Epo Health Insurance Pros And Cons

Why you need a health insurance broker.

Epo health insurance pros and cons - News and advice. The job of a health insurance broker is to provide clients with the most appropriate insurance plans based on their unique needs and budget. Here we will compare these popular health insurance plans so that you can better determine which is right for you.

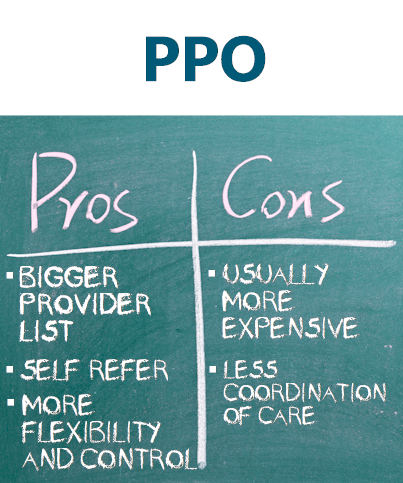

Brought to you by sapling. Both an epo and a ppo can provide you and your family with comprehensive health coverage. You don t have to get a referral from a primary care doctor to see a speciali.

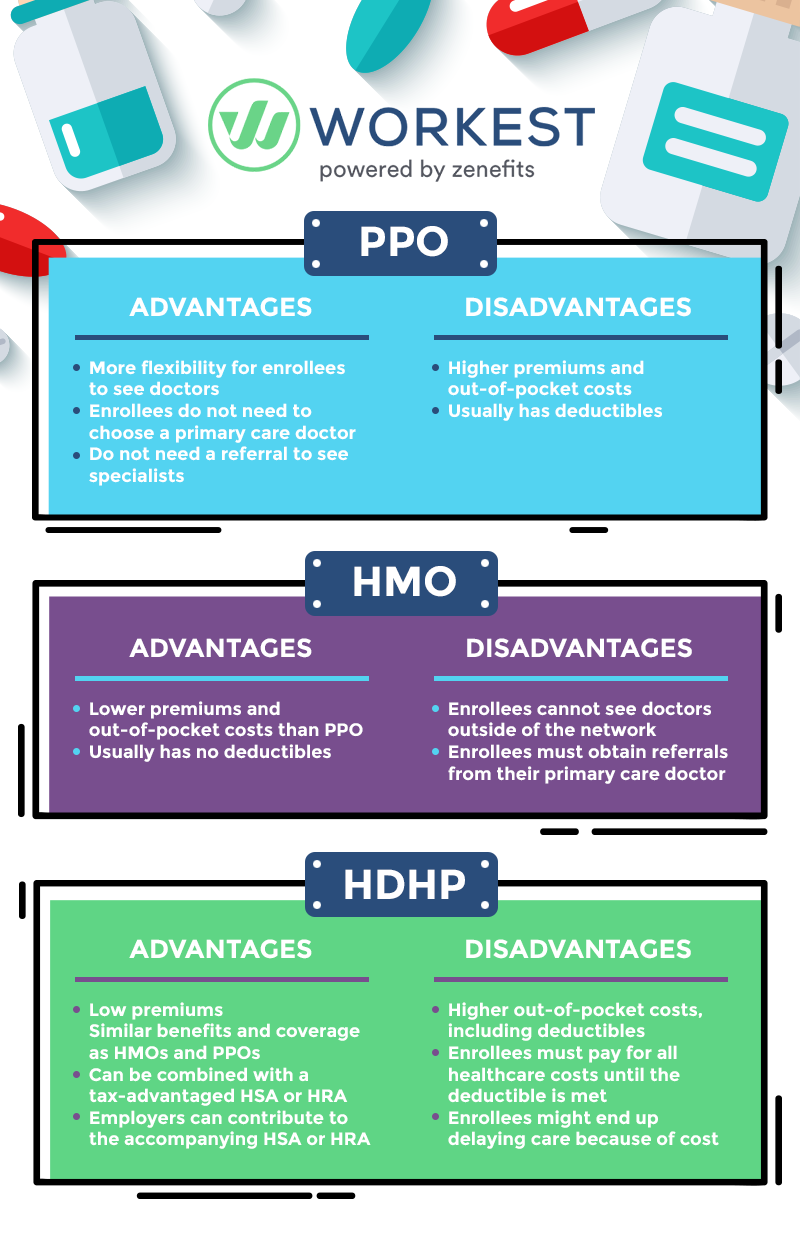

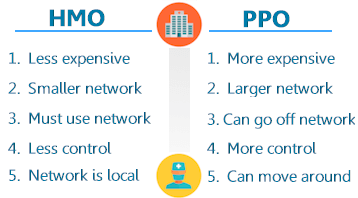

Hmo health insurance plans features and costs can be overwhelming. Epo stands for exclusive provider organization while ppo stands for preferred provider organization these insurance plans offer the same type of coverage. The most common types of health insurance plans include hmo ppo and epo.

