Human Life Value Insurance

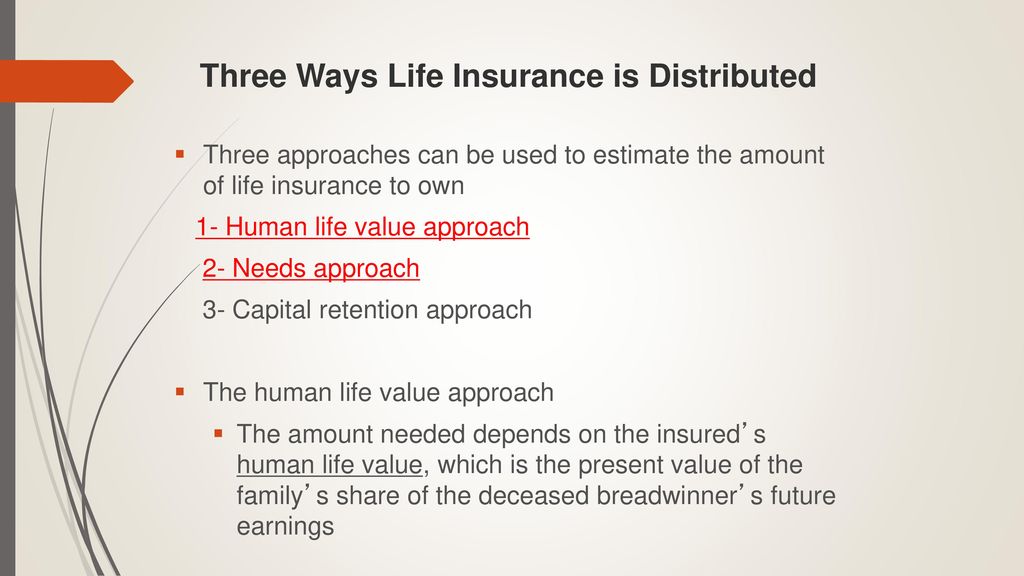

The human life value concept deals with human capital which is a person s income potential.

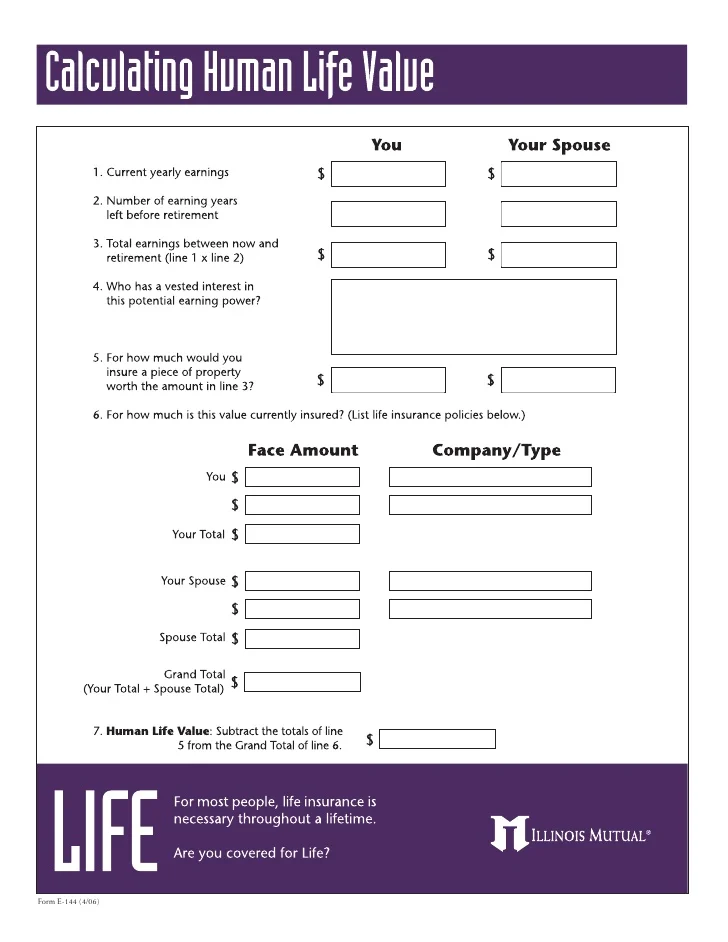

Human life value insurance - It provides only a rough estimate of your human life value which can factor into how much insurance you need. Human life value calculator. Simply put your human life value is the amount of income you will be expected to earn in your lifetime.

Human life value calculator a valuable tool that helps you gauge the financial obligations your family would face in your absence. Human life value calculator. A person earning 100 000 per year over a 30 year period for example would have an approximate human life value of 3 000 000.

Calculating one s life insurance needs with this process involves multiple steps. It is important to insure yourself first and then your dependents as per your income. The human life approach is a method of calculating how much life insurance is needed for a family that is based upon their financial loss when the insured person in the family passes away.

The human life value concept is a universally adopted approach utilized by underwriters as well as courts when establishing the economic value of a human life. This calculator helps you assess the financial loss your family would incur if you were to die today. In life insurance parlance human life value or hlv represents the amount that ensures a family s standard of living does not get affected if the one who earns for the family dies or.

Assessing human life for its economic value is a useful tool for insurance companies to determine the amount of money a family needs in case of death of the sole earning member. Adequate insurance cover is vital as it cannot be left to chance especially when it concerns your family. Human life value is the monetary worth placed on a human life.

Life insurance is designed to meet your financial obligations your family s living expenses and often your child s education.

.png)