Life Insurance Letter To Beneficiary

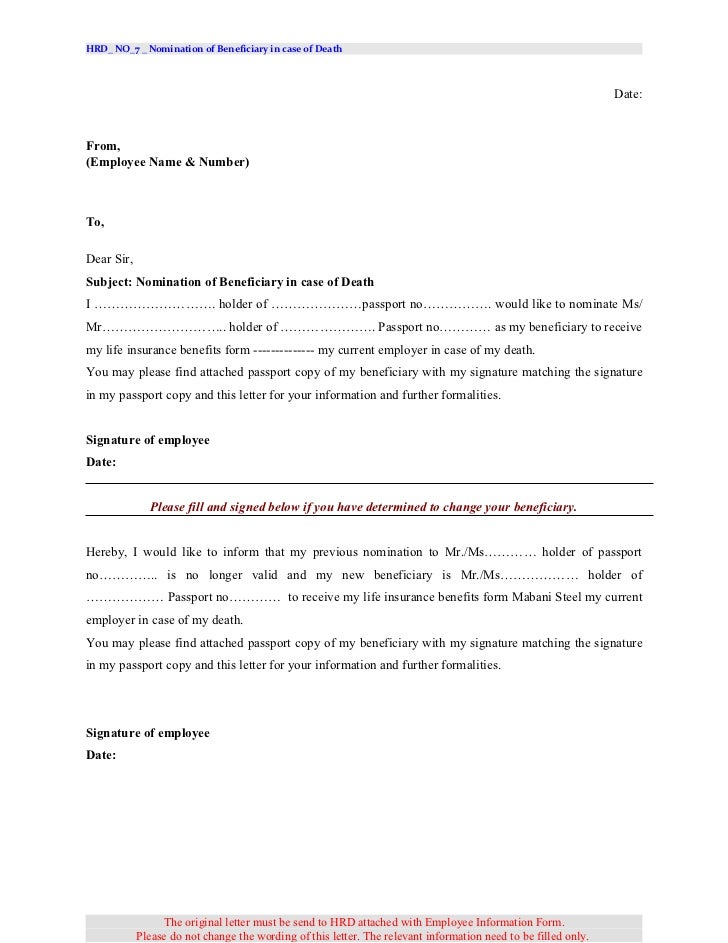

A change of beneficiary letter helps ensure everything is in order.

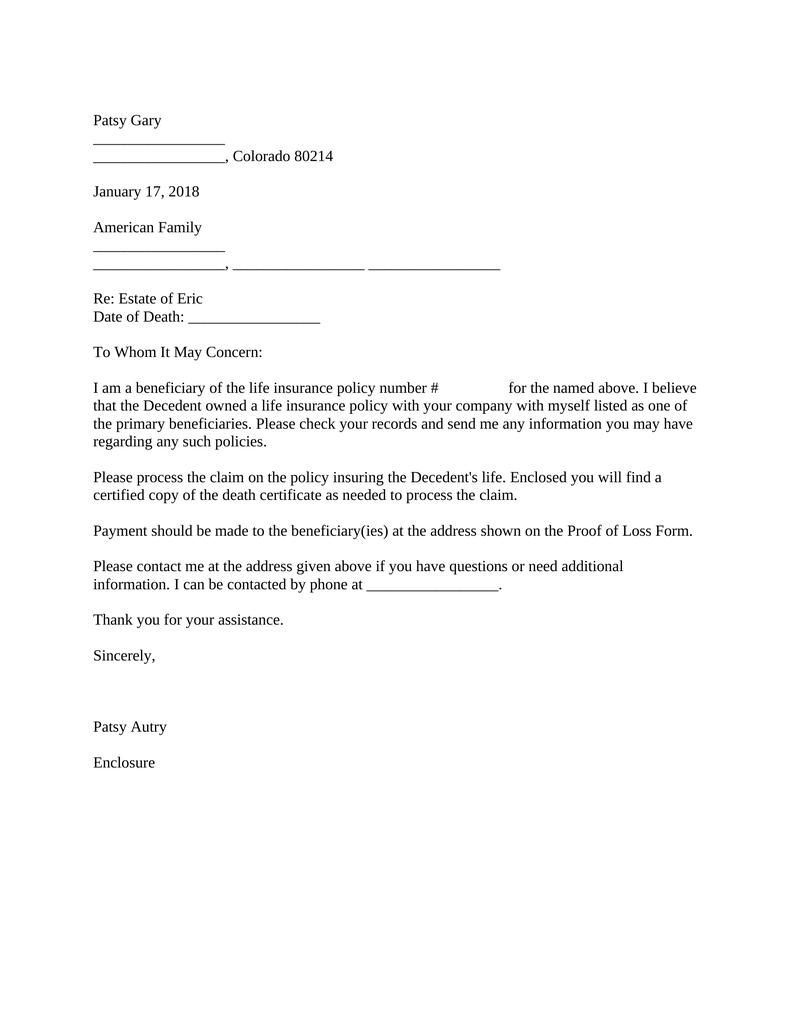

Life insurance letter to beneficiary - I recommend sending this out shortly after receiving the death certificate. This letter is easy to write and will not take too much time. This letter is easy to write and will not take too much time.