Both hmo and ppo plans feature a network of hospitals doctors and specialists that provide patient. Hmo insurance plans are one of the most popular types of health insurance plans used by millions of people across the country. See if an epo plan may be right for you.

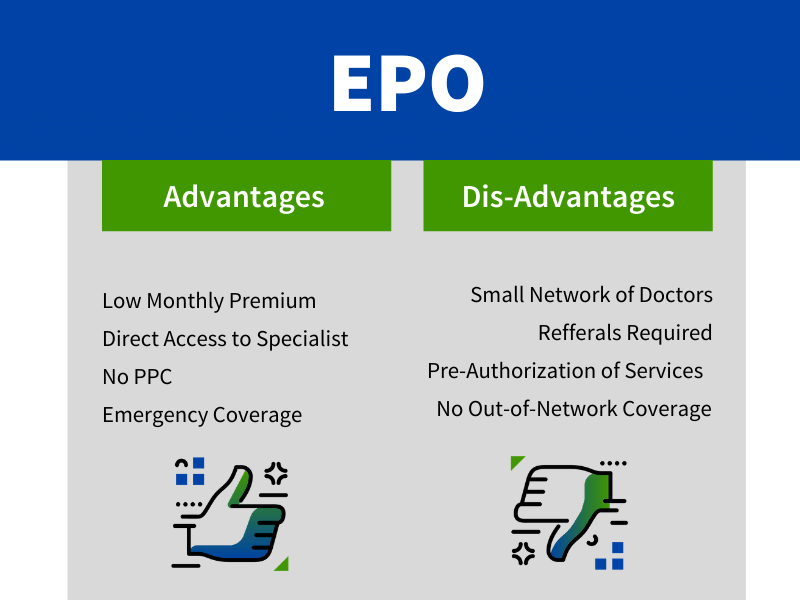

An exclusive provider organization or epo is a hybrid health insurance plan that has both pros and cons. With an epo exclusive provider organization you have a moderate amount of freedom to choose your health care providers. If you re struggling financially and need rates as low as possible an epo can be a good way to get insurance at a low price.

Brought to you by sapling. Each has their own set of pros and cons and not all are right for everyone. Fortunately a qualified health insurance broker can help.

While each has its own set of benefits exclusive provider organization epo plans are one of the most attractive options. Video of the day. The big difference is in how many choices you have when you sign up.

