Different Types Of Health Insurance Plans

A health reimbursement arrangement is a type of health benefit that allows employers to provide health benefits without having to offer a group health insurance plan.

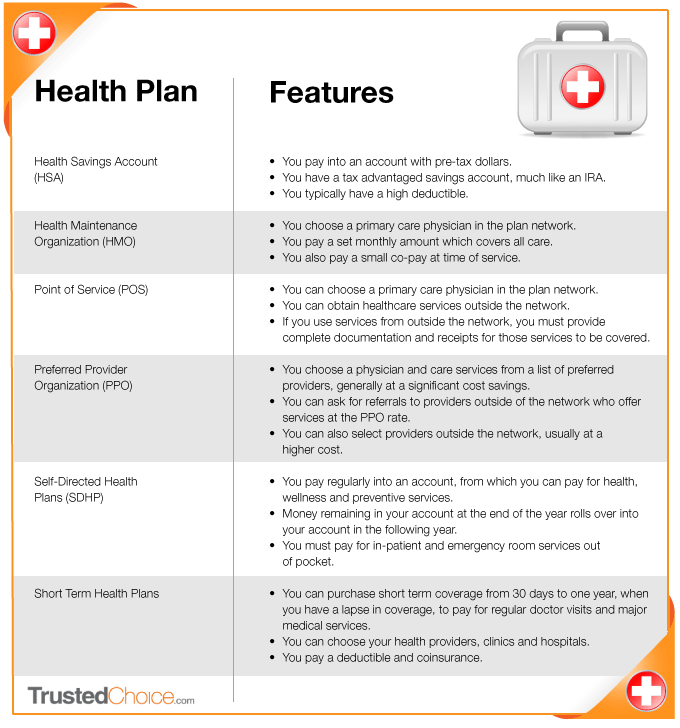

Different types of health insurance plans - Like other plans if you reach the maximum out of pocket amount the plan pays 100. Traditional health insurance plans feel a bit like alphabet soup with their acronyms. But the availability of various types of health plans from individual health plans family floater policies to senior citizen health plans etc.

