Comprehensive Car Insurance Definition

Comprehensive insurance can help if your car is damaged by hail fire or even a fallen tree branch.

Comprehensive car insurance definition - There are two other types of insurance you can choose. Comprehensive car insurance coverage and glass claims. It protects the insured person or company from things that happen to their property or business that are beyond their control.

Collision insurance can also be used toward your rental car in most cases which can spare you from having to buy rental car insurance. Third party fire and theft tpf t and third party only tpo. This means that if you have an accident you can claim to have your car fixed and your insurance provider may also compensate anyone else involved if eligible.

Comprehensive car insurance also known as fully comprehensive covers damage to yourself your car as well as compensating a third party if you are involved in an accident. Comprehensive insurance protects your car from damages you can t control like fire hail wind theft vandalism or even hitting a deer. Glass damage is usually included in comprehensive coverage on an automobile policy and would be subject to the comprehensive coverage deductible.

Comprehensive coverage is the driver s control over the car accident. The term is most often used to refer to comprehensive car insurance. Comprehensive car insurance also known as fully comp is the top level of non business insurance you can get for your car.

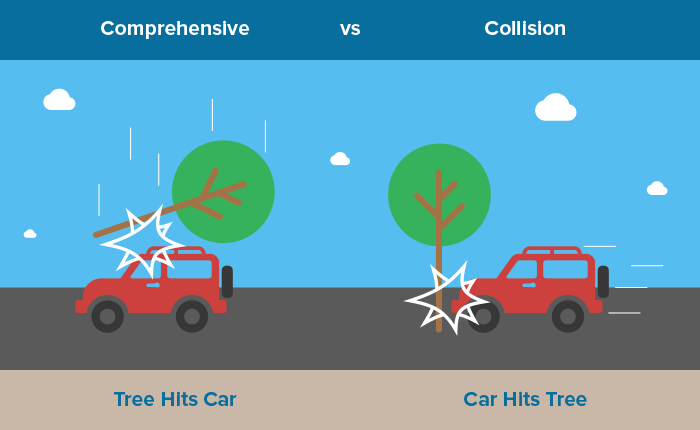

Comprehensive insurance is a type of insurance policy that provides wide ranging coverage for unforeseen mishaps. Learn what comprehensive auto insurance covers when you may need it and how it differs from collision coverage. Comprehensive insurance would cover your vehicle if it was destroyed by.

Most car owners choose a deductible of between 250 and 1 000. The difference between comprehensive and collision insurance the key difference in collision vs. Many people use the comprehensive coverage to repair or replace windshields.

Comprehensive insurance is a type of automobile insurance that covers damage to your car from causes other than a collision. Usually you can choose for your comprehensive deductible an amount anywhere from 100 to 2 500 deductible choices vary according to state laws and insurance company guidelines.

.jpg)