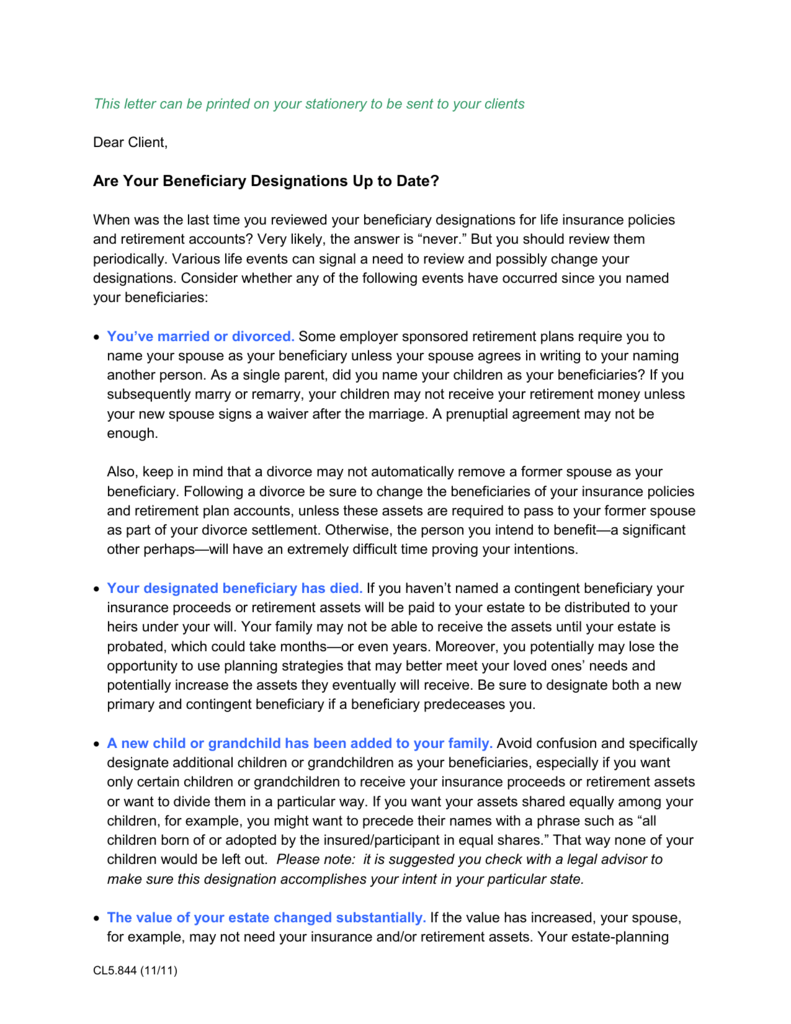

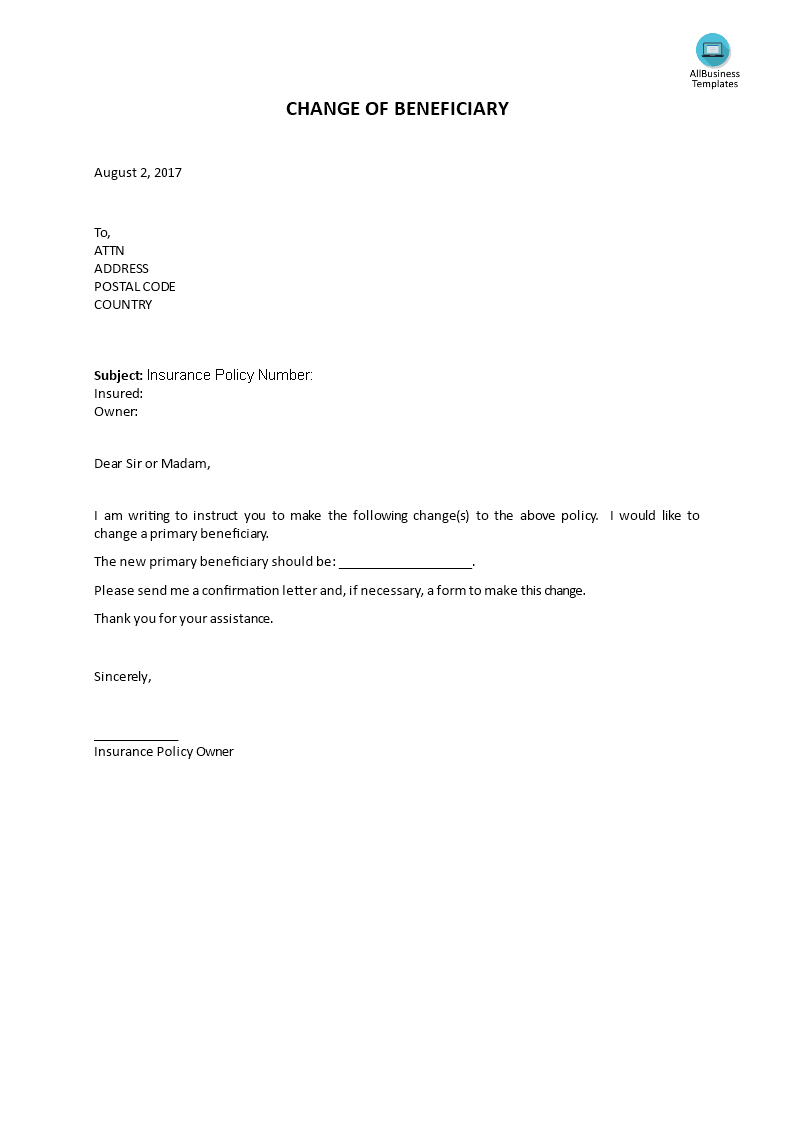

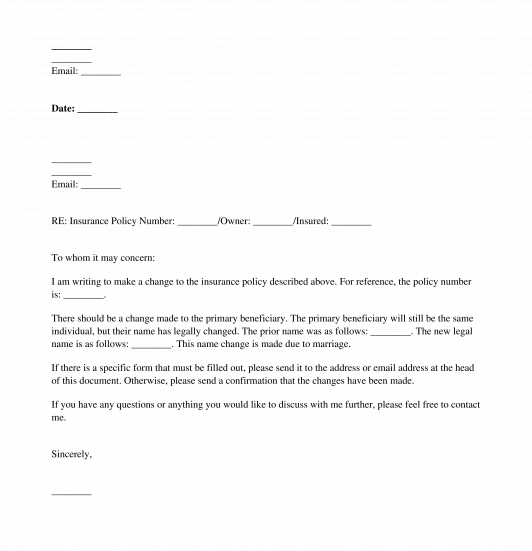

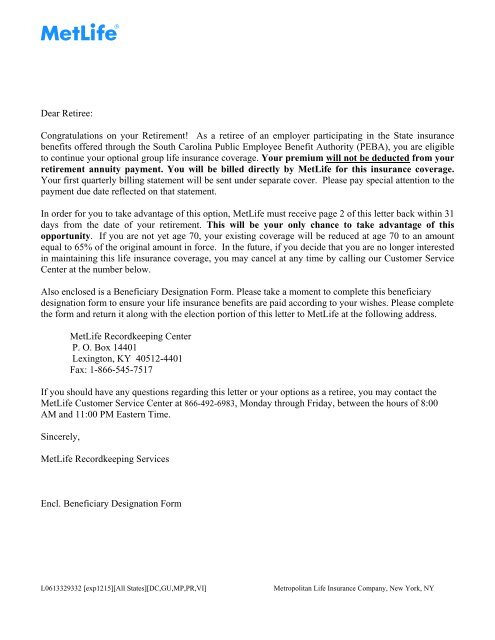

If you want to change who your primary beneficiary is on your life insurance policy make sure it happens with a beneficiary designation form. A common beneficiary dispute arises when an ex spouse remains the named beneficiary on a life insurance policy. The insured s person will is a separate document that is not usually taken into consideration when life insurance benefit is paid out.

