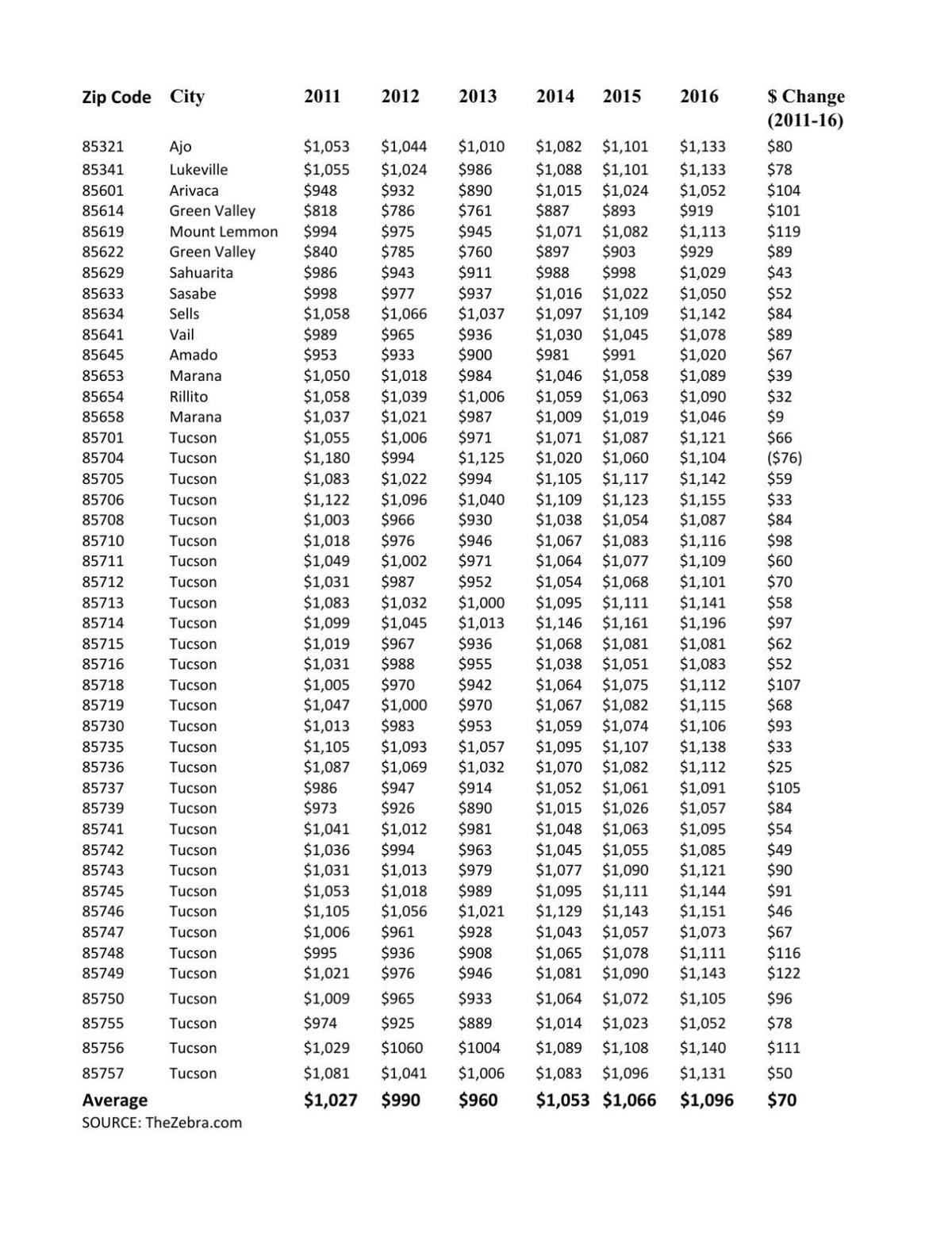

Car Insurance Zip Code Rates

For the cheapest zip codes rankings were determined by identifying the zip code with the least expensive average rate for home insurance and then listing them in ascending order.

