Life Insurance Check Taxable

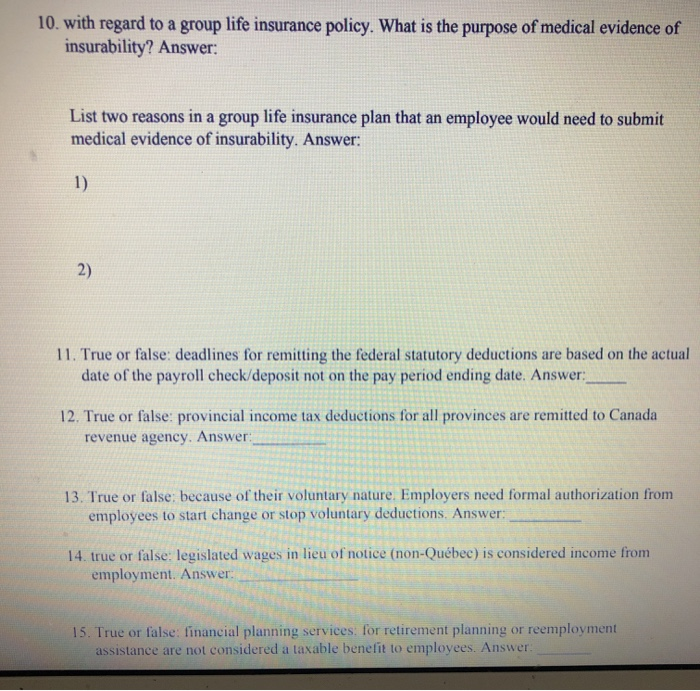

Death benefits and estate taxes life insurance proceeds are not included as part of a decedent s estate unless the decedent owned the policy or the estate was the beneficiary.

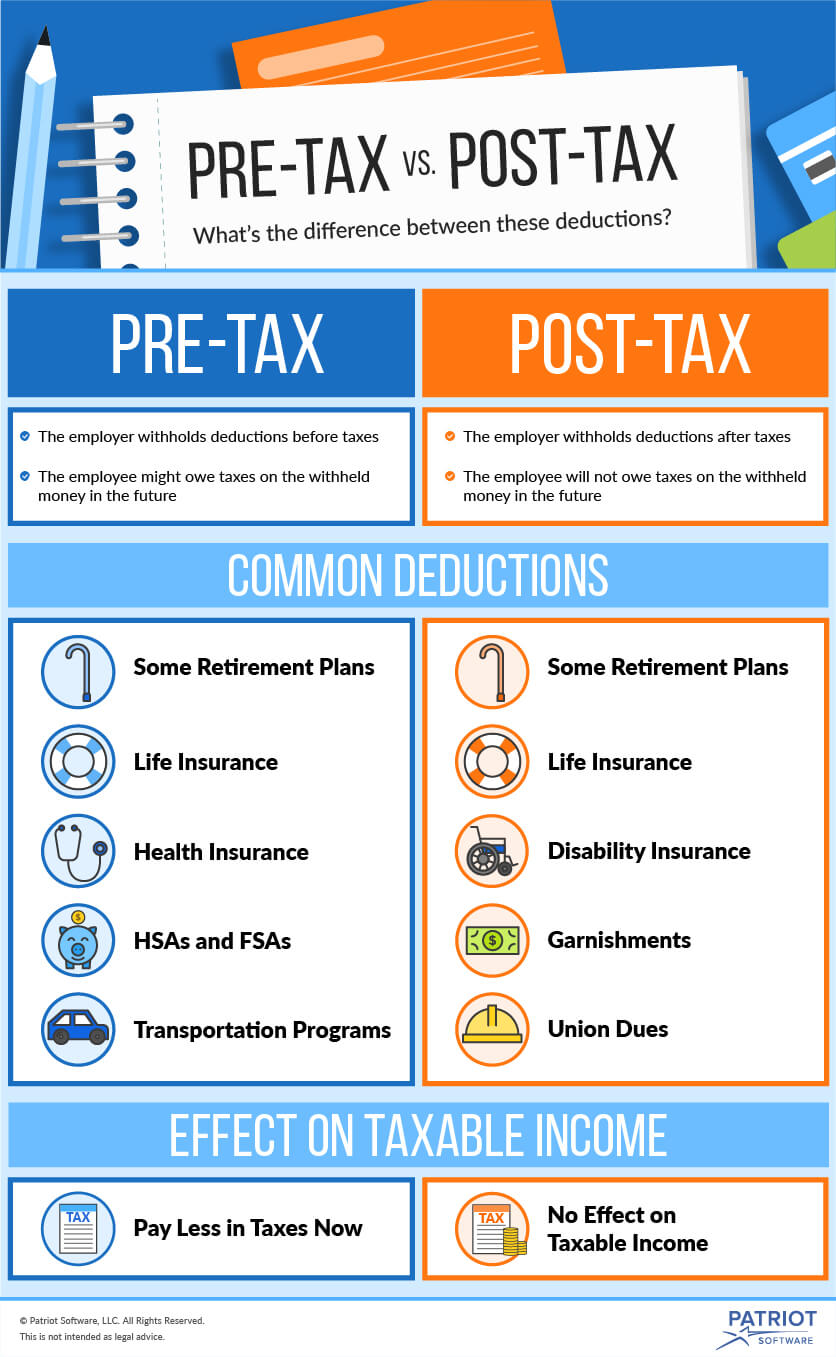

Life insurance check taxable - While life insurance is not taxable most of the time there are certain instances where tax is due. But there are times when money from a policy is taxable especially if you re accessing cash value in your own policy. Whether a life insurance check is taxable depends on what kind of life insurance check it is.

Here s how it works. Is group term life insurance taxable. As long as the check reimburses you for damage or loss of your property you won t need to pay taxes on the insurance proceeds.

However any interest paid to you on the death benefit between the date of death and the date the insurance company cuts you a check does count as taxable income. The premiums for an employer paid supplemental life insurance policy under 50 000 are tax free to the employee. The payout you get from your life insurance policy can add to the value of your estate so if your assets are worth 200 000 and your insurance policy payout is 200 000 giving you a total of.

You didn t say if it was the death benefit proceeds or if it was a cash withdrawal from the policy or if it was a loan against the cash value of the policy. Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it. When your estate exceeds the estate tax threshold usually life insurance is paid directly to.

However you may need to report a gain if the amount of the check is more than your adjusted basis in the property. However the premiums for policies that. As a general rule casualty insurance claim checks are not taxable.

The most common uses of dividends include. Most of the time proceeds aren t taxable. Life insurance payouts are made tax free to beneficiaries.

/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg)