Life Insurance For Parents Under 60

If your parents purchase the policy they do not need to prove insurable interest because they will be the owners of the policy and.

Life insurance for parents under 60 - Sometimes a life insurance policy on your parent just isn t necessary. Life insurance for parents. Not everyone needs to buy life insurance on their parents.

There are two ways to buy life insurance for your parents. To begin let s focus on the seven essential facts you need to know about purchasing life insurance for your parents. It might be 10 or 15 years or more.

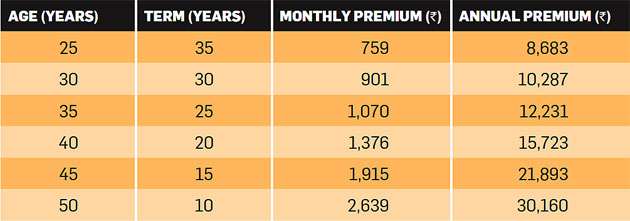

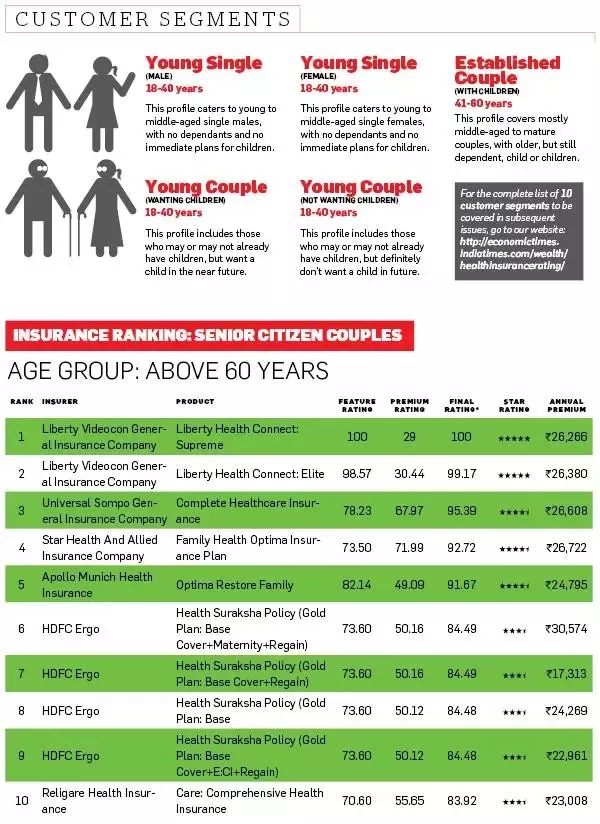

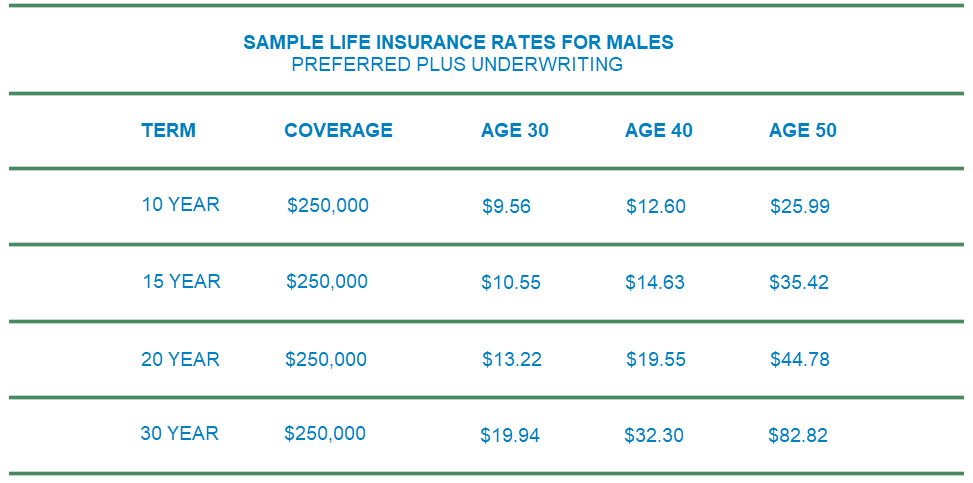

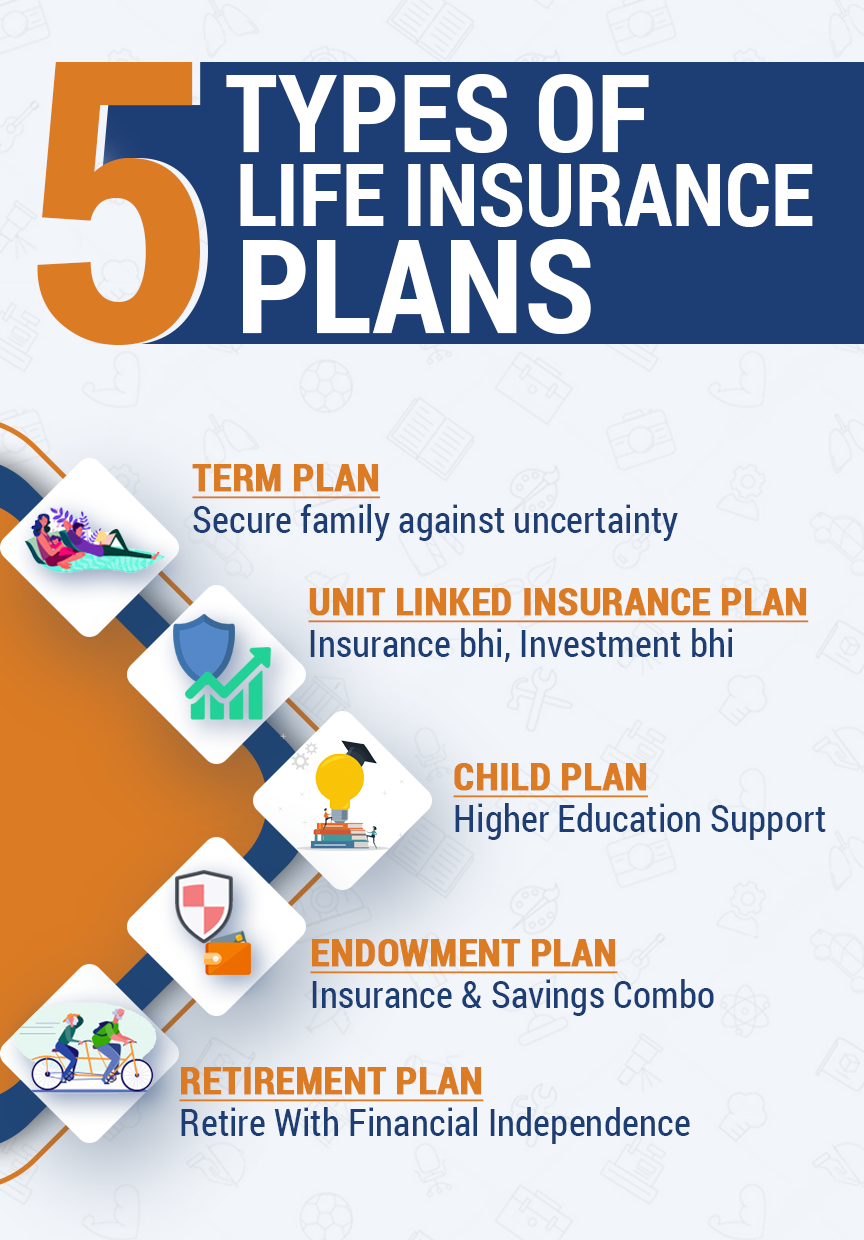

Why you may want to consider taking out a life insurance policy for your parents. When you are thinking of applying for a life insurance for parents over 60 programs for your parents you must discuss it with them. A term policy covers the insured for a specific period of years.

In order to purchase life insurance on a parent or on anyone for that matter you must have consent it s always necessary for your parent to agree to the life insurance policy. Buying a life insurance policy for your parents is just like shopping for coverage for yourself. It s important to remember that while your parents could easily name you the premium payer as the sole beneficiary on their life insurance they are not under any obligation to do this.

