Life Insurance Facts Canada

Canadian life and health insurance facts 2019 edition presents authoritative factual information about life and health insurance in canada.

Life insurance facts canada - Of the 13 5 million people who live in ontario 7 9 million of them carry life insurance benefits so more than half of ontarians have life insurance coverage where do you stand. Interesting insurance facts 1. The open account excludes the former new york life former crown life and canada life closed blocks of policies.

Insurance experts find some products more useful than others. The reasons for wanting to avoid a medical exam are many. 1 70 of americans are interested in buying life insurance that doesn t require a medical exam.

A life insurance purchase is usually a long term. 54 percent of american adults who have life insurance. Canadian life and health insurance facts 2016 edition presents authoritative factual information about life and health insurance in canada.

Finding the best life insurance company can be difficult for any consumer who has to navigate a huge range of products and pricing variables. 27 of american adults with life insurance the percent who only have group coverage which usually isn t enough and is rarely portable. Term life insurance disability insurance and critical illness insurance can change your life if you need the policy to pay out.

On the other hand variable life insurance jumped up 22 points and universal life policies spiked by 6. It is published by the canadian life and health insurance association clhia. Here are 10 facts and statistics about life insurance that will blow your mind.

At the end of 2011 residents of ontario held more than 1 5 trillion dollars worth of life insurance protection for their dependants. 1 2020 to reflect the amalgamation based on the combined statements of great west life london life and canada life as at dec. It will take some time to update our websites materials and forms so until we re done all references to great west life or london life are to be understood.

Financial facts are shown as of jan. 1 2020 the great west life assurance company london life insurance company and the canada life assurance company became one company the canada life assurance company. It is published by the canadian life and health insurance association clhia.

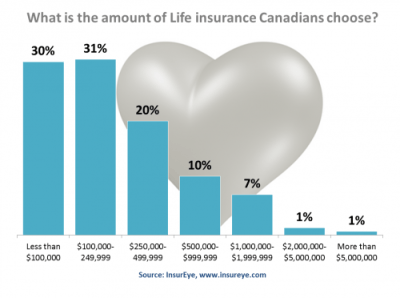

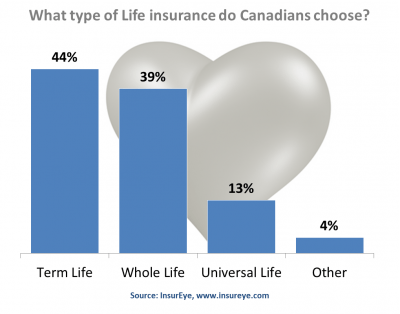

In 2019 the number of people buying whole life insurance dropped by 27. This kind of life insurance is called simplified underwriting. 10x to 15x the multiples of your annual income that most financial advisors recommend you need when buying life insurance for income replacement.

When it comes to permanent policies whole life insurance has always been the most popular until now. The clhia is a voluntary association whose member companies account for 99 of canada s life and health insurance business. The popularity of whole life insurance is declining.

The clhia is a voluntary association whose member companies account for 99 of canada s life and health insurance business.