Definition Health Insurance Meaning

Insurance against loss by illness or bodily injury.

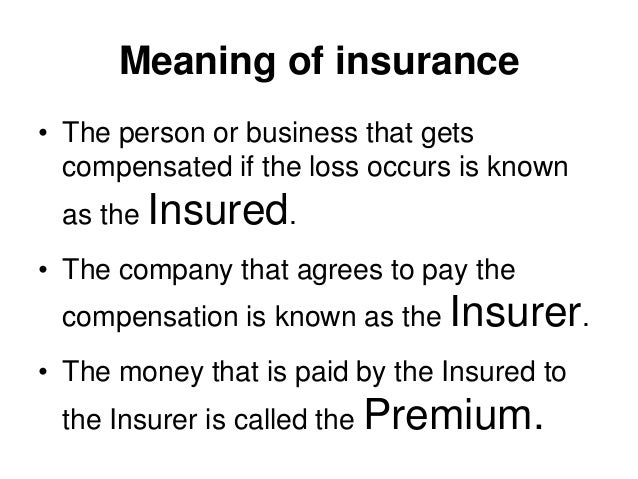

Definition health insurance meaning - Health insurance an insurance policy that provides coverage when the policyholder or his her dependent becomes ill. Health insurance covers cost of an insured individual s medical and surgical expenses. The policyholder pays a premium each month in.

And social insurance which is provided by. Private noncommercial health insurance which is provided by blue cross and blue shield. An arrangement in which you make regular payments to an insurance company in exchange for that.

Commercial health insurance which is provided by many different companies. Health insurance provides coverage for medicine visits to the doctor or emergency room hospital stays and other medical expenses. Moop is an acronym standing for maximum out of pocket costs.

For example a health insurance policy may pay for most or all of the costs of a surgery. Disease management programs can help control health. Health insurance may cover doctor s visits medical procedures prescription drugs and so forth.

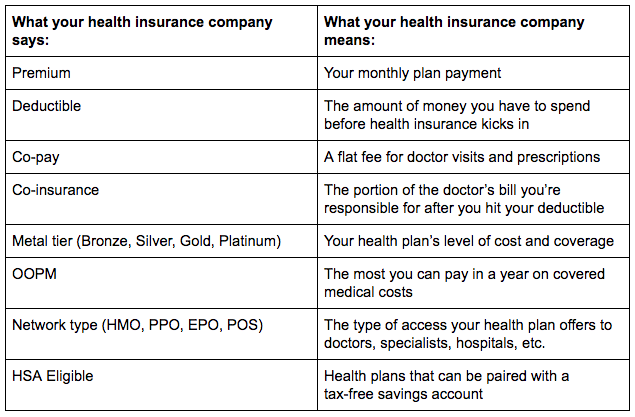

These plans fall into three classifications. The moop is the limit on annual out of pocket expenditures paid by a health plan enrollee for medical services that are covered by a health insurance plan. Subject to the terms of insurance coverage either the insured pays costs out of pocket and is subsequently reimbursed or the insurance company reimburses costs directly.

Insurance providing compensation for medical expenses. Definition of the health insurance term moop moop. Employers who provide health insurance to spouses must offer insurance to registered domestic partners as additional workers lose their health insurance they use hospital emergency rooms as a last resort she retained her pension health insurance and other benefits.

Insurance against expenses incurred through illness of the insured. A program offered by a health insurance company to manage the costs of policyholders chronic health conditions. Insurance that compensates the insured for the medical expenses of an illness or.

Policies differ in what they cover the size of the deductible and or co payment limits of coverage and the options for treatment available to.

:max_bytes(150000):strip_icc()/obamacare-5bfc36e446e0fb00511c5f97.jpg)

/ProConUniversalHealthCare_4156211_final_2-5b9d7ce04bff4f8dab98a4b87deca55e.png)