Group Health Insurance Vs Individual Health Insurance India

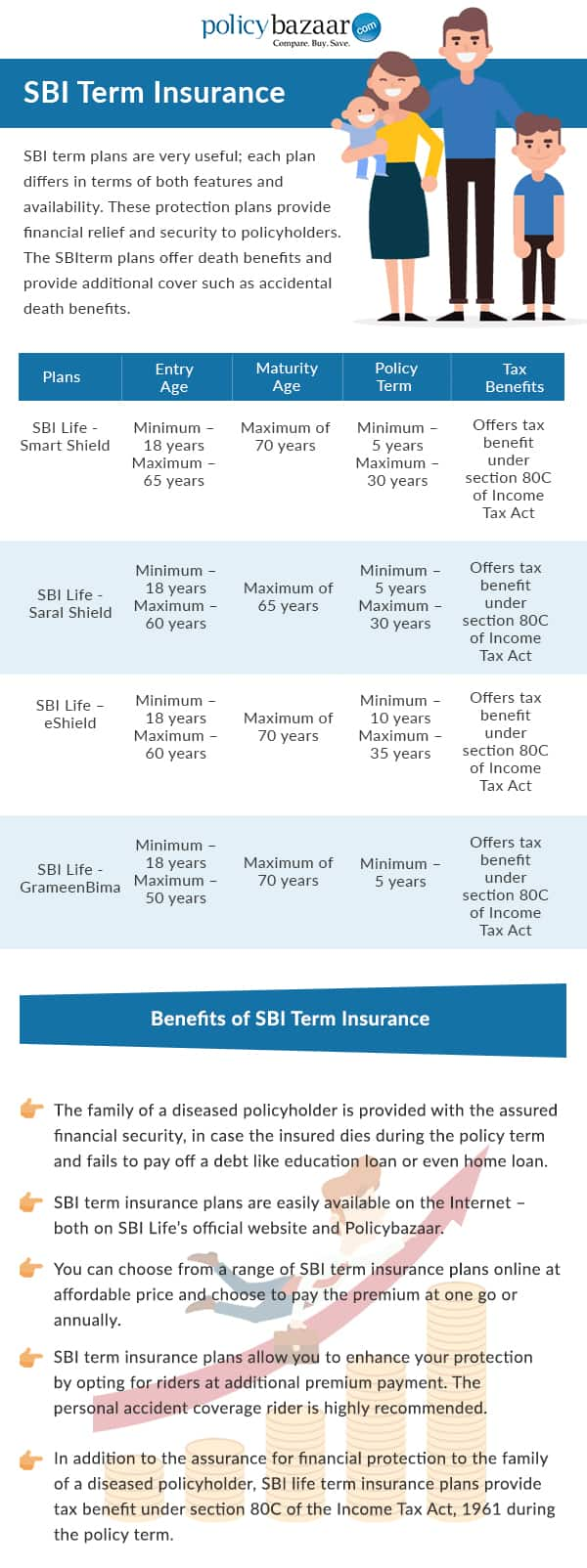

The organisation may design a self insured plan itself or select a pre.

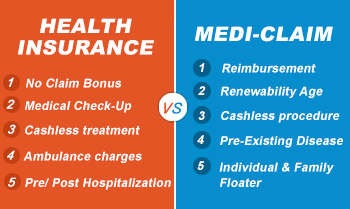

Group health insurance vs individual health insurance india - But their inherent limitations and lack of flexibility make it necessary for people to not rely solely on them. Having said that let s have a look at the differences between group and individual insurance. A business that has one or more employees may be eligible to purchase group health insurance.

The organisation may design a self insured plan itself or select a pre planned insurance policy from an insurance company. Here the company is the direct point of contact with the respective group health insurance provider. Group health insurance karen menezes 24 march 2016 group insurance plans is a health cover availed by companies for their employees whereas an individual health insurance policy is a cover that a person buys for himself or herself.

Limitations of group health insurance vs. Knowing the difference between group insurance and individual health insurance is necessary before making a decision. Group health insurance in india is simply an insurance package an organisation buys for the benefit of its employees.

All said and done employer provided group health insurance plans in india have decent benefits to begin with. Individual health insurance vs. You can buy group health insurance or individual health insurance online without any documentation.

Now let s talk about the downside of group health insurance over individual health plans. Group insurance policies cannot be customised to individual needs. You have broadly understood how group vs individual insurance differ.

Individual insurance group insurance is the type of insurance that is typically offered by most employers. Royal sundaram is an online insurance company that offers affordable health plans with a wide range of benefits to take good care of you and your family. You do not enjoy the freedom to customize your health insurance policy as per your needs under a group insurance cover.

Every individual holds the right to cancel their policy at any point in time. In this case every individual is the direct point of contact with their respective insurer. Employers may not offer a well rounded product for the benefit of their workers.

Definitions group insurance is simply an insurance package an organisation buys for the benefit of its employees. With group health insurance you have the ability to help your employees pay for health care expenses. Further you should also know the family floater vs individual health insurance benefits.

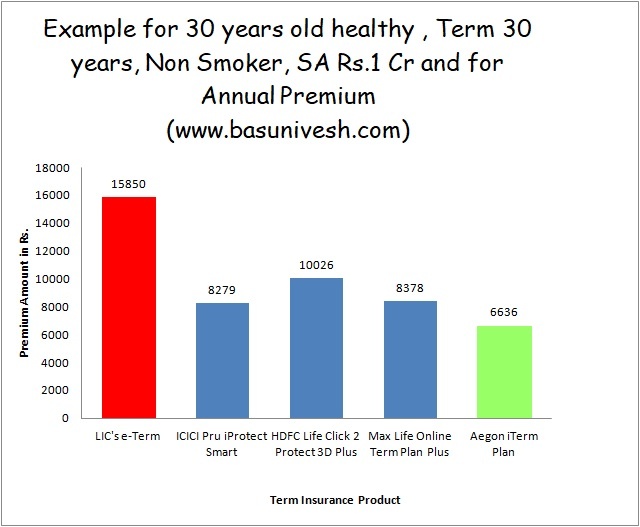

Most business owners and employees find group health insurance to be more cost effective than individual health plans.