Life Insurance Definition Economics

Insurance protects economic interdependence among businesses by insuring supply chains which become increasingly vulnerable with more complex technological components.

Life insurance definition economics - The wisconsin state life fund is a state sponsored life insurance program. Least expensive alternative treatment leat. In this lesson we ll talk about the two types of companies from which you can get life insurance.

Wisconsin state life fund. Financial intermediary the insurer that shares the financial risk of untimely death of its policy holder the insured. A life insurance distribution system available to residents of wisconsin.

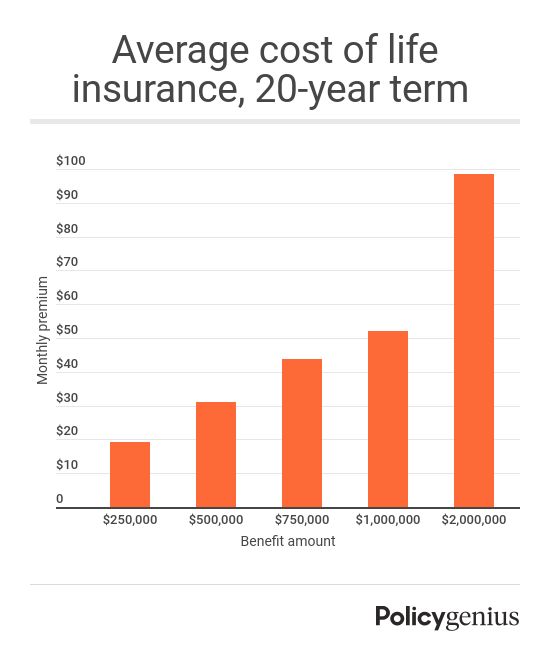

An insurance premium is the amount of money an individual or business must pay for an insurance policy. Premium is an amount paid periodically to the insurer by the insured for covering his risk. The selling of a life insurance policy by a terminally ill person so that person can receive a benefit from the policy while still alive and the purchaser of the policy can receive a.

Term life insurance is pure life insurance. Insurance reduces the need for rainy day funds rather than having to set aside a relatively large amount of money to pay for unexpected losses. Each has a different set of features.

The state of. The premium is a function of a number of variables like age type of employment medical conditions etc. The policyholder pays premiums regularly.

The key definition when it comes to term life is the term. If they die while the policy is in effect their beneficiary or beneficiaries receives a death benefit. The economic life of an asset is the period of time during which it remains useful to its owner.

It s very straightforward which is the selling point for people who want a simple life insurance option. Insurance premiums are paid for policies that cover healthcare auto home and life insurance. In an insurance contract the risk is transferred from the insured to the insurer for taking this risk the insurer charges an amount called the premium.

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

:max_bytes(150000):strip_icc()/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg)

:max_bytes(150000):strip_icc()/life_insurance-5bfc371046e0fb0083c33fed.jpg)