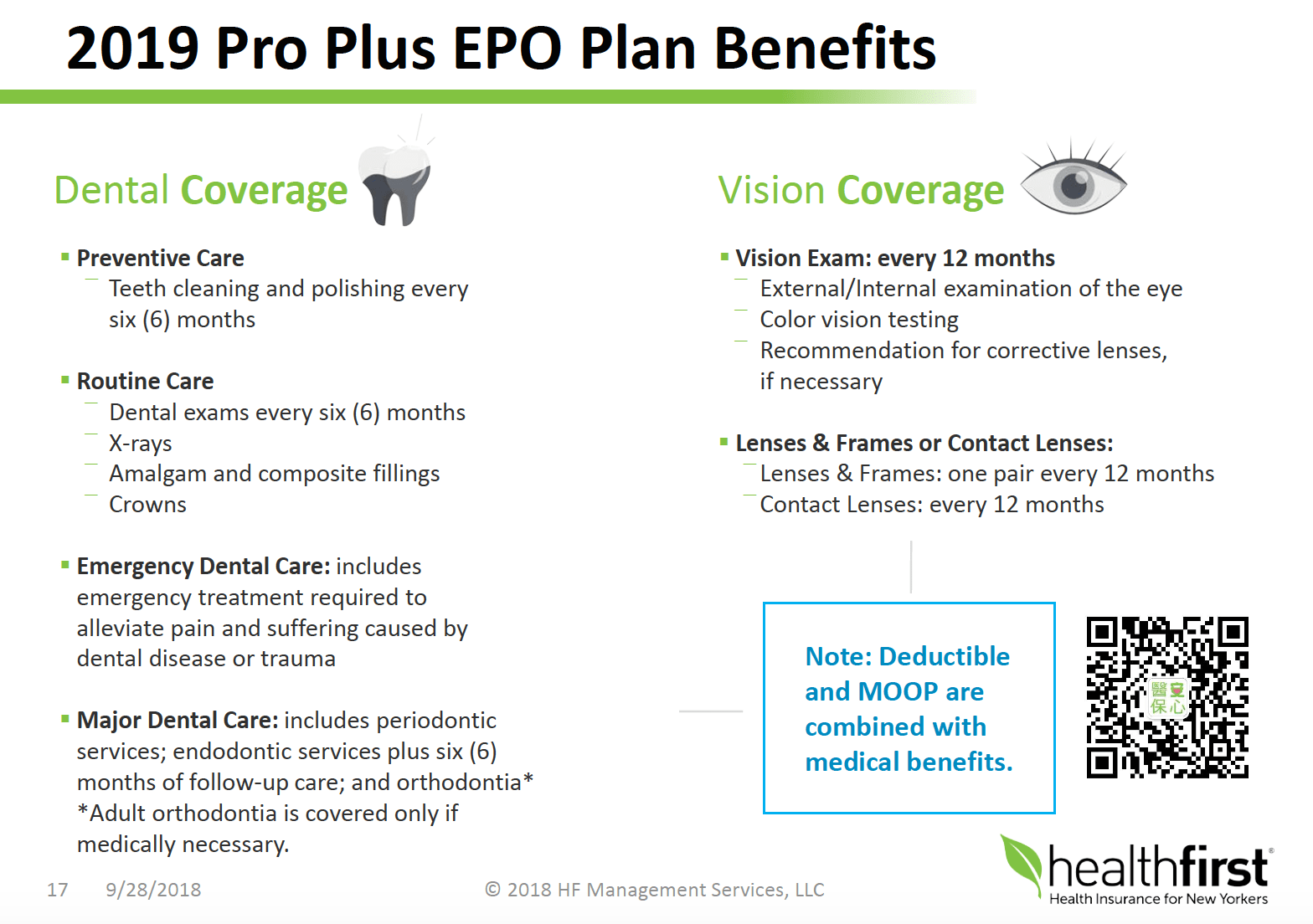

Epo stands for exclusive provider organization similar to a health maintenance organization hmo an epo requires members to use a network of providers that participate in the plan including hospitals doctors and other healthcare. Comparing the epo vs. Choosing the right health insurance can make a significant difference in the cost and quality of your medical care.

Learn more about epo insurance how it differs from other plans and why you should speak with a health insurance broker. The insurance company can provide you with a detailed list of providers within either network so you can weigh the pros and cons of each option before making a decision. By mallory malesky.

/ProConUniversalHealthCare_4156211_final_2-5b9d7ce04bff4f8dab98a4b87deca55e.png)