Life Insurance Check Made Out To The Estate

If that fails you can see if the small estate affidavit will work to allow you to negotiate the check.

Life insurance check made out to the estate - This can depend on state law and the insurance company s. On the other hand you can see if the payor on the check will reissue a new one. In order to avoid hefty estate taxes the policy owner can name an irrevocable life insurance trust as the beneficiary.

If you have a check from an insurance company that is made out to you then yes you may cash it. The life insurance proceeds will pass directly to the decedent s living heirs at law individuals so closely related to him that they would be legally entitled to inherit from him if he had not left a will. The money can then be transferred to whomever was designated in the trust.

The life insurance proceeds will pass into the decedent s probate estate and become available to pay the decedent s final bills. Trusts named as life insurance policy beneficiaries. The executor has the authority to endorse checks made payable to the decedent or the estate but he has no authority to manage life insurance proceeds payable to a named beneficiary or financial accounts with a joint owner or payable on death designations because these assets are not part of the probate estate.

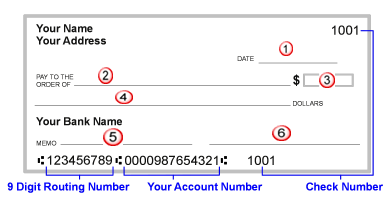

This is usually requested in the form of photo id such as a valid driver s license. The insurance company is sending a check made out to the estate of. When a check is made out to an estate you need an estate bank account to deposit that check.

An executor managing someone s estate after their death must obtain a tax id number and open an estate bank account taking care to endorse handle and segregate estate assets appropriately. You may also deposit the check into a checking or savings account. The trust states that everything is to be divided evenly amongst my 2 sisters and i.

Upon death the trust receives the money without having to pay taxes on it. Review the check to ensure that the writer made the check payable to the estate using its full legal name and not an abbreviated version. Insurance companies often refuse to honor checks that are deposited into accounts with titles that do not precisely match the payee line on the check.

This would order the insurance company to reissue the insurance refund check to that person in partial reimbursement of the funeral and or medical expenses. The estate executor usually creates a bank account for the estate and it is through this account that checks are both written and cashed. At the close of probate this account is closed.

However the clerk fee to file this type of proceeding is about 231 00 so if the refund check doesn t exceed the filing fee it wouldn t be worth doing. A check made out to a decedent s estate or a deceased person must be deposited into the estate s account and only the executor can endorse and deposit it.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/ethnic-senior-couple-with-financial-advisor-1141794014-867b0f9d96ac4d249588dae2460ed501.jpg)

:strip_icc()/irrevocable-life-insurance-trust-ilit-estate-planning-3505379_FINAL-6d6885e041c040bb89b0f30828fc2b05.png)

/when-will-you-get-your-inheritance-3504965-FINAL-5b8813fc46e0fb0025520c3f.png)

/1310-RefundClaimDuetoDeceasedTaxpayer-1-292bd14843c94bf4abf09ea5d6eb9a4b.png)

/1310-RefundClaimDuetoDeceasedTaxpayer-1-292bd14843c94bf4abf09ea5d6eb9a4b.png)

/what-is-probate-3505244-v3-5c07e7f746e0fb0001693ecf.png)