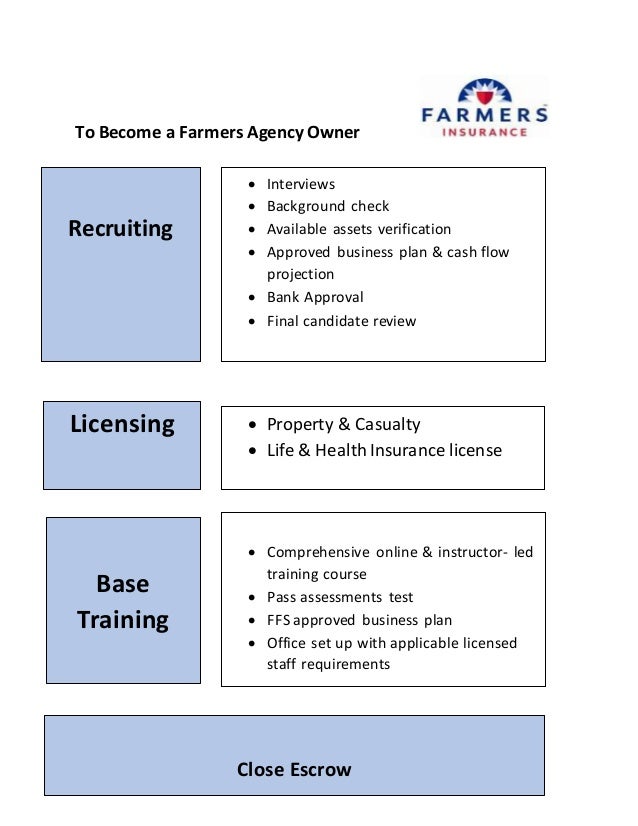

Life Insurance Background Check

It is best to consult a finace attorney if you have experienced life insurance discrimination.

Life insurance background check - Life insurance companies will check your application driving record and medical exam to get a picture of your drinking habits. If you would like to buy life insurance and you have been convicted of a felony the best advice is to be honest don t hide it. Posted may 22 2019 by jason metz.

If you have a criminal record. Life insurance is a very common asset that figures into many people s long term financial planning purchasing a life insurance policy is a way to protect your loved ones providing them with the. Most insurance providers may conduct an applicant background check including medical records with the medical information bureau.

However if you have a marijuana prescription insurers will run a background check of the mib medical information bureau to see what the prescription is for. Drinking can pose a potential health risk. Life insurance is available for marijuana users with or without a prescription.

And once that happens your application will be automatically declined. A simple criminal background check which is virtually routine in the insurance industry will reveal the omission. Drinking less alcohol.

So the question then becomes what is the key to getting the best rates on life insurance with marijuana. But yes this is way too long for the check to clear something isn t right. Ummm usually life insurance companies don t send checks.

A criminal record can affect your life insurance application and rates. Your best bet is to work with an experienced insurance broker and to fully disclose the criminal record. Find the right lawyer for your case with legalmatch.

An individual applying to be an indiana navigator will need to complete a criminal background check and submit a copy of the background check results to the indiana department of insurance idoi. Life insurance criminal record checks. The first thing the carrier does when they get an application is a background check.

When life insurance companies are pricing policies they generally look at many factors such as age health occupation credit driving record and even criminal records. Life insurance companies do their due diligence when people apply for policies with them and if an applicant lies about their criminal record their insurance provider is going to find out when they do a background check. If you lied on the application they will deny your application without giving you a chance.