Life Insurance For Parents Over 60

If they don t have a policy yet you can open up a new one on their behalf.

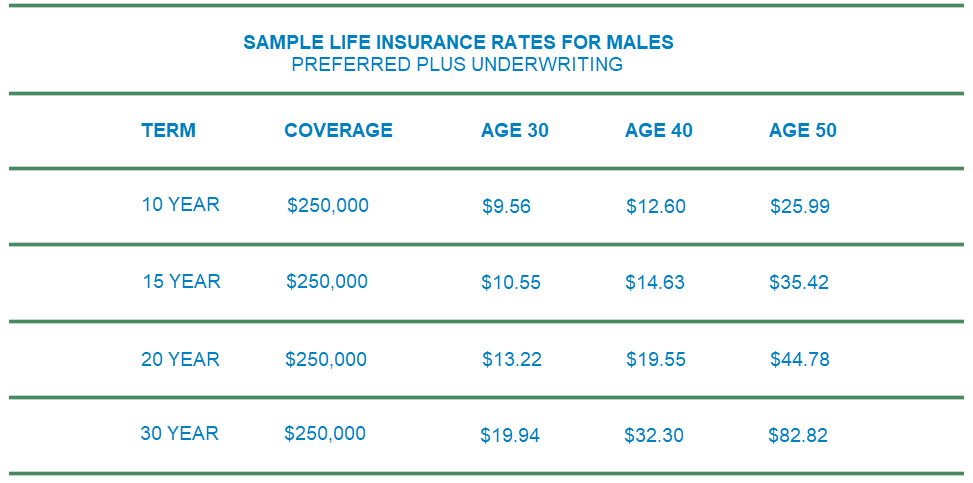

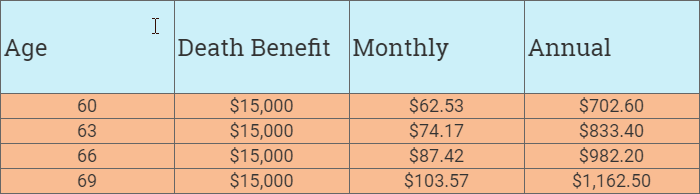

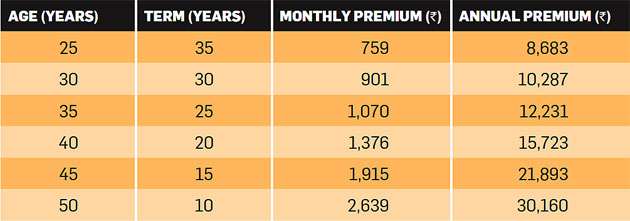

Life insurance for parents over 60 - Therefore choosing life insurance for parents over 60 is a vital financial decision. If your parents are over the age of 60 securing a term life insurance policy for more than five to 10 years can be difficult and expensive. Term life insurance.

A term policy covers the insured for a specific period of years. Sometimes a life insurance policy on your parent just isn t necessary. A permanent or whole life policy although more expensive usually will protect the insured for the rest of life and build cash value.

It might be 10 or 15 years or more. It depends on your situation. With that in mind buying life insurance for parents over 60 or even those who have parents over 70 can make good financial sense especially if they have taken on debt that would be the responsibility of the next generation at their passing or if they do not have enough savings to cover their burial cost.

Not everyone needs to buy life insurance on their parents. Some do and some don t. If you have a parent or parents that already have life insurance you can simply take over their payments.

Please note not all of the partners on hippo currently offer life insurance for parents and that the information in this article is provided for informational. The steps to take when applying for life insurance for parents over 60 discuss with your parents before applying for life insurance for parents over 60. A term life insurance policy is generally the least complicated and most affordable life insurance policy but some people over 60 may have a hard time finding a traditional term policy.