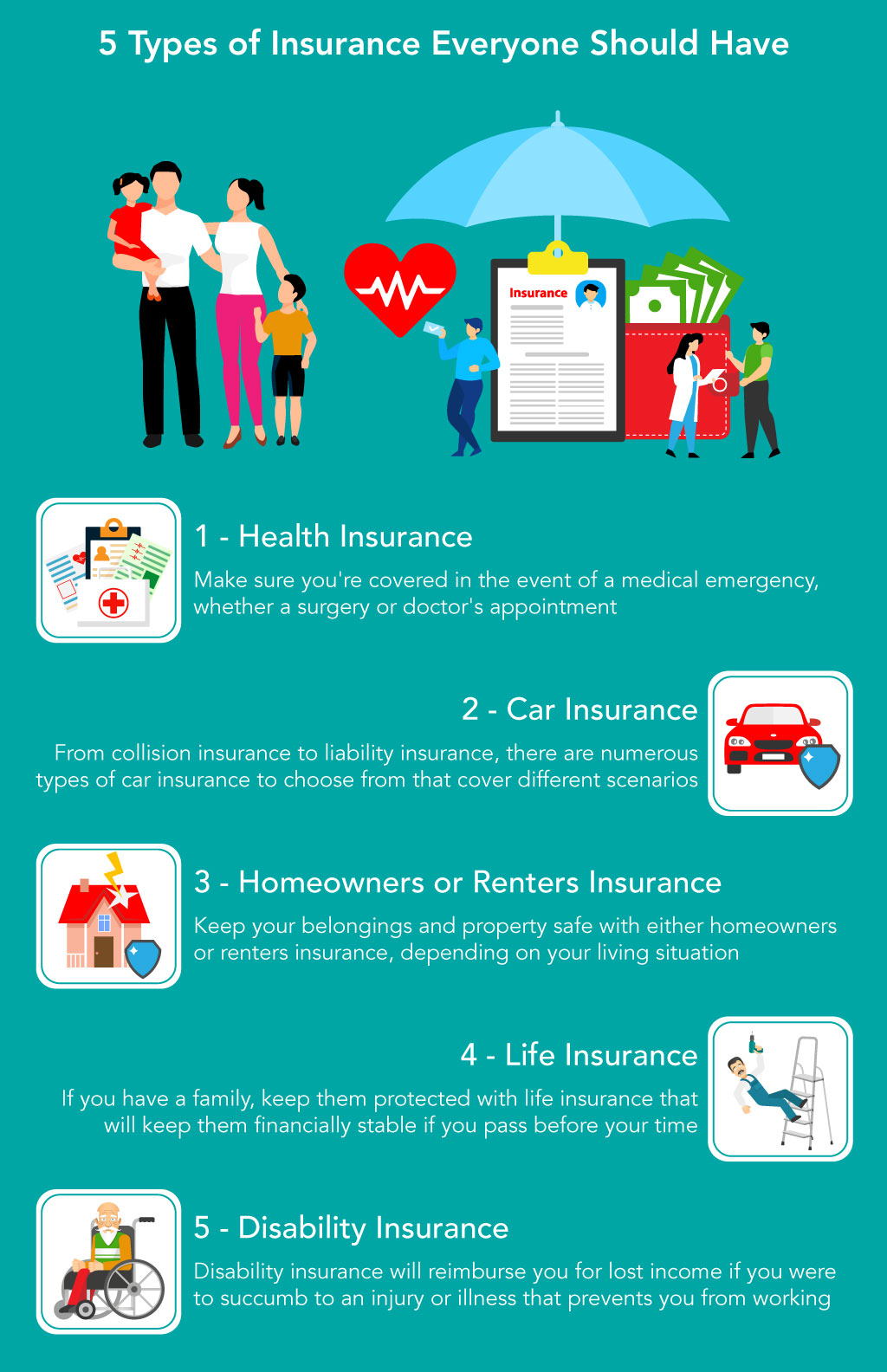

Car insurance types explained - There are many insurance companies offering n number of products for customers. Key insurance terms explained. 5 types of car insurance coverage explained when you start to consider the various types of auto insurance coverage available it can get overwhelming.

The two main categories of car insurance are comprehensive and third party. Should you be involved in a covered car accident that you are responsible for liability insurance will cover the cost of the damaged property or the medical bills of people injured in the accident up to a certain amount as specified in. If you cause a road accident and someone else is injured or their car is damaged it s not fair for them to have to pay out of their own pocket to fix this.

What is comprehensive car insurance. All three policy types have this. The following will explain what each type covers as well as the main differences between the two.

It s usually relatively inexpensive to add uninsured underinsured motorist protection to your car insurance policy especially considering the amount of protection it offers. This is the most basic level of cover and the bare minimum required by law. There are 4 different types of car insurance in australia below i explain each of the different types of car insurance and help you decide what type of insurance you can consider.

You should choose the best policy to cover your vehicle specific driving conditions specific driver specific. If you are buying the car insurance policy for the first time it will be an overwhelming experience.