Health Insurance Deductible Vs Out Of Pocket Max

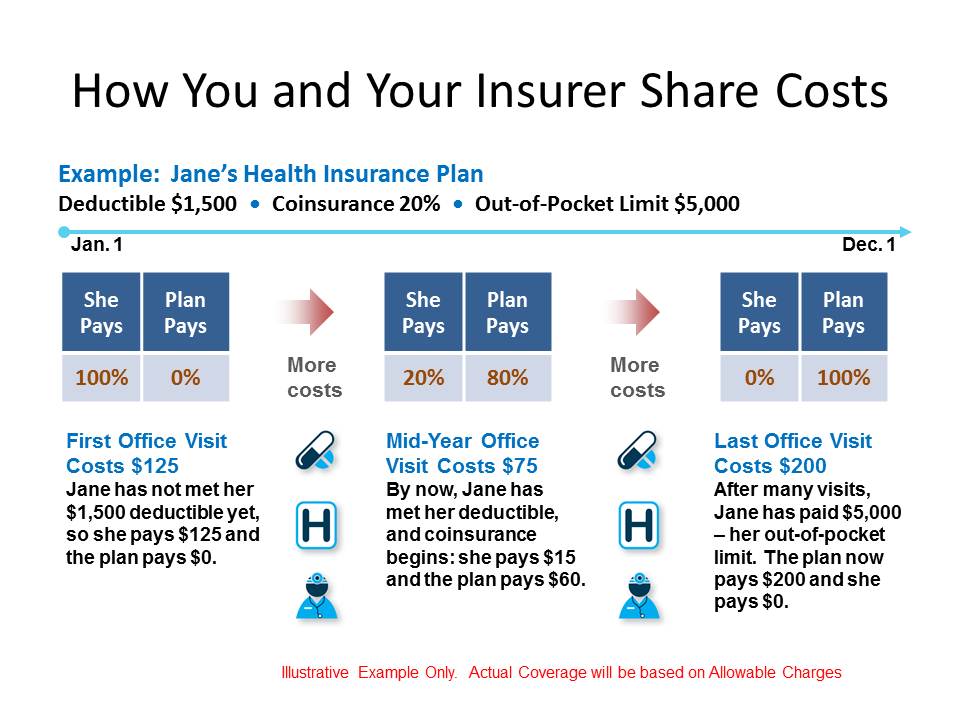

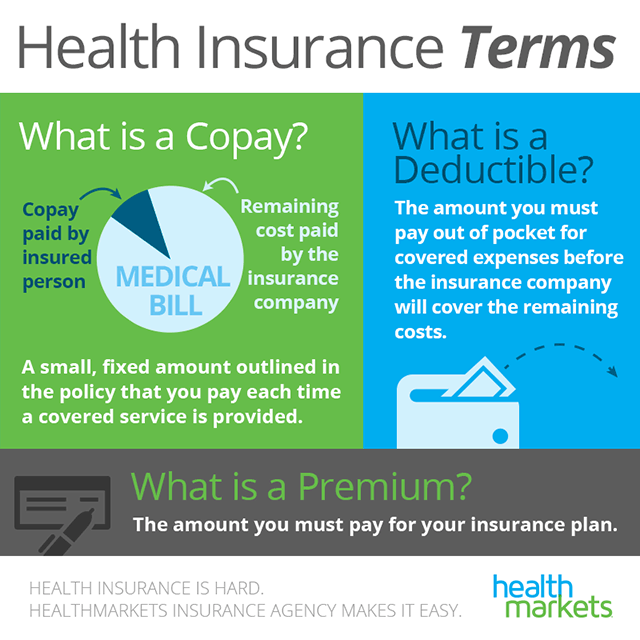

A deductible is an accumulation of out of pocket claims that are not copays.

Health insurance deductible vs out of pocket max - Once you spend this much on in network services. Still deductibles copayments and coinsurance all count toward the out of pocket maximum under the affordable care act aca. For 2020 the out of pocket maximums are 8 150 for individuals and.

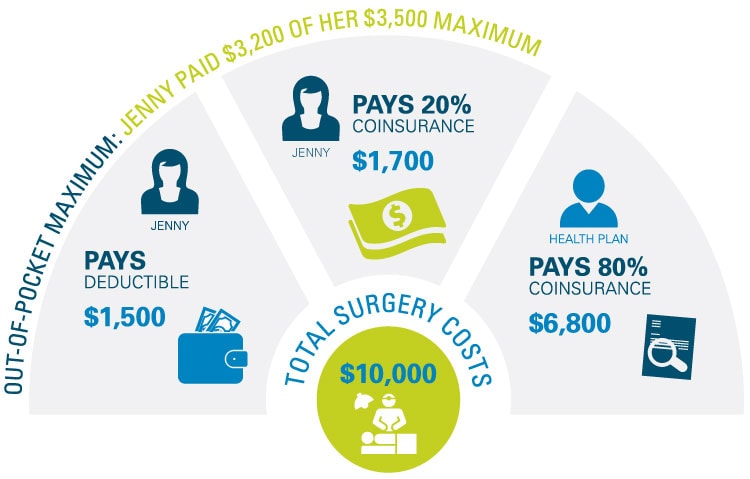

Now you owe your coinsurance amount on the rest of the medical costs of 15 000 for a total of 3000. In basic terms a deductible is a prerequisite requirement you need to spend first before the insurance company starts paying the claim. A common question surrounding health insurance is how much you ll be expected to contribute to the cost of your medical care.

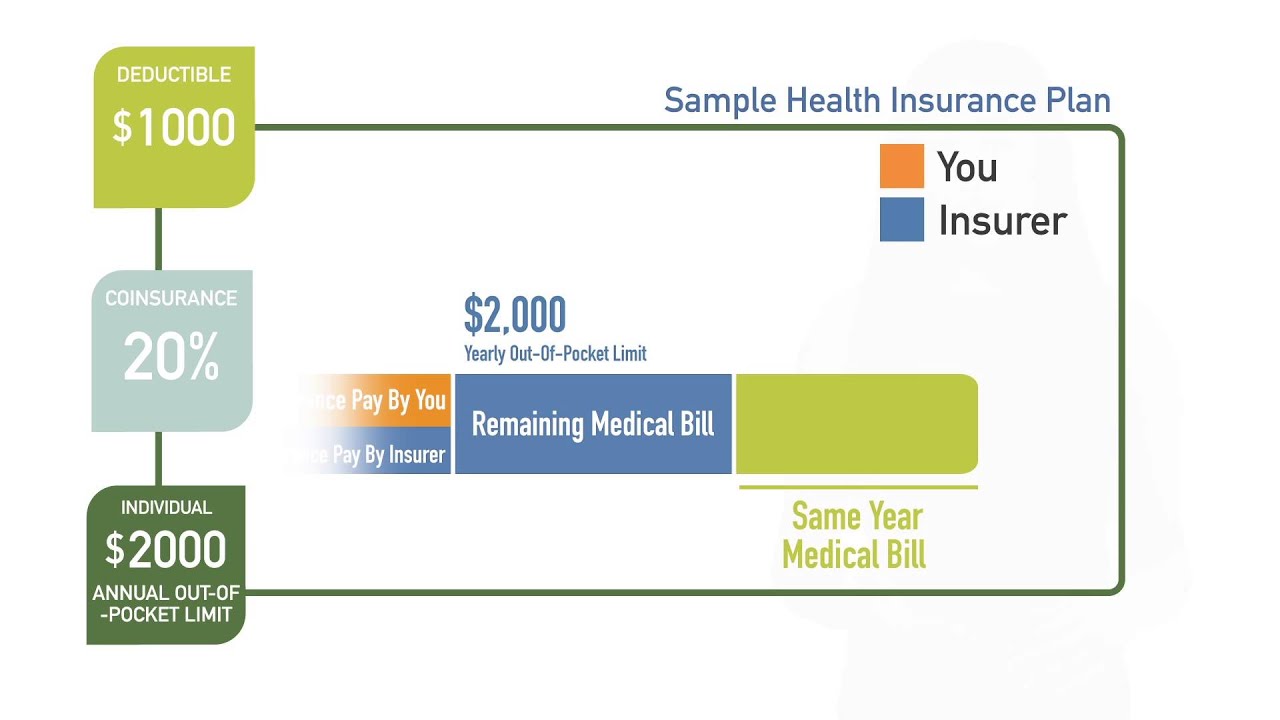

There are a few basic differences between your deductible vs maximum out of pocket. Comparing the out of pocket maximum vs. Cost sharing is a financial risk management strategy that includes items like deductibles coinsurance and copayments.

Since health insurance works on an annual basis the deductible and out of pocket will change each year. The deductible amount you pay for medical services in a health insurance plan is a step we should all take. Those post deductible charges add up which is where the out of pocket maximum comes in.

Plans with lower premiums tend to have higher out of pocket maximums and vice versa. You pay the first 5000 of covered medical expenses towards your deductible. The out of pocket is the amount payable a maximum applies which a person needs to pay before the insurance will cover all further costs.

Out of pocket maximum. This can help you see whether the plan will help you save money on your medical needs or result in paying too much for coverage you don t need. In a health insurance plan your deductible is the amount of money you require to spend out of pocket before your health insurance begins paying for your healthcare costs the insurer still will not pay for everything though.

This brings you to a total of 8000. Insurance will cover part of your expenses and you will pay the rest which is known as coinsurance. The deductible applies before the health insurance will cover medical costs.

The highest out of pocket maximum for a health insurance plan in 2020 plans is 8 200 for individual plans and 16 400 for family plans. Additional considerations for deductible vs.