Car Insurance Types In India

Before you start looking for the best car insurance and the best insurance company assess your needs and know the type of policy you want.

Car insurance types in india - It s similar to car insurance. 3 types of car insurance policies. There are three types of car insurance policies in india namely third party car insurance policy standalone own damage car insurance policy and comprehensive car insurance policy.

In india three types of car insurance policies are offered by all the general insurance companies. There are two types of car insurance plans at national insurance for you to choose from. We ve listed the top 5 car insurance companies solely based on their incurred claim ratio and net earned premium in fy 2017 2018 as reported by the insurance regulatory and development authority of india irdai.

This insurance provides protection against natural and man made calamities like. You cannot ride a bike or scooter in india without insurance. It is mandatory to buy car insurance in india irrespective of the vehicle type i e.

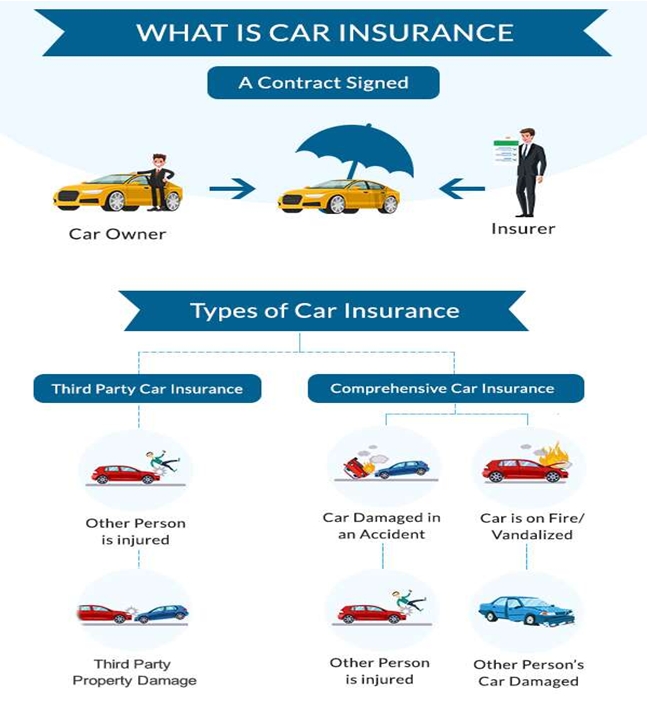

In india there are two types of car insurance policies third party insurance and comprehensive insurance. New products are discovered and existing products are enhanced as per the guidelines of the irdai. Fire rockslide landslide storm hurricane flood earthquake burglary theft riots or any damage caused to the vehicle in transit by road air inland waterway or rail.

This is your bike s guardian angel. Here is the detail explanation of 2 types of car insurance to help you choose the right car coverage. All india insurance car insurance.

What the insurer will pay for depends on the type of car insurance plan you purchase. The all india insurance is a fully owned subsidiary of indian government and has some of best insurance policies for its customers. National insurance is one of the leading car insurance providers in india.

The insurers compensate for the loss or damage caused to the insured vehicle and a third party from the insured four wheeler. Fire explosion or self ignition. It also covers towing charges for up to rs 1500.

Personal or commercial vehicle. The car insurance protects the individuals form the loss arising from accident or theft of the vehicle. It is governed by the indian motor tariff.

094444 48899 customer service. Here are some of the reasons to buy new car insurance policy in india in addition to it being a. Two wheeler insurance is another type of popular auto insurance in india.

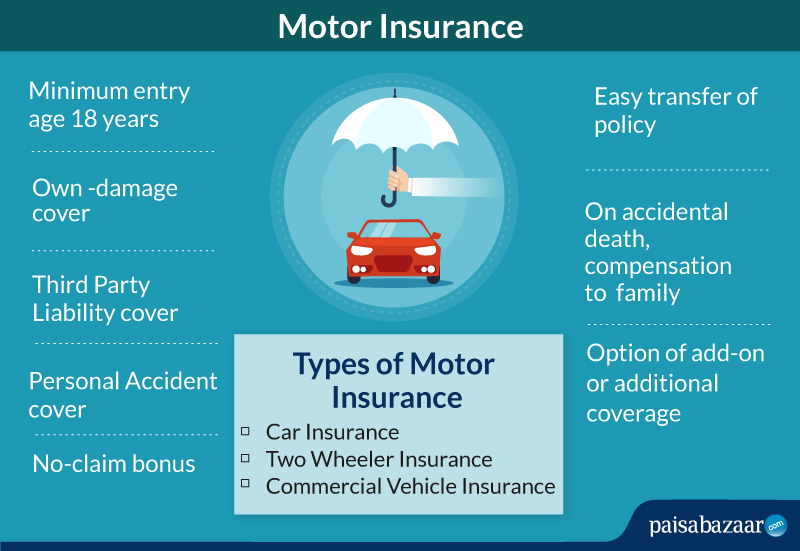

Types of car insurance. The insurance companies will design various kinds of products as per the needs of customers. While a third party liability only provides coverage for third party liabilities only a standalone own damage cover takes care of the own damages incurred by your.

Read more to know about car insurance policy. Third party insurance is a mandatory requirement by law. It provides protection against third party liabilities loss damage to the car due to natural disasters theft and manmade disasters.