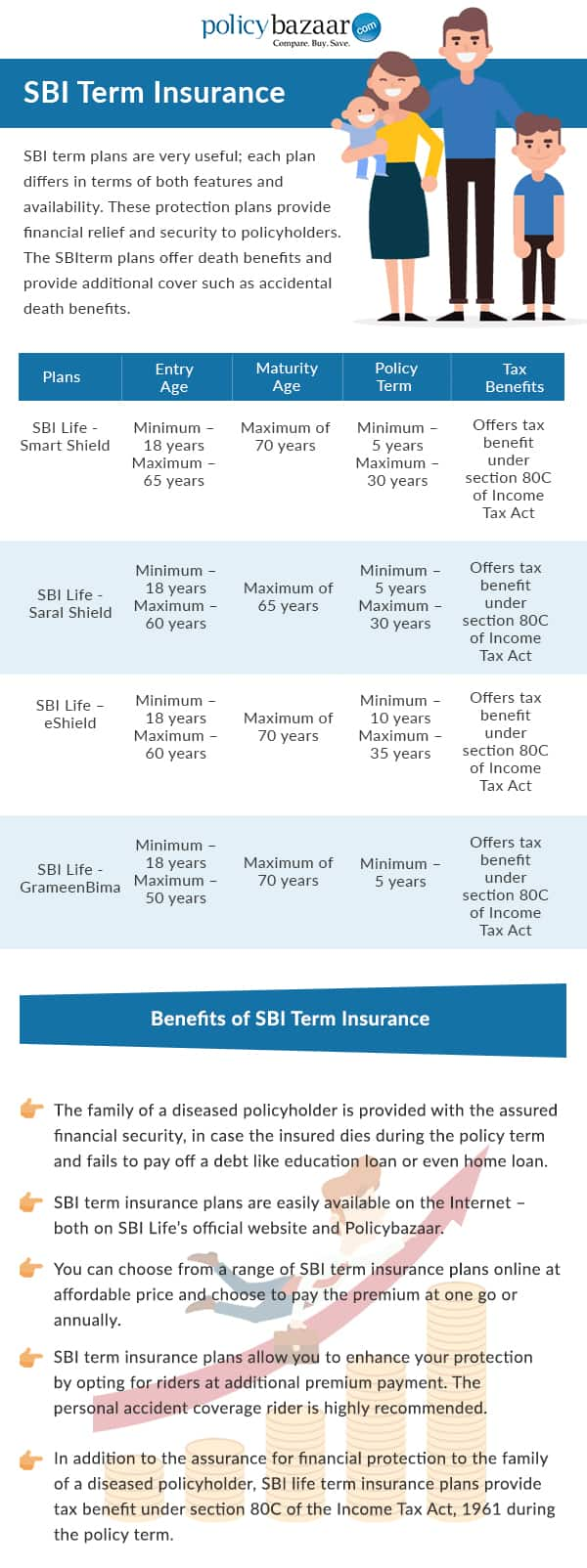

The individual pays a fixed sum premium every year for the health cover. You may find a variety of health insurance plans available to cater to your different insurance needs. Therefore to help you understand better here is a quick rundown of the different types of medical insurance plans in india and their benefits.

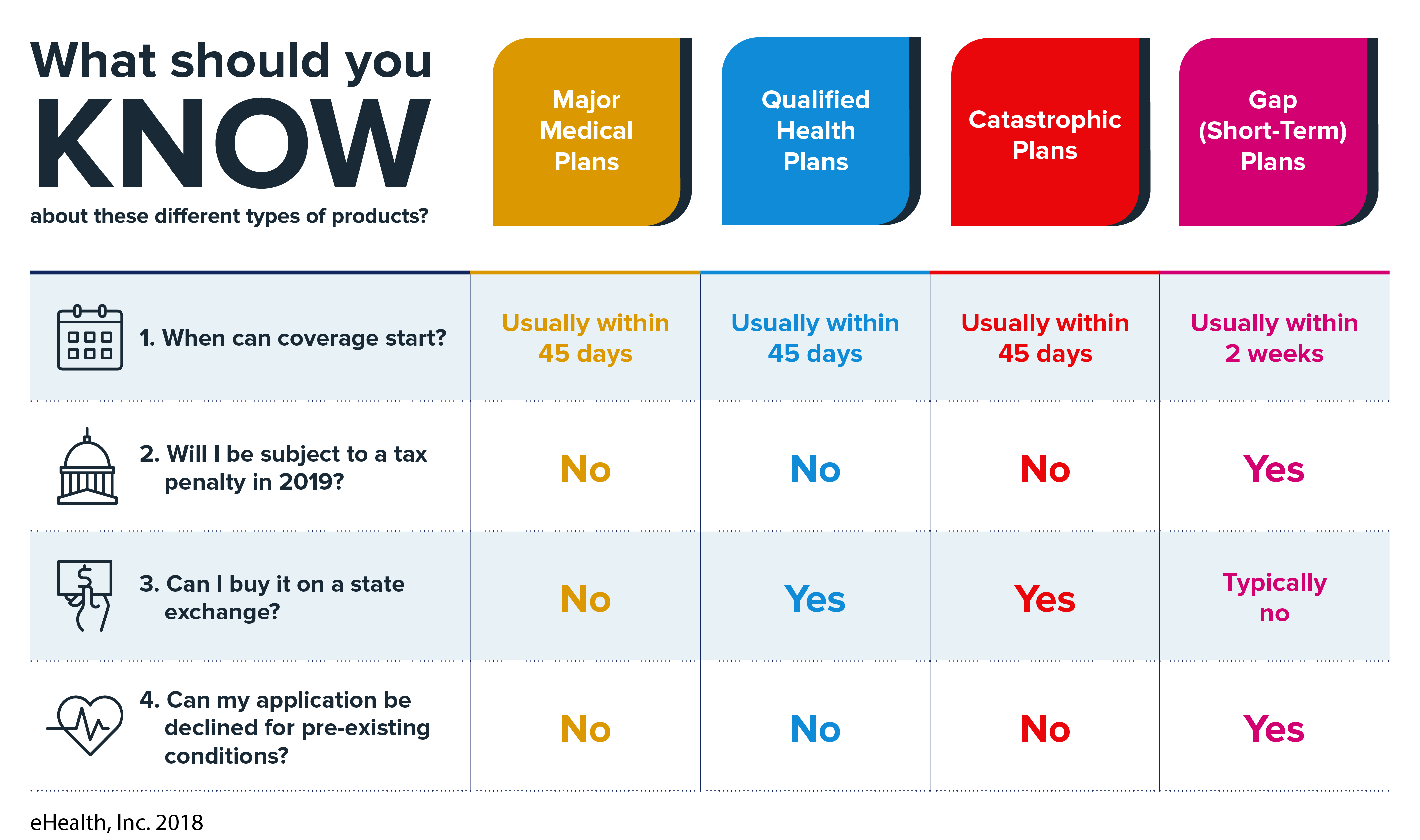

Traditional types of health insurance plans. Qualified health plans these are obamacare plans that can be purchased with a subsidy catastrophic plans primarily available to people under age 30. There are several types of health insurance plans available and they vary on many levels from the extent of the coverage to the cost to the ease of use for the insured.

