Group Health Insurance Vs Individual Health Insurance

Employers may not offer a well rounded product for the benefit of their workers.

Group health insurance vs individual health insurance - Similar to individual health insurance group health insurance may offer a number of coverage options. There are numerous benefits for people who have this coverage. Now let s talk about the downside of group health insurance over individual health plans.

Individual health insurance vs. Group health insurance in india is simply an insurance package an organisation buys for the benefit of its employees. These plans can be purchased on the open market just like individual coverage by the employer and not the employee or they can be a self insured plan set up by the company typically seen with larger companies or a combination of the two i e.

Some of the most common types of coverage available include medical vision dental life and short term and long term disability insurance. All it takes is just a few clicks little bit of your time and you are all set. Individual health insurance and group health insurance are quite different from each other.

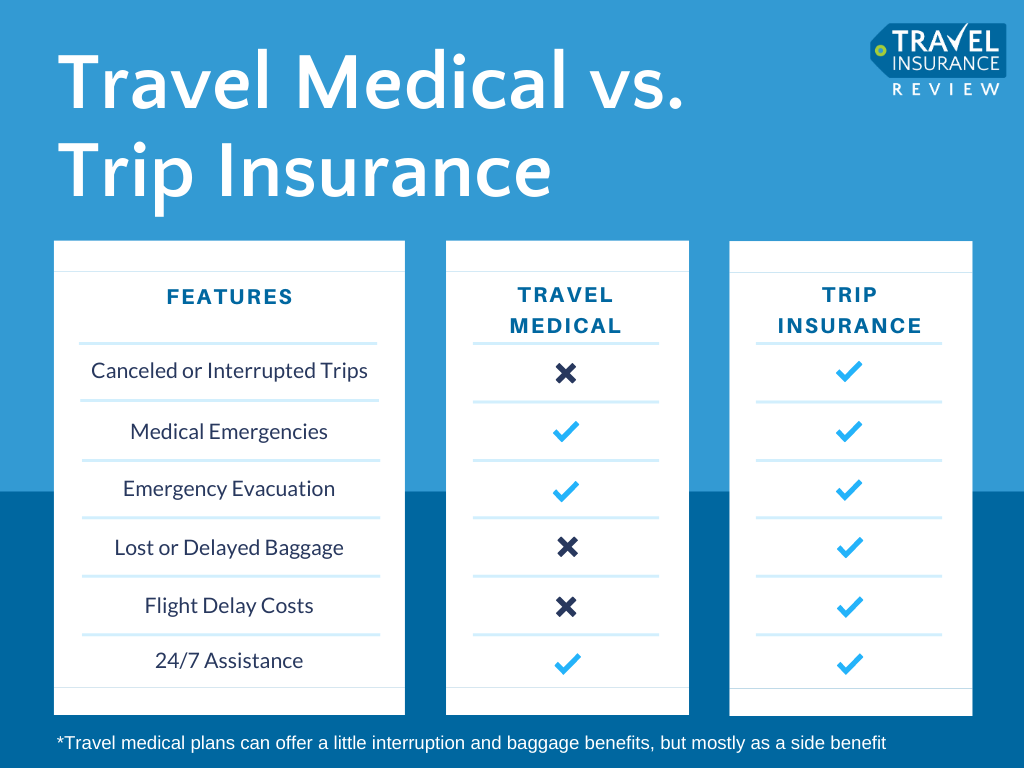

Most individual plans will only offer smaller hmo plans but most group policies are ppos. You can buy group health insurance or individual health insurance online without any documentation. Individual health insurance is the most expensive option for people who don t have coverage or don t have enough coverage through employers.

Both of these types of plans will be explored in detail later in this article. Knowing the difference between group insurance and individual health insurance is necessary before making a decision. People typically only explored individual plan.

September 18 2015. This type of coverage is designed specifically for companies to buy for their employees. Most employer s group insurance plans are managed care plans typically either hmos or ppos.

It is important for business owners to consider what type of coverage their employees may need. Limitations of group health insurance vs. Each has its own advantages that can be made the most of on making the right choice.

The organisation may design a self insured plan itself or select a pre. Further you should also know the family floater vs individual health insurance benefits. Prior to passage of the affordable care act aca and the creation of public health insurance exchanges individual heath insurance was difficult to get and generally did not provide very good coverage.

Group health insurance is a top choice for most people. Individual health insurance policies are often purchased with the guidance of an insurance agent to help navigate plan choices and premium costs. So if you have not been able to reach a final decision regarding going with group policy or individual insurance policy read the differences carefully to identify.

The biggest difference these days are the networks. Group insurance policies cannot be customised to individual needs. Self insured up to a certain limit.

Group health insurance individual health insurance is a type of health policy an individual purchases for himself and or his family. Breaking down the basics.