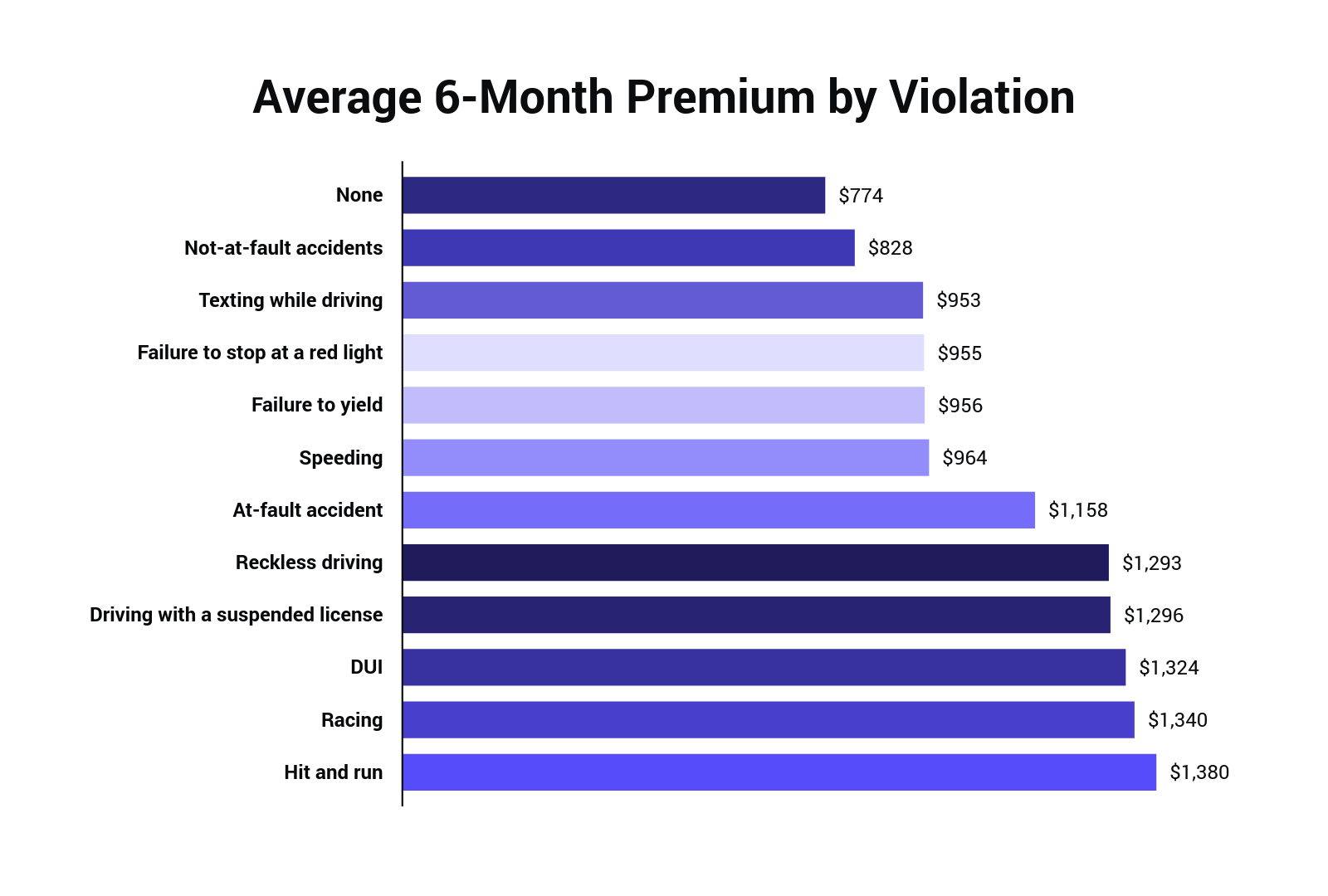

Car insurance zip code rates - Amongst the numerous factors used for rating a client the place where the person lives will have a deep impact. A comparison of auto insurance quotes in various tampa zip codes for liability comprehensive and collision coverage for a 40 year old man driving a 2007 honda accord found the lowest rates in a more suburban section of the city at 967 a year. Why car insurance rates are influenced by the zip code.

When comparing the national annual premium to the anchorage and alaska rates there s a notable 30 9 difference. But his insurance rates fell. Miles apart on car insurance.

Detroit has the nation s most expensive zip code for car insurance at an average of 527 21 month. This rate is equal to the state annual average but much lower than the national average rate of 1 424. Our average car insurance rates tool above lets you compare auto insurance rates by zip code.

