Importance Of Non Life Insurance

It develops a habit of saving money by paying premium.

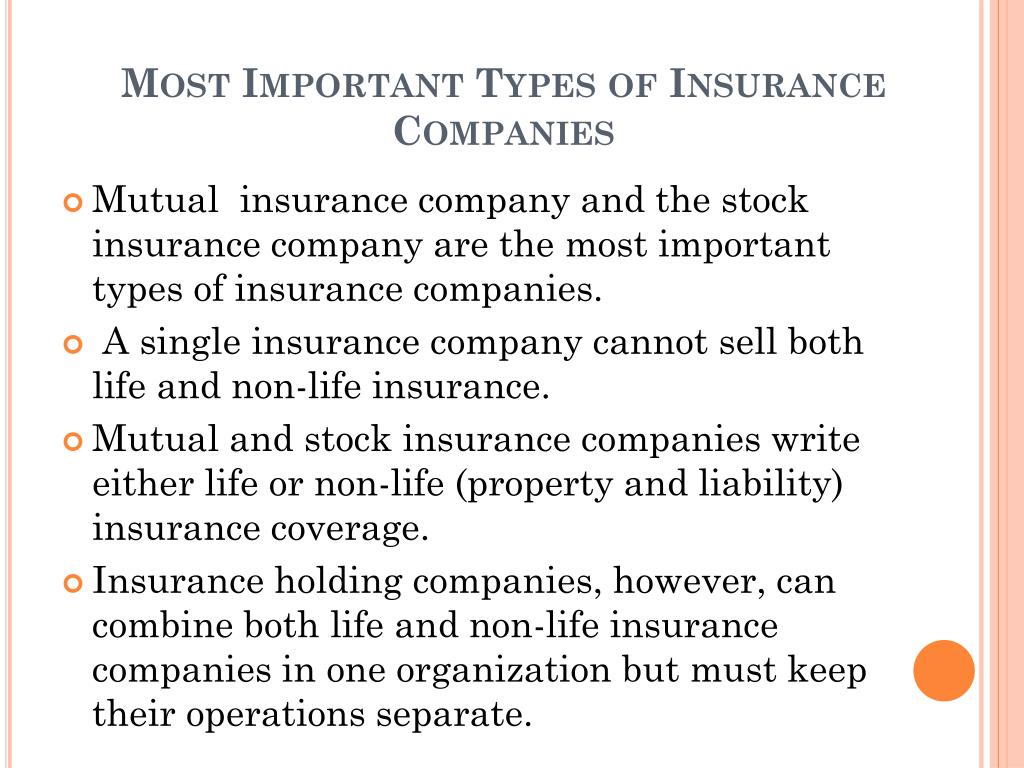

Importance of non life insurance - The risks that are covered by life insurance include premature death income during retirement illness. When you purchase life insurance you are making a plan to be sure your family will be safe from the effects of losing your contribution to the household income. Non life insurance also called property and casualty insurance is a type of coverage that is very common and covers businesses and individuals.

It protects them monetarily from disaster by providing money in the event of a financial loss. The main products for the same consists of whole life endowment term medical and health life annuity plan. Life insurance enables systematic savings due to payment of regular premium.

Before you purchase this type of insurance. The important thing to note is non life insurance is valuable and you should consider getting one if your situation calls for it. Definition of non life insurance.

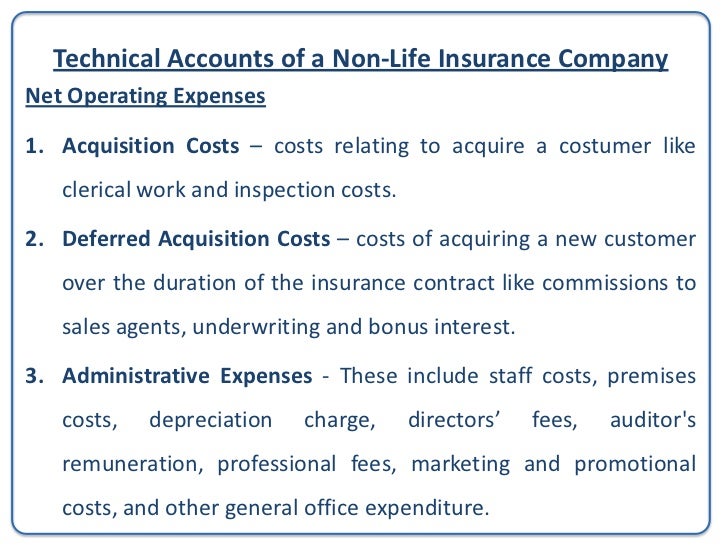

An amount of premium paid for non life insurance is normally considered as business expenses. Fire insurance is a type of insurance which is taken for getting financial compensation against the loss by fire. It is a contract in which the insurer promises to pay a certain sum of money to the insured in.

Since its inception insurance has been all about transferring risk thereby avoiding the anxiety of potential loss. Life insurance provides a mode of investment. Explain in short about fire insurance.

Insurance does not only protect against risks and uncertainties but also provides an investment channel too. You can have more than one type of non life insurance.