Irrevocable Life Insurance Trust

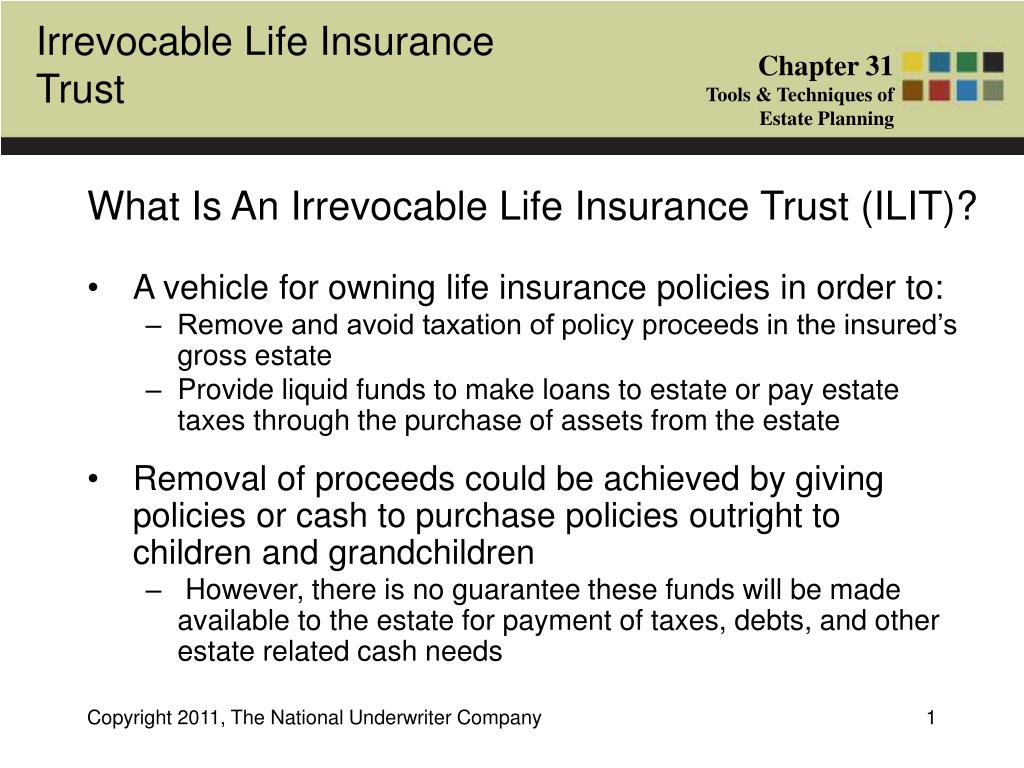

An irrevocable life insurance trust ilit is a trust that cannot be rescinded amended or modified post creation.

