Insurance Automation

You already know about the repetitive tasks that exist in your industry.

Insurance automation - Intelligent automation for insurance learn about the main drivers for insurance automation and find out why intelligent automation is the ultimate solution to the challenges that the industry faces today. Automate this automate that but what does it really mean. Join automation academy course.

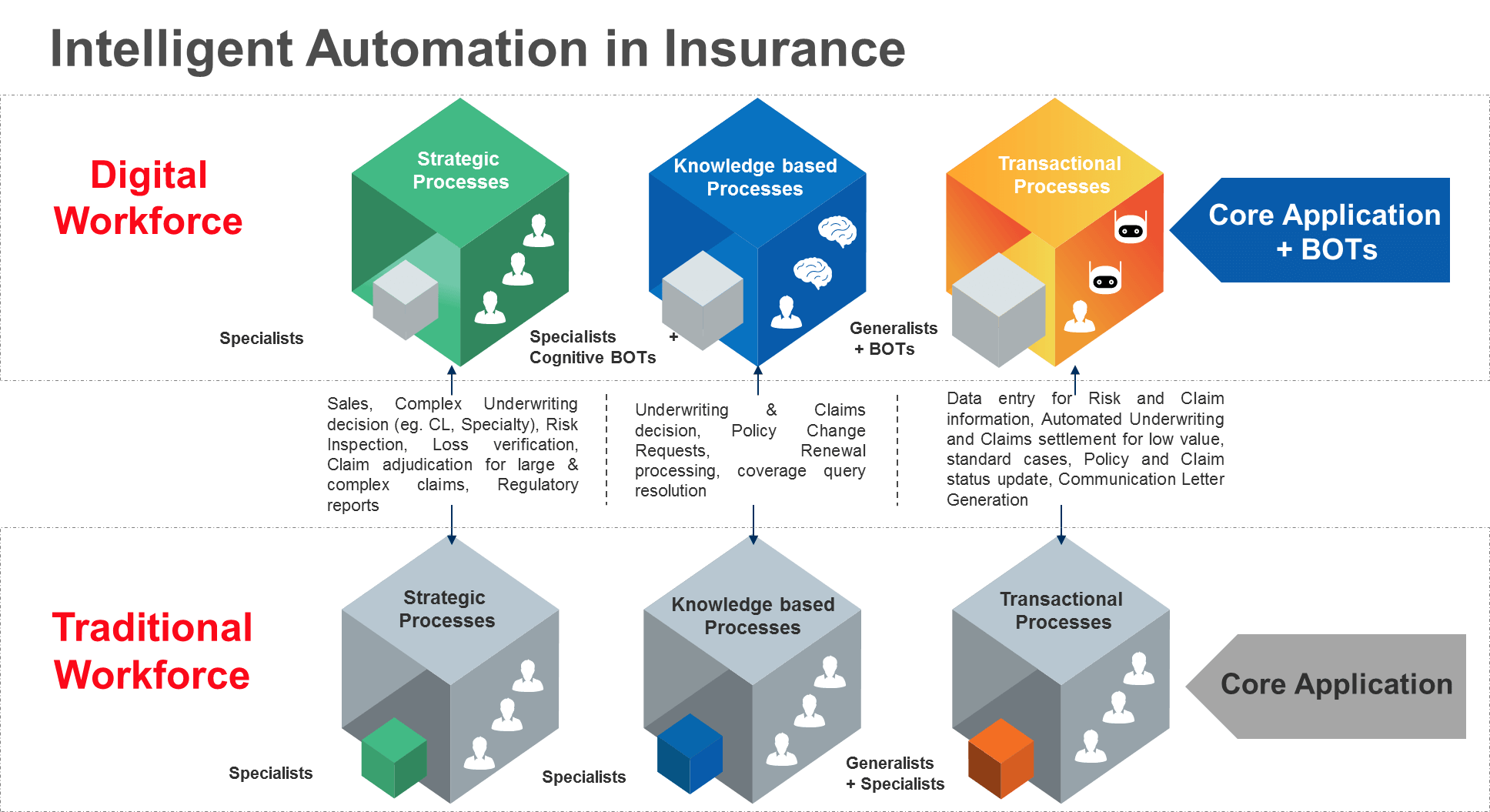

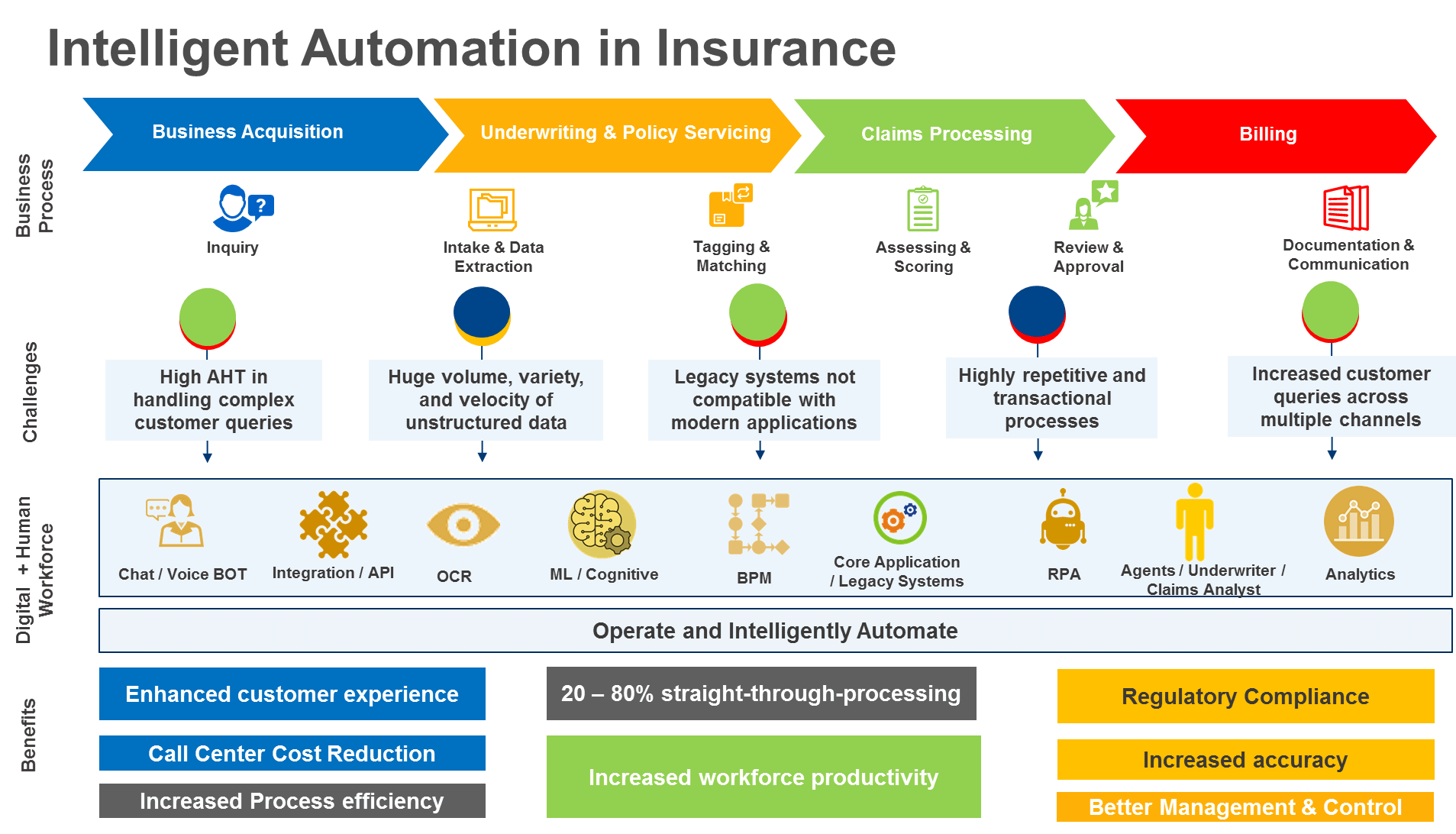

A document audit bot can generate daily reports for underwriters or claims heads and can trigger missing. Rpa allows companies to gain efficiencies and hopefully save money by automating routine tasks according to forbes though rpa in insurance is considered artificial intelligence ai these new systems are designed to be remarkably easy to use. Automation has become a reality in almost every industry and the insurance industry is no exception to this revolutionizing technology.

When these insurance leaders talk about how automation is changing the game in insurance what specific processes are they referring to. Remove the monotony by implementing a streamlined automation system that will automatically take care of these repetitive tasks for you. The insurance industry traditionally cautious heavily regulated and accustomed to incremental change confronts a radical shift in the age of automation with the rise of digitization and machine learning insurance activities are becoming more automatable and the need to attract and retain employees with digital expertise is becoming more critical.

