Life Insurance Check Medical Records

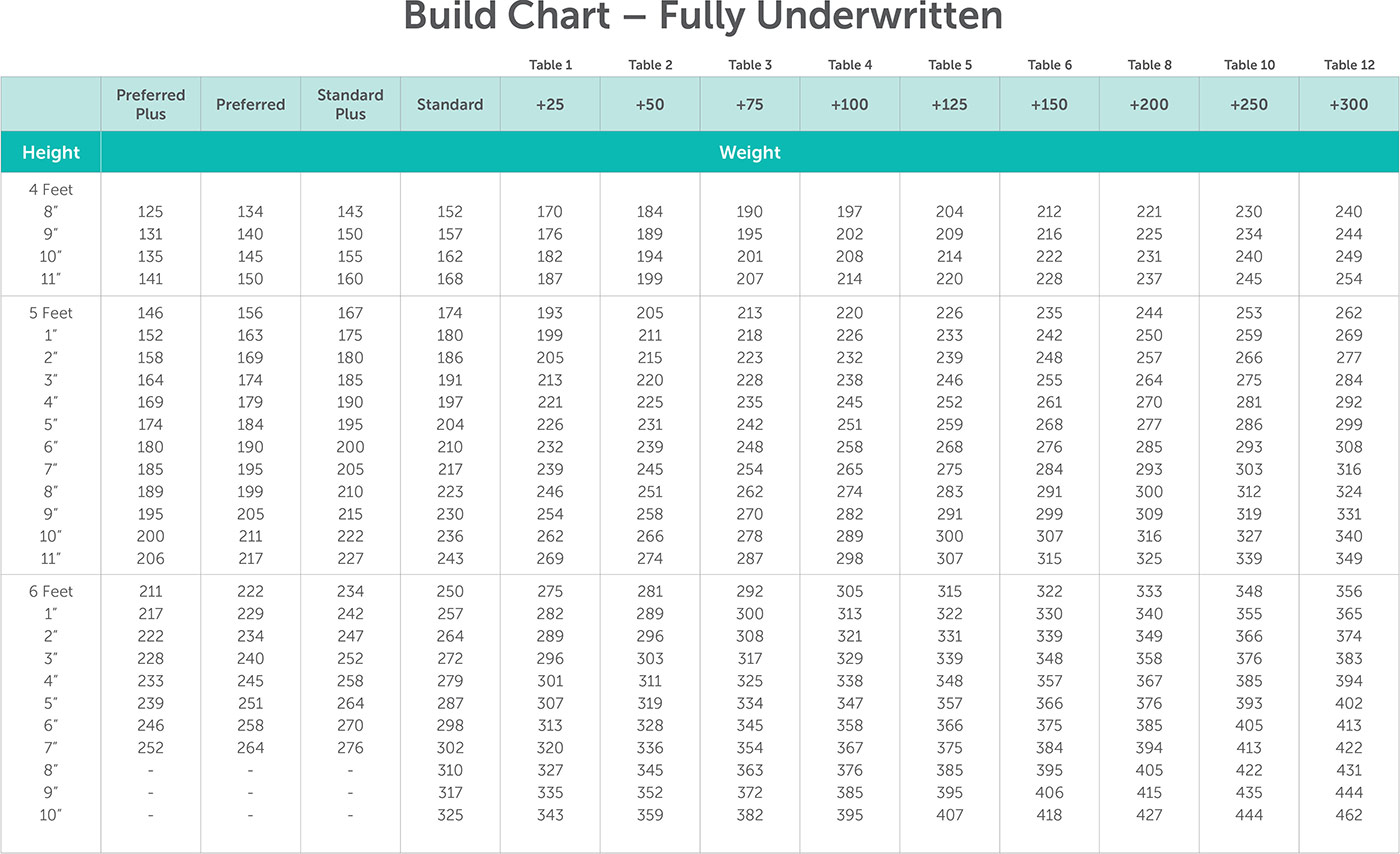

Non smokers have five categories that can represent a 20 difference in price so prepping for good exam results may be just as important as good medical records.

Life insurance check medical records - The premium rate for which you qualify largely depends on the current and past status of your health. The life insurance company wants these records for a purpose. How to save on your life insurance premiums.

Most insurers will look at a variety of evidence such as the cause and timing of death documentation left by the deceased and any relevant medical history. After all you ve had specimens collected at your paramedical exam and you ve passed all of the lab tests with flying colors. The reason i want to know is that i cough and vomit out blood each day and i need this on my official medical records where all life insurance companies check so if and when someone is trying to get fraudulent policies under my name without my knowledge or consent so that all life insurance companies would reject or deny such applications from.

Do life insurance companies check medical records after death. Life insurance has several underwriting categories that parse your medical information to calculate lowest cost of insurance. By seeing your medical records a provider can decide how likely you might be make an insurance claim in the future.

It will outline what medical tests you have had done over a period. They want to know your medical background. What will my life insurance company do with the health records.

You can save time during the underwriting process by providing complete records of your medical history. Thus if you sign an authorization giving the life insurance company access to your records they absolutely can legally request a copy or copies of your records and receive them. The healthier you are the less you ll pay for health insurance.

Most times an insurance company will require a medical exam before it approves an applicant for a life insurance policy. They can do but only with permission from someone authorised to act on the deceased s behalf in the event of a claim. If the information doesn t match your application you may be charged a higher rate or denied coverage.

For all other policies your insurer will most likely pull your medical records as part of the underwriting process. The medical records will give them a lot of important information. So if there is information you do not want them to have for some reasons make sure you read any and all paperwork very carefully before filling it out and signing.

If you take a medical exam to get life insurance and everything checks out you might be curious to learn why you would need to give the company approval to check your medical records.

/2615505-article-how-to-get-copies-of-your-medical-records-5a74bc258e1b6e0037a24b25.png)