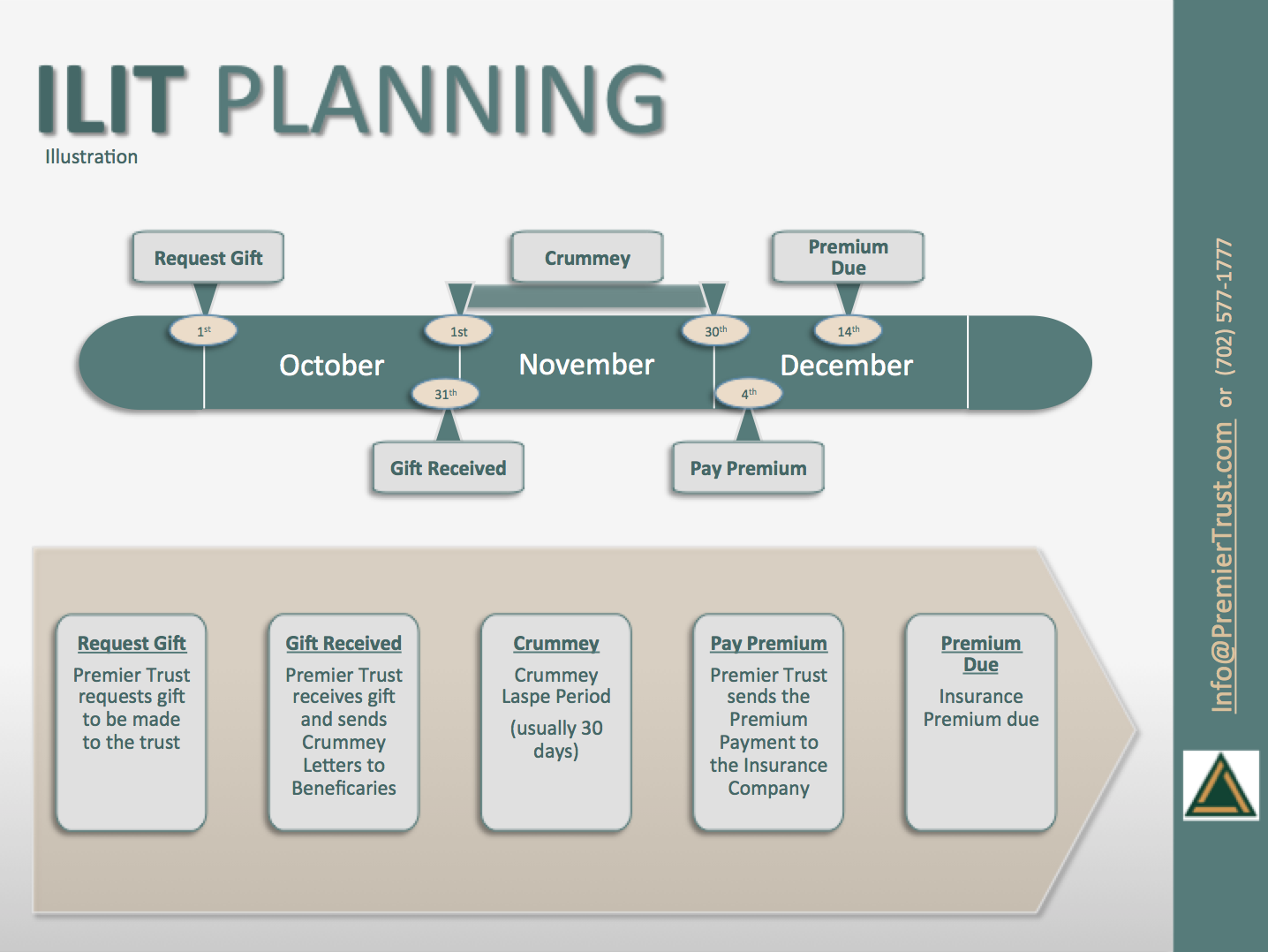

Irrevocable life insurance trust - Learn more about these and other reasons to own an ilit. This article provides a general overview of ilit funding and administration requirements. What is an irrevocable life insurance trust accessed june 2 2020.

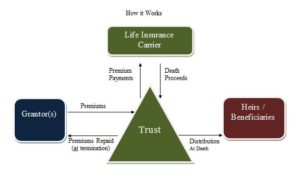

So you can leave more to your loved ones. An insurance trust has three components. An irrevocable life insurance trust ilit is a trust that can be used to minimize estate taxes by moving the proceeds of life insurance policies outside of your taxable estate.

It s a good idea to speak to an experienced trust attorney who can tell you more about trusts and help you with estate planning. To set up an. Ilits are constructed with a life insurance policy as the asset owned by the trust.

The irrevocable life insurance trust ilit can be an important estate strategy tool that may accomplish a number of estate objectives. An irrevocable life insurance trust ilit helps minimize estate and gift taxes provides creditor protection and protects government benefits. The insurance policy is owned by the ilit rather than by the person whose life is insured.

Life insurance can be an inexpensive way to pay estate taxes and other expenses. How does an irrevocable insurance trust work. The grantor is the person creating the trust that s you.

The importance of policy reviews accessed june 2 2020. An ilit is a trust whose primary purpose is to hold a life insurance policy and the cash needed to pay premiums on that policy. An ilit is an irrevocable trust used to remove the death benefit of a life insurance policy from the insured s taxable estate.

The trustee you select manages the trust. What is an ilit. What an irrevocable life insurance trust looks like.

An ilit is created by an individual the grantor during his or her lifetime. An irrevocable life insurance trust ilit is a special trust which serves as both the owner and beneficiary of one or more life insurance policies when it comes down to it an ilit is primarily a financial planning and estate planning tool that is used for to protect assets specifically a large life insurance death benefit from being subject to estate taxes. However it may not be appropriate for every individual.