Life Insurance Explained Canada

There are several types of life insurance in canada here is brief overview of different insurance types.

Life insurance explained canada - National service centre 4400 dominion st suite 260 burnaby bc v5g 4g3. There are many different kinds of life insurance. There are two basic types of life insurance in canada dictated by how life insurance premiums are paid.

Simple and easy to understand. Posted on december 20 2019 and updated december 23 2019 in life insurance canada news permanent insurance term insurance whole life 2 min read i m going to talk a little bit now about cash surrender value and how it works in terms of a life insurance policy. Depending on the contract other events such as terminal illness.

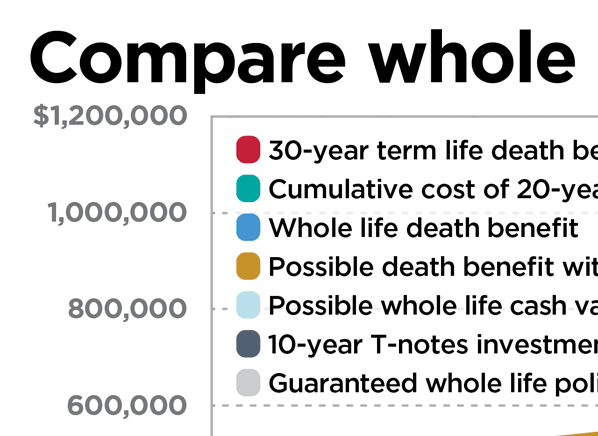

There are different types of term life insurance policies including 10 year term 20 year term and 30 year term. Cash value life insurance explained. Once you get older the need for life insurance changes.

So if in 20 years your kids will be out of college and your mortgage will be paid off then a 20 year term policy for those amounts may be fitting. Life protection that will expire at the end of a set term e g. 1 866 238 9271 send us an email.

Choosing a life insurance policy can be somewhat daunting especially if you are new to it and don t know much about the coverage options. Term life insurance has premiums that are initially less expensive and increase as we get older. On the most basic level it can be broken down into two main categories and from there into a few simple options.

Request call back. Check out life insurance. In a nutshell cash value life insurance is a type of permanent life insurance with a cash value savings component.

It is a combination of life insurance and. The foundation of all life insurance is the death benefit which pays an income tax free amount to your beneficiaries when the insured person passes. Like some term life insurance there is a set expiration date to mortgage life insurance although there isn t the option to renew at the end of the term.

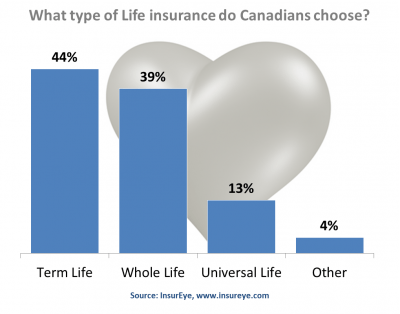

Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder. Home permanent universal whole life insurance explained 1 888 767 6576. Term life whole life and universal life are just three of the most basic kinds.

Fortunately life insurance isn t quite as confusing as it seems on the surface. Selecting a policy is much easier when you know how each. It also offers a pair of different benefits.

An annual state of the residential mortgage market in canada report from 2013 notes that the actual contracted period of mortgages within 2010 2013 was just shy of 15 years.