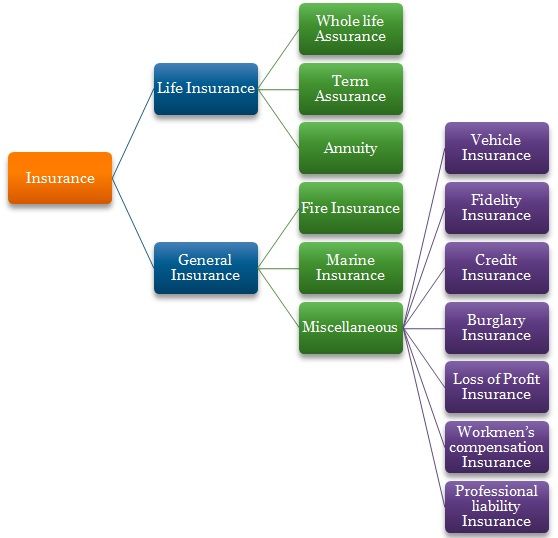

Life Insurance General Insurance

General insurance is typically defined as any insurance that is not determined to be life insurance it is called property and casualty insurance in the united states and canada and non life insurance in continental europe.

Life insurance general insurance - It includes property oriented coverage such as auto homeowner and boat policies as well as health and group benefits plans the malpractice insurance carried by health professionals and the errors and omissions insurance that plays the same role for other professionals are both forms of general. There is a surrender value of policy in life insurance. Description wikipedia life insurance is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policyholder.

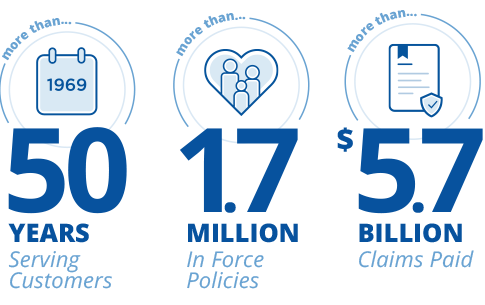

The insurer for general insurance products unless otherwise specified is the hollard insurance company pty ltd abn 78 090 584 473 and for all life insurance products is hannover life re of australasia ltd abn 37 062 395 484. General insurance or otherwise known as non life insurance or property and casualty insurance is a contract that covers any risk apart from the risk of life. In this article let s learn the difference between life insurance and general insurance along with learning the types of plans offered under each of the two insurance categories.

The insured can claim only the actual amount of loss subject to a maximum of sum assured. The insurance is to safeguard us and our property such as home car and other valuables from fire theft flood storm accident earthquake and so on. General insurance is a contract that covers any risk other than the risk of life.

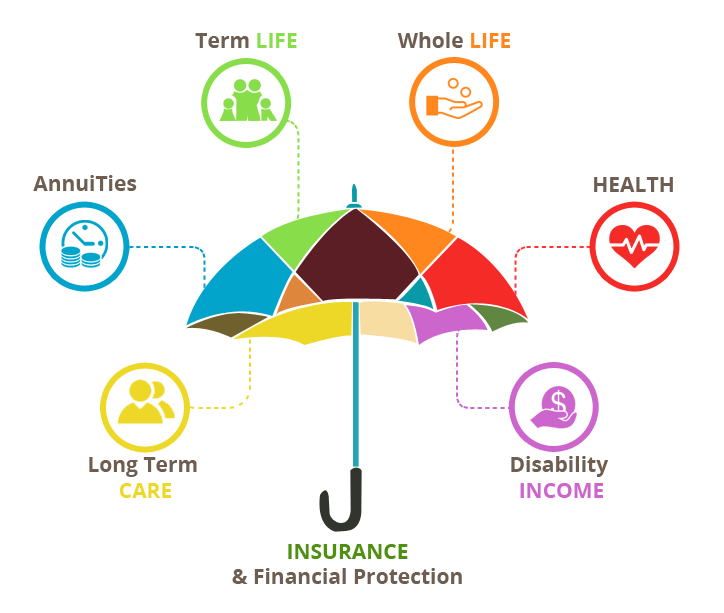

Life insurance is a contract under which the insurance company undertakes to pay either a lump sum or an annuity if an event occurs involving human life in exchange for the payment of a premium as remuneration from the policyholder for the risk taken on. While life insurance covers the life of a person general insurance provides cover to other aspects and assets in a person s life for example health car travel home etc. This type of cover insures assets against theft or damage due to fires natural calamities accidents man made disasters like riots or terrorist attacks etc.

General insurance is a catchall phrase to describe almost any insurance other than life coverage. Insurance is broadly categorised into two types life insurance and general insurance. These are the contract of indemnity wherein the general insurer promises to make good the losses occurred to.

The event insured against may or may not happen. Difference general insurance fire and marine. In addition to the specific risk coverage the insurance premium includes all costs related to the acquisition and administration of the.

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)