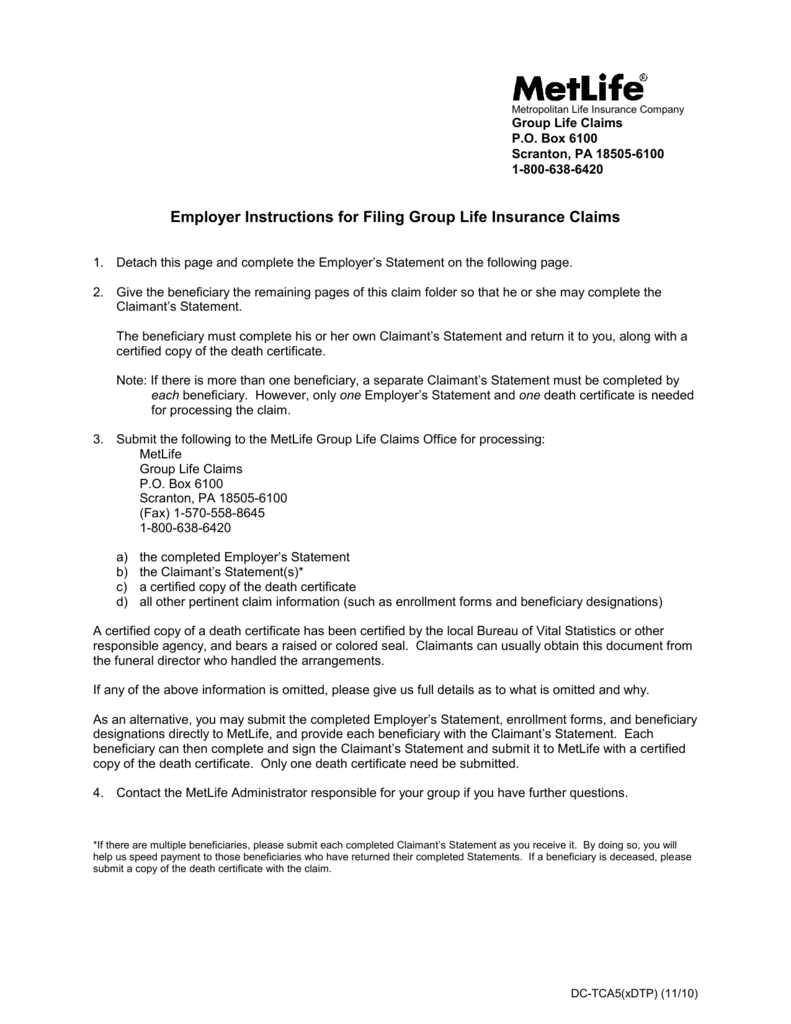

This letter is a formal way of finding out who the beneficiary is if you re unsure and to help speed the process along. Make sure to include the death certificate as well. A sample letter to send to life insurance company by a beneficiary of the life insurance policy.

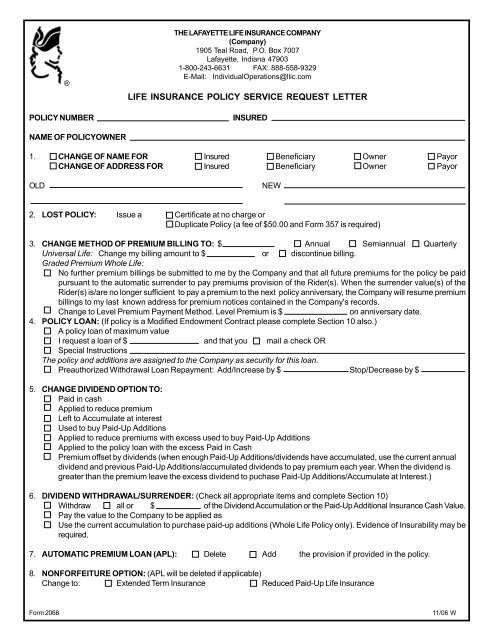

Maybe you want to add another beneficiary or perhaps you want to remove one. A life insurance proceeds letter can get you the information you need and get the process started. Keep your paperwork is up to date.

The beneficiary designation on file at the time of death is binding in the payment of your benefits. Depending on the type of policy and the state in which the. When applying for life insurance online you ll be asked to name a beneficiary for your policy this is an important step in the buying process because properly naming a beneficiary and providing their contact information is key to helping ensure that a life insurance payout is received in a timely manner.

A life insurance claim letter will prevent you from having to make direct contact with a rep from the company. This is the person that receives the benefit upon death. A beneficiary is the person or entity named in a life insurance policy retirement plan or health savings account.

A life insurance claim letter will prevent you from having to make direct contact with a rep from the company. There are no reviews yet. Most of the time beneficiaries know they have been designated as the benefit recipients but they do not know their rights regarding policy information time frame for filing a claim or interest payable on the claim.

This may occur if the policyholder neglects to change the beneficiary after a divorce or if the ex spouse s designation as beneficiary was part of the divorce decree. After the passing of a friend or loved one the life insurance policy becomes payable to the beneficiaries who the insured listed. After the passing of a friend or loved one the life insurance policy becomes payable to the beneficiaries who the insured listed.