Life Insurance Broker Commission

Insurance agent commission is nothing but the commission that an insurance agent gets from the corporation.

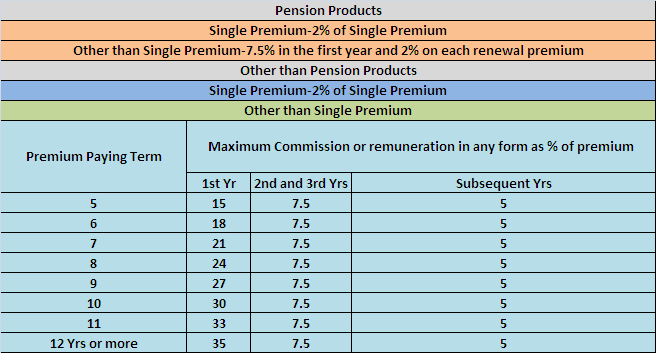

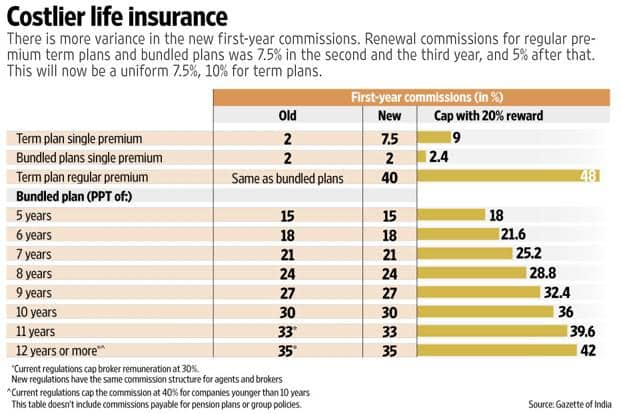

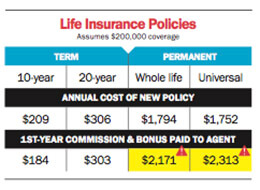

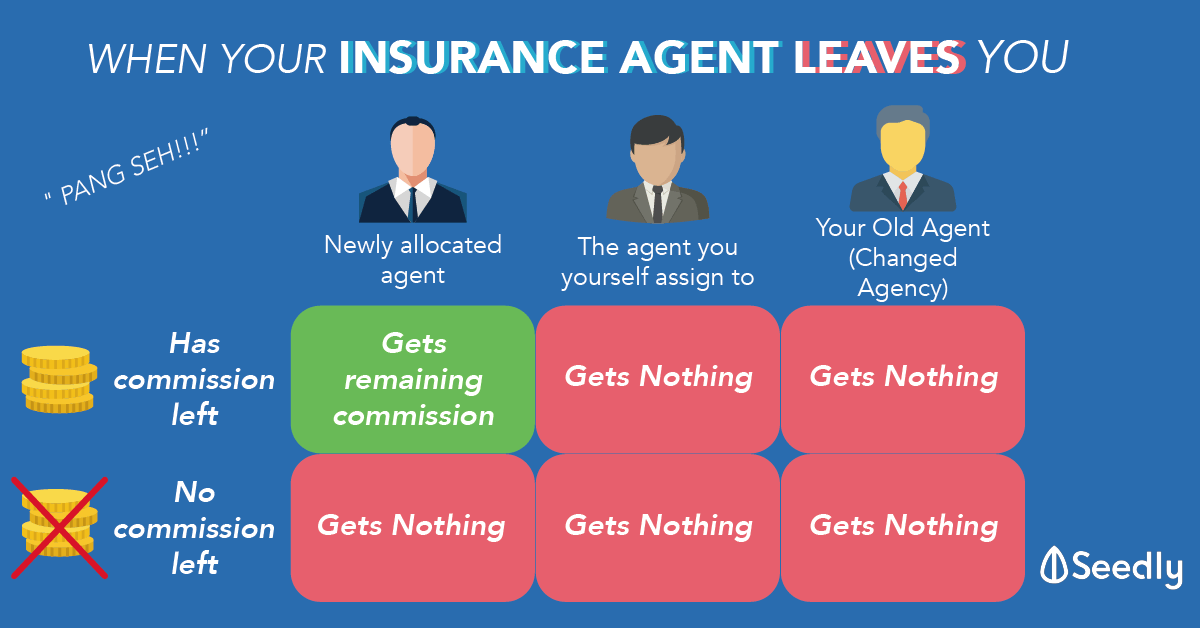

Life insurance broker commission - This means that although you may hold the policy for 20 or 30 years most of the commission is paid in the first 12 months. Annuity agent commissions are built into the policy. Corporate agents insurance brokers and insurance agents commission from 1st april 2017.

They are like life insurance single and regular premium health insurance vehicle insurance or other than vehicle insurance. If you value the personal service of a broker you won t have to pay. A life insurance agent s commission depends on a few factors including the company s commission plan and how much life insurance the agent is selling.

Why you should care about agent commissions. With life insurance and annuity products the commission paid to the selling agent is typically built into the policy. Commission structure of life insurance agents.

Life insurance brokers in particular can earn up to a 100 commission the first year. However a life agent earns most of the commission he or she makes during the first year of the policy. An insurance broker makes money off commissions from selling insurance to individuals or businesses.

Insurance companies issue annuities and if you put 100 000 into an annuity you will see 100 000 on your statement and 100 000 will go to work for you. The brokerage will split its commission with the life insurance agent but the total amount of remuneration remains the same. Life insurance commissions are paid to us in the first year of the policy because it s in that time that most of the work is done to put it in force.

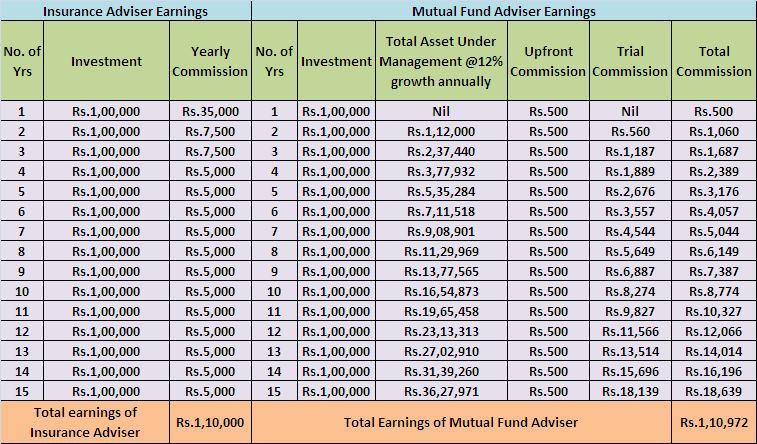

Agents and brokers that sell life insurance also earn commissions. Most commissions are between 2 and 8 of premiums depending on state regulations brokers sell. Therefore higher the term the higher the commission will be.

Hence i try to separate one by one for your better understanding. Here is all the information you need to know to help you find out how much the person selling you your life insurance policy is making and a few tips to help you understand what the options are. Brokers often receive a larger commission on the first policy versus renewals.

It varies from policy to policy and also the commission of insurance agent is based on the term of the policy.

/GettyImages-499760171-5893b7c33df78caebcf8bcde.jpg)