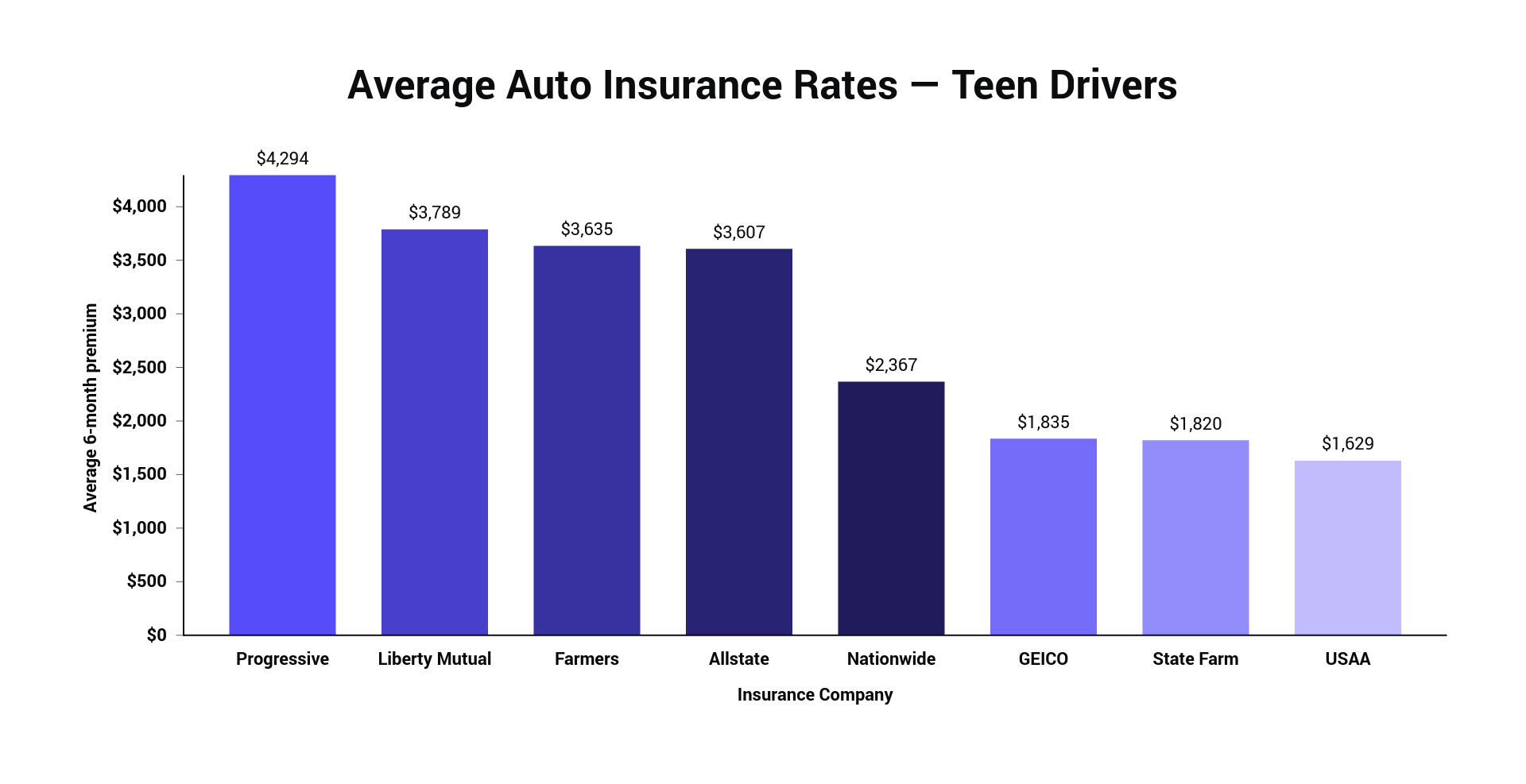

And calculated rates by surveying the nation s six largest auto insurers allstate farmers geico nationwide progressive and state farm. This is why in states with high car insurance rates we usually encounter a high number of uninsured. Compare car insurance rates by zip code to save money on the cost of car insurance.

Each particular area is characterized by a series of demographic geographic and economic factors. Using our car insurance zip code calculator below you can see average car insurance rates by zip code as well as the highest and lowest rate fielded from up to six major insurers for the same. Zip codes in brooklyn new york and new orleans louisiana rank second and third respectively behind detroit michigan.

How are auto insurance rates by zip code calculated in 2020.