Life Insurance Explained

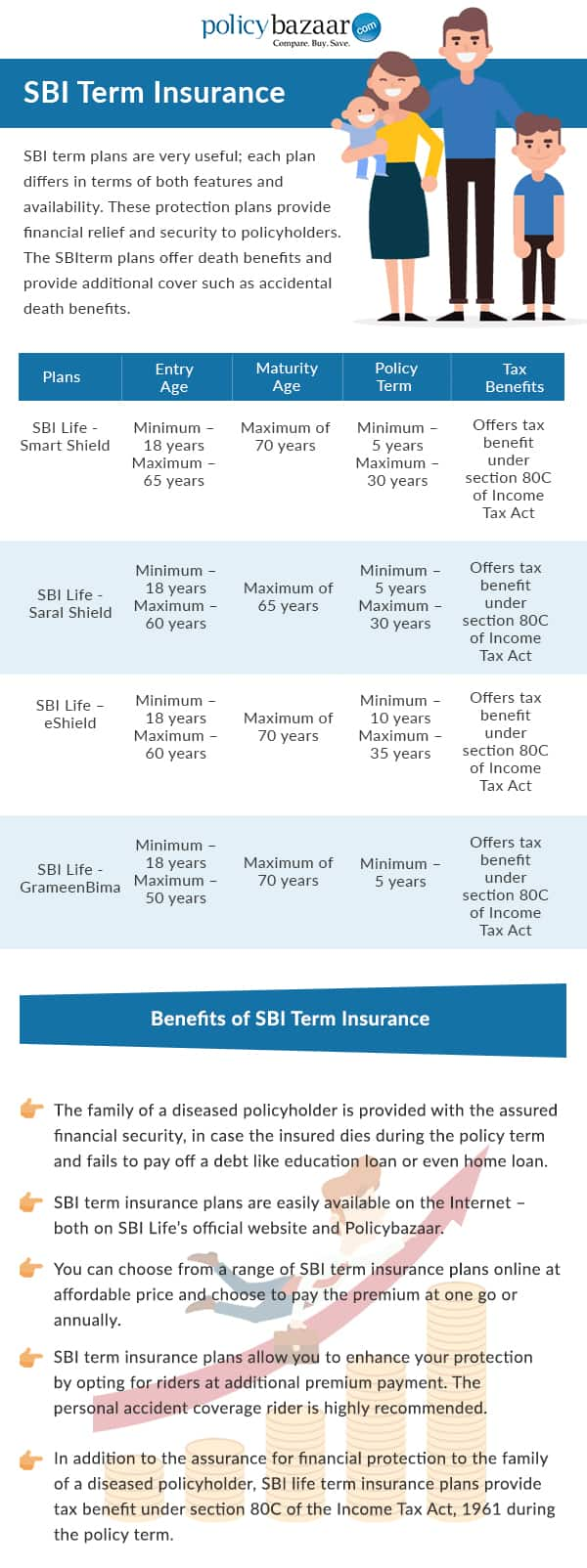

The policy expires at the end of the term which can last up to 30 years.

Life insurance explained - As you might expect life insurance generally becomes more expensive the older you get as your risk of passing away increases. Whole life insurance is also eligible to receive. With term life insurance coverage is purchased for a certain length of time it could be as short as a 5 year policy a short term life insurance plan or longer terms such as for ten years 15 years 20 years 25 years 30 years and in some cases even longer.

Whole life insurance is a type of life insurance that is meant to be permanent and last for an insured person s whole life. It can serve as financial protection for your loved ones who would lose your income in the event of your death. Life insurance is an agreement between you and an insurance company that the company will pay your beneficiaries a tax free benefit if you die within the conditions of the policy.

However some providers offer specialised cover for people aged 50 or older so these groups can find affordable life insurance. Whole life insurance has a level premium structure the premiums due are the same each year and will build cash value over time. Term life insurance policies are more affordable than other types of life insurance policies usually costing 30 40 a month for a 30 year 500 000 policy for healthy people in their 20s and 30s.

Whole life insurance explained.

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

/life_insurance-5bfc371046e0fb0083c33fed.jpg)