Life Insurance Cash Value Chart

A method used in actuarial analysis which is often used in the insurance industry.

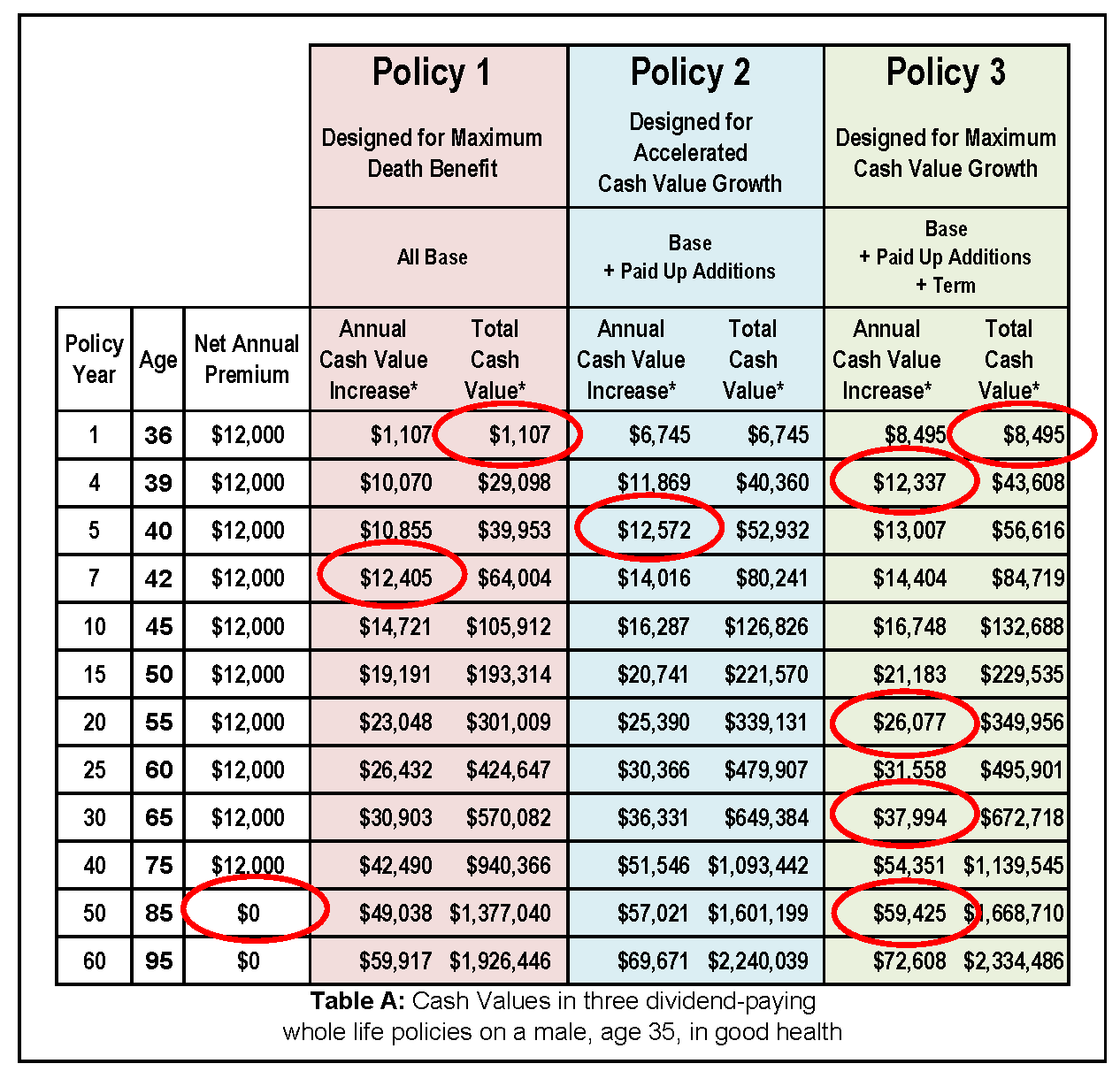

Life insurance cash value chart - Cash value works like this. A portion of that 100 covers the cost of actually insuring your life and the rest is put into investments by the insurance company. The following charts illustrate how much cash value a 35 year old nonsmoking male with a preferred rate 100 000 whole life insurance policy could build up over his lifetime.

Policy values and benefits shown are based on a dividend scale that is not guaranteed and could be more or less than what s shown. The gross amount of collections expected to be obtained through the liquidation of assets in an asset pool. The chart shows how much the cash value is expected to appreciate over the years.

Yearly price of protection method. For some whole life policies the policy itself will contain a cash value chart. This guaranteed cash value growth is one of.

Creating a high cash value life insurance policy gives you the benefit of a policy that grows cash value quickly that will also grow your death benefit as you get older. The yearly price of protection method is used to find out the cost of. Fees are taken from the cash value before you get the pay out.

The cash component can be withdrawn reinvested or used as collateral for loans during the policyholder s life. Initial targeted cash value. Whole life policies contain a cash value account that builds cover time at a fixed interest rate.

Growth of your cash value can be tied to an index such as the s p 500 indexed universal life insurance or sub accounts that contain investments you choose variable universal life. However insurance companies may place restrictions on the timing of cash withdrawals and the termination of policy coverage. Cashing out on your life insurance when you decide to surrender your life insurance policy you are essentially requesting to cancel the life insurance in exchange for any cash value that has accumulated.

Each line in the chart includes the number of years the policy holder maintains the policy and the corresponding cash value per 1 000 in death benefits. Say you re paying 100 a month for your cash value life insurance policy. And chances are you are more likely to live longer so a policy that maximizes your death benefit as you age focusing on high early cash value growth may be the better option.

The initial targeted cash value or itcv is used in the.