Hence it becomes vital to compare the different insurance types online in terms of their offerings premium or claim settlement ratio of the insurers. Different types of major medical health insurance include. However it requires thorough research of the market before zeroing down on a plan.

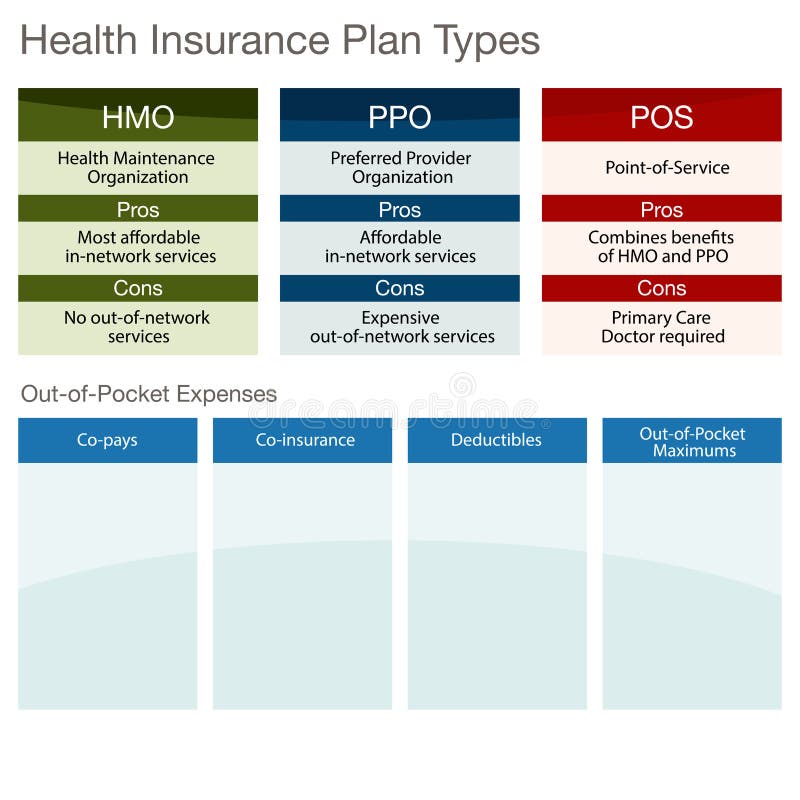

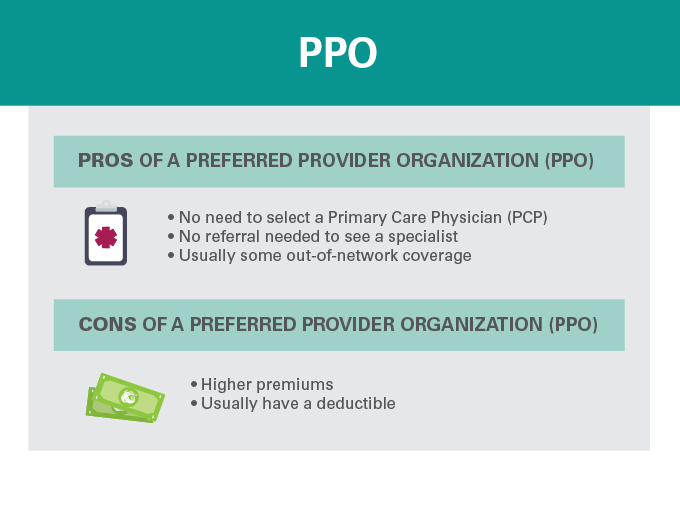

Hmo ppo epo or pos higher out of pocket costs than many types of plans. Can make it confusing to select the right one. There are broadly three types of health insurance in india.

Health insurance also called medical insurance or simply mediclaim covers the cost of an individual s medical and surgical expenses. Obamacare health insurance plans for individuals and families.