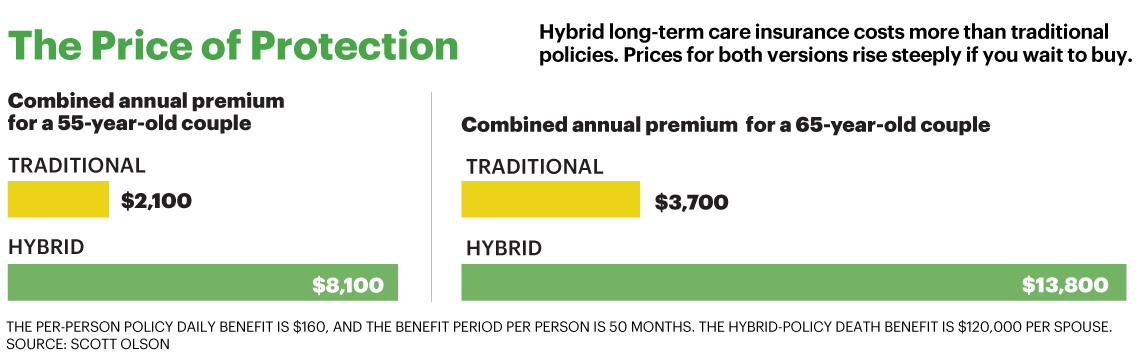

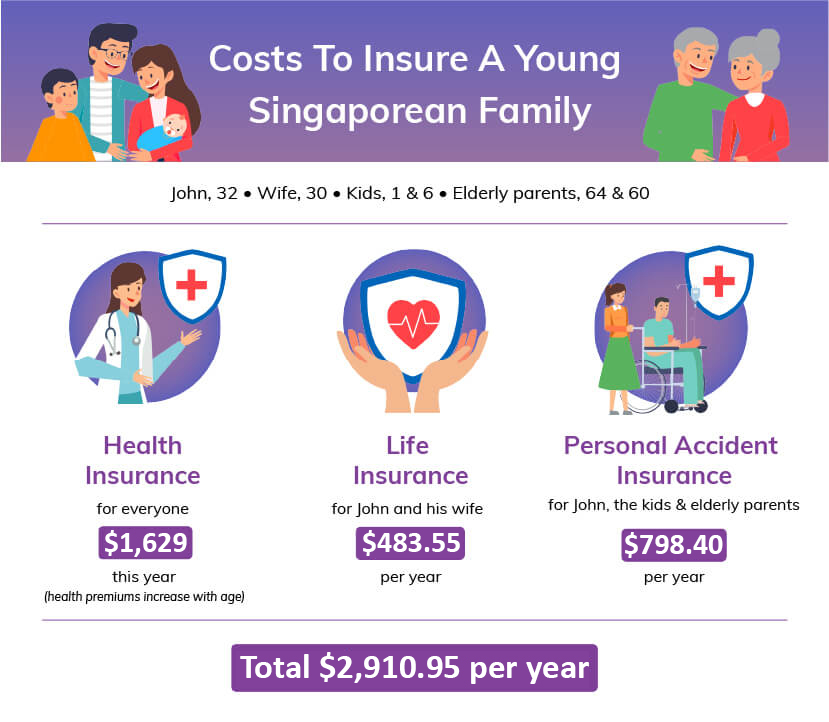

In most cases prior to age 85 buying life insurance for elderly parents can be relatively affordable depending on the type and amount of coverage and the carrier you choose to purchase the coverage through. Determine how much coverage you need. Some do and some don t.

Taking out a life insurance policy for your parents allows you to take care of your family s financial needs after their passing. When buying life insurance on your parents you will typically need to have their knowledge and their approval first and foremost. Discuss with your parents before applying for life insurance for parents over 60.

Choose a policy type. Consider your parents assets debt savings and other financial obligations and try to take out a policy to match. It depends on your situation.

For those that want or need to here s 10 proven tips that will ensure you purchase the. How to buy a life insurance policy for your parents. Essentially paying premiums for someone does not entitle you to any payout from the life insurance should they pass away unless you are named as a.

Buying life insurance for parents. 10 tips when buying life insurance policy for your parents. A permanent or whole life policy although more expensive usually will protect the insured for the rest of life and build cash value.

Buying life insurance for your parents or anyone else requires their consent and evidence of insurable interest equal to the amount of the death benefit.

.png)