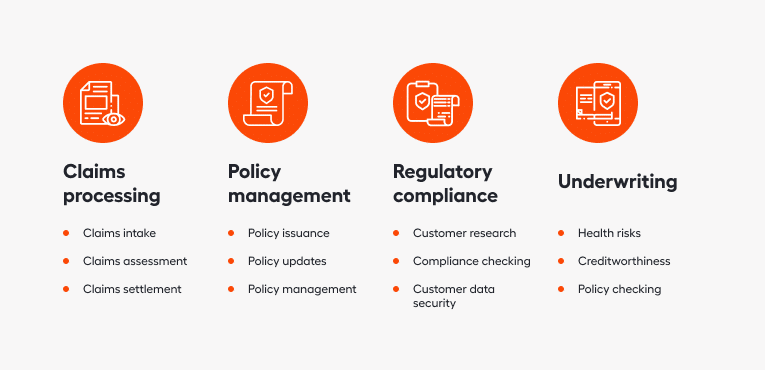

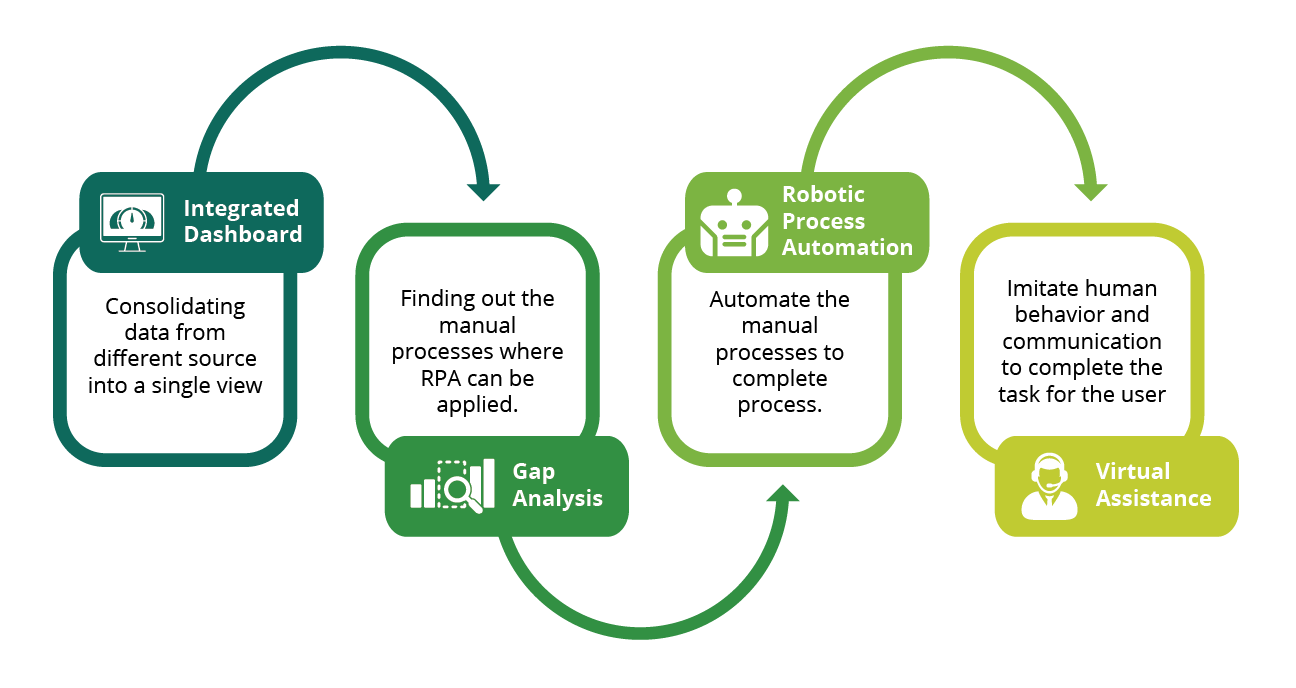

The insurance industry has begun to leverage automation to process vast siloes of complex data boost the overall operational efficiency reduce costs and maintain competitive relevance in the market. Technology is transforming how insurers do business and one important example of this is robotic process automation rpa. Automation using bots is accomplished in several processes within insurance businesses.