Life Insurance Investment Account

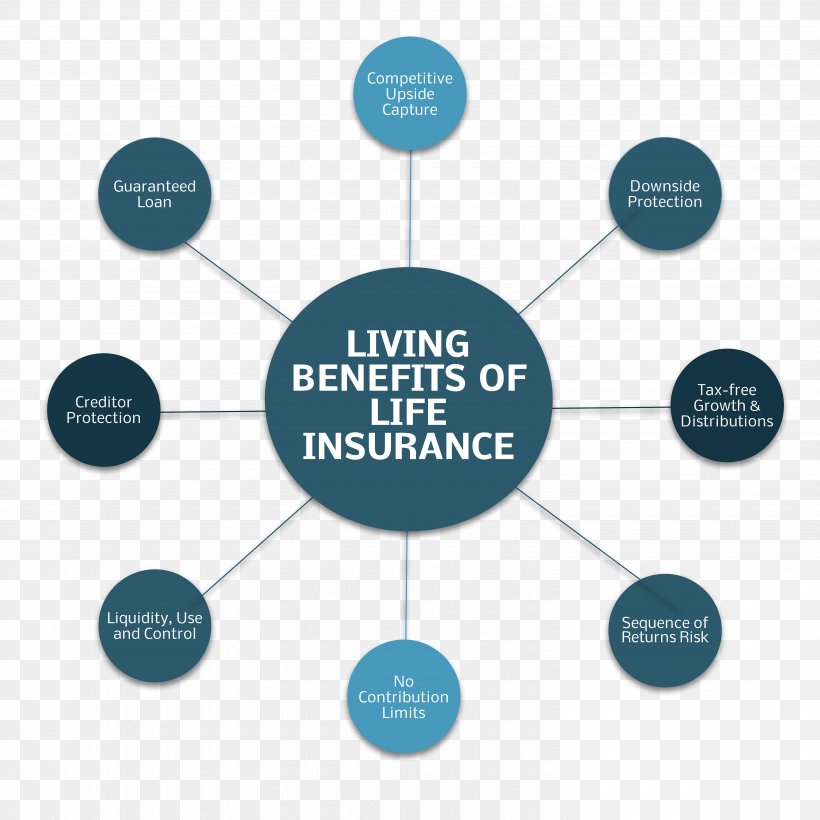

Whole life cash accounts grow tax deferred.

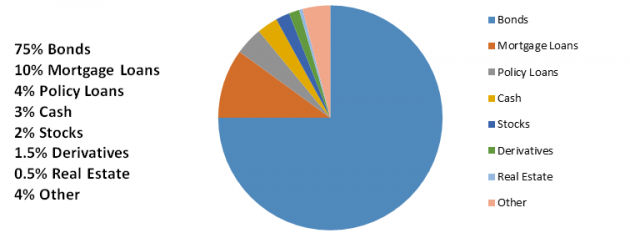

Life insurance investment account - There are the investment risks of a variable life policy where the money is invested in mutual fund like accounts. Variable investment options. Investing in a discretionary stockbroker account means that you give the stockbroker full authority to make investment decisions and undertake transactions on your behalf without the need for you to get.

This type of life insurance policy has the benefits of both variable life and universal life insurance. When you purchase permanent life insurance part of your premium goes into a cash value account that can grow based on policy dividends interest and or earnings from mutual fund like sub accounts. Whether or not life insurance is a good investment for you depends on your individual finances as well as the length you ll need coverage.

The self invested fund has a unique investment option for customers and financial advisers who want a discretionary investment management service. The investment portion of permanent life insurance grows. Life insurance vs investment account.

Separate accounts are typically opened through a. Life insurance vs investment account. The benefit of whole life insurance and the reason you might prefer it to a savings account lies in the cash account s tax treatment and flexibility.

Life insurance life pro advantage life insurance calculator get answers for professionals. Page 6 of 10 prev 1. A separate account is a privately managed investment account owned by an investor seeking to manage a pool of individual assets.