Health Insurance Gift Tax

Gift tax is imposed as a result of giving property with a donatives intent and receiving consideration less than the market value of the gift.

Health insurance gift tax - The tax rates range from 10 to 50 excluding local income tax on the taxable income. Thus if payment for a medical expense is reimbursed by the donee s insurance company the donor s payment for that expense to the extent of the reimbursed amount is not eligible for the unlimited exclusion from the gift tax and the gift is treated as having been made on the date the reimbursement is received by the donee. Thus gift tax is not imposed when inheritance tax has.

The end of the so called hif is an election year gift to the health insurance industry which has for years been fighting to put off or get congress and the white house to repeal the fee. Pay directly for everybody s health insurance premiums doctor bills pharmacy bills and. Gift tax is considered a supplement to inheritance tax.

Are payments of health insurance premiums for a child grandchild or other party subject to federal gift. For 2020 irs rules exclude 15 000 per year per person from the gift tax. If he or she does not the donor s payment will be treated as a taxable gift.

The donee must reimburse the donor. Land and buildings tax pajak bumi dan bangunan or pbb is due annually at maximum 0 3 of the regional government determined market value. Gift tax returns are due simultaneously with your regular tax return form 1040.

Filing a gift tax return. Income from lottery prizes is subject to a 25 final income tax. Inheritance estate and gift taxes.

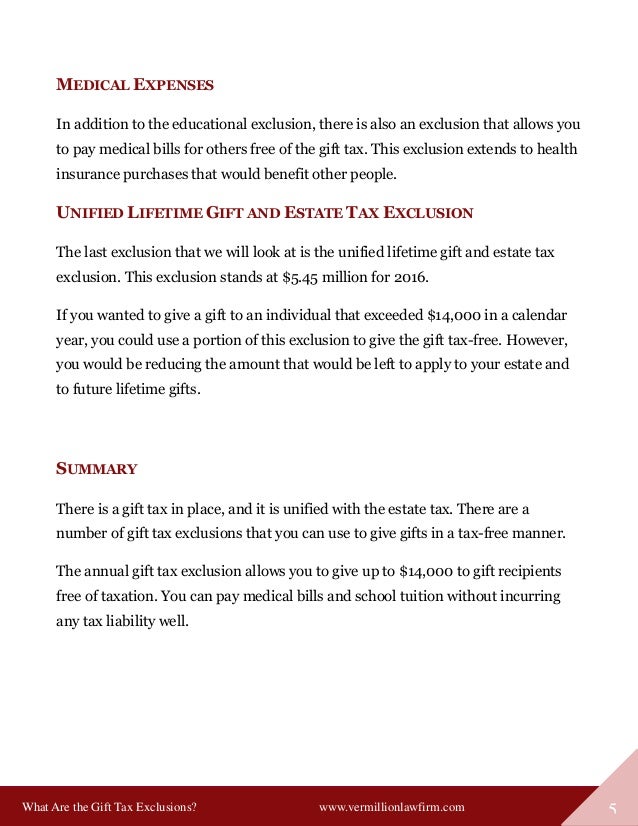

You do not have to file one if your gift meets any of these exclusion rules but you must do so otherwise even if your gift goes over the 15 000 limit by only 10. What if the expenses subsequently are paid by health insurance. 2503 e 2 excludes from gift tax any amount paid on behalf of an individual.

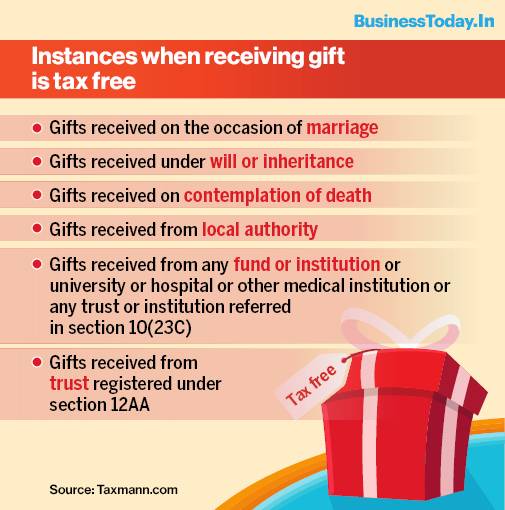

Direct payments for someone s educational or medical expenses are exempt from the federal gift tax without regard to the annual exclusion limitation 14 000 year in 2014. In connecticut that means they are also exempt from connecticut gift tax. The gift tax exclusion is not available if the donor makes the gift to the patient or student who in turn pays the medical or tuition expenses himself or herself.

If a donee s medical expenses are subsequently reimbursed by insurance the donor s payment does not qualify for the exclusion. Just as the government provides a standard amount that is exempt from income tax the